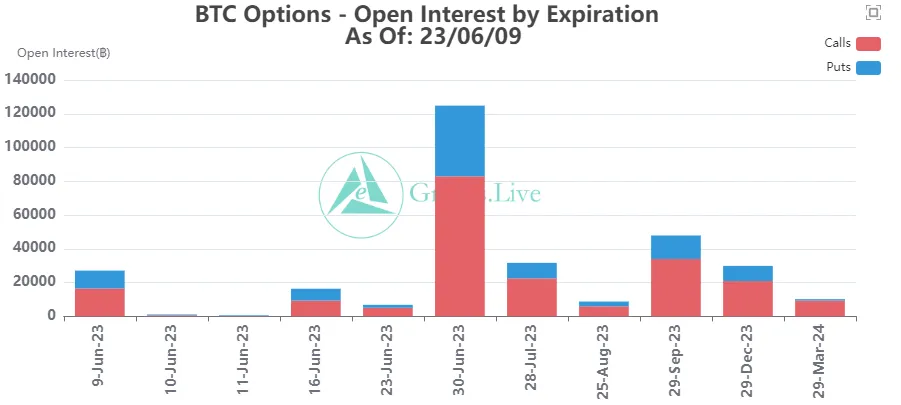

A large number of Bitcoin options contracts are set to expire, but will they have an impact on a market that has been very inactive lately?

On June 9, 27,000 Bitcoin options will expire with a notional value of $720 million. The max pain price is $26,500.

Furthermore, it is the second–largest batch of Bitcoin options contracts to expire in June. Around $3.3 billion worth of contracts are set to expire on June 30, which could have a much larger impact.

ផុតកំណត់ជម្រើស Bitcoin

The max pain point is the price with the most open contracts, currently exactly where BTC is trading. It is also the price at which the most losses will be made upon contract expiry.

Furthermore, the Bitcoin options contacts have a put/call ratio of 0.64.

The ratio is calculated by dividing the number of put (short) contracts by the number of call (long) contracts. Values lower than 1 are considered bullish since more traders are buying long contracts than shorts.

GreeksLive commented that although volumes and positions rose, market impact is likely to be minimal this month.

“Volume and positions both rose significantly this week, with the impact of SEC’s indictment festering. June has always been a month of news, but the market tends to be relatively flat.”

According to derivatives platform Deribit, open interest on BTC options is currently 305,852. OI refers to the total number of contracts that remain open and have yet to expire.

In addition to the BTC options, 189,000 Ethereum options are also set to expire on June 9. They have a notional value of $3.23 million and a max pain point of $1,850.

The put/call ratio for Ethereum options is 0.91, which is much more neutral with longs and shorts more balanced.

ទស្សនវិស័យទីផ្សារគ្រីបតូ

Crypto markets are unlikely to be impacted by the expiry of these derivatives contracts. Furthermore, there has been very little movement over the past 24 hours as the dust settles from the SEC’s latest bombing raid on the industry.

Total capitalization is at similar levels to yesterday at $1.14 trillion. It has declined around 4% over the past week, however.

Bitcoin was trading at $26,505 at the time of writing, having recovered 3.6% since its SEC-induced dip on Tuesday. The asset remains range-bound within a channel that formed in mid-March.

Ethereum prices are equally flat, with the asset changing hands for $1,838.

ការមិនទទួលខុសត្រូវ

នៅក្នុងការអនុលោមតាមគោលការណ៍ណែនាំគម្រោងការជឿទុកចិត្ត BeInCrypto ប្តេជ្ញាចិត្តក្នុងការរាយការណ៍ដោយមិនលំអៀង និងតម្លាភាព។ អត្ថបទព័ត៌មាននេះមានគោលបំណងផ្តល់ព័ត៌មានត្រឹមត្រូវ និងទាន់ពេលវេលា។ ទោះជាយ៉ាងណាក៏ដោយ អ្នកអានត្រូវបានណែនាំឱ្យផ្ទៀងផ្ទាត់ការពិតដោយឯករាជ្យ និងពិគ្រោះជាមួយអ្នកជំនាញមុនពេលធ្វើការសម្រេចចិត្តដោយផ្អែកលើខ្លឹមសារនេះ។

Source: https://beincrypto.com/bitcoin-options-contracts-720m-expire-btc-put-call-ratio-bullish/