- BTC’s price has rallied by 40% since 1 January.

- Investors have recorded significant gains, and now, a price reversal might follow.

Exchanging hands at the $23,200 price mark at press time, the leading coin Bitcoin [BTC], currently trades at levels last seen in August 2022. On a year-to-date basis, BTC’s price has rallied by 40%, per data from CoinMarketCap.

Sharing a statistically significant positive correlation with several other assets in the market, the growth in BTC’s price has resulted in the growth in the value of several other crypto assets in the last month.

នេះបើយោងតាមទិន្នន័យពី កាក់ហ្គេកកូ, global cryptocurrency market capitalization has increased by 21% in the last month.

តើមានប៉ុន្មាន 1,10,100 BTCs ដែលមានតម្លៃថ្ងៃនេះ?

Holders are in profit, but for how long?

BTC’s rally to a five-month high in the last month has led many of its holders to log profits on their BTC holdings. An assessment of the cost basis for short-term and long-term holders revealed this.

The cost basis for any BTC holder is the average purchase price of the BTC they possess. This considers any variations in BTC’s price at the time of purchase. This cost basis determines capital gains or losses when the BTC is sold.

នេះបើតាមអ្នកវិភាគ Twitter នឹង Clemente, the cost basis for short-term and long-term BTC holders were $18,900 and $22,300, respectively.

However, since BTC’s price has rallied beyond these points, these cohorts of investors were “no longer underwater,” Clemente said.

Bitcoin has now reclaimed its long-term holder cost basis ($22.3k) in addition to its short-term holder cost basis ($18.9k) and the aggregated cost basis. Behavioral shift as holders in aggregate are no longer underwater.

The last three times this has happened are shown below: pic.twitter.com/8fCSyU5sqk

- Will Clemente (@WClementeIII) ខែមករា 29, 2023

Further, CryptoQuant analyst Phi Deltalytics assessed BTC’s short-term Spent Output Profit Ratio (SOPR) and found that “sentiment from Bitcoin short-term on-chain participants has reached the greediest level since January 2021.” According to the analyst, the SOPR was positioned well above the bullish threshold of one, indicating an overly stretched market.

តើផលប័ត្ររបស់អ្នកមានពណ៌បៃតងទេ? សូមពិនិត្យមើល ការគណនាប្រាក់ចំណេញ Bitcoin

Deltalytics noted further that the bullish trend could be short-lived without an increase in stablecoin reserves on spot exchanges.

ក្រឡេកមើល សន្ទស្សន៍គ្រីបតូភ័យខ្លាចនិងលោភលន់ confirmed the analyst’s position. At press time, the index showed that greed permeated the cryptocurrency markets.

When the index is in the “greed” range, it means that investors have become increasingly confident and optimistic about the market and may be more willing to take on risk.

This also suggests that prices are becoming overvalued and that a market correction may be imminent.

An assessment of BTC’s movement on the daily chart confirmed the possibility of a price correction. Since 21 January, the king coin has traded in a tight range.

When BTC’s price oscillates within a tight range, it means that the price is not making significant moves in either direction and is staying within a relatively narrow band.

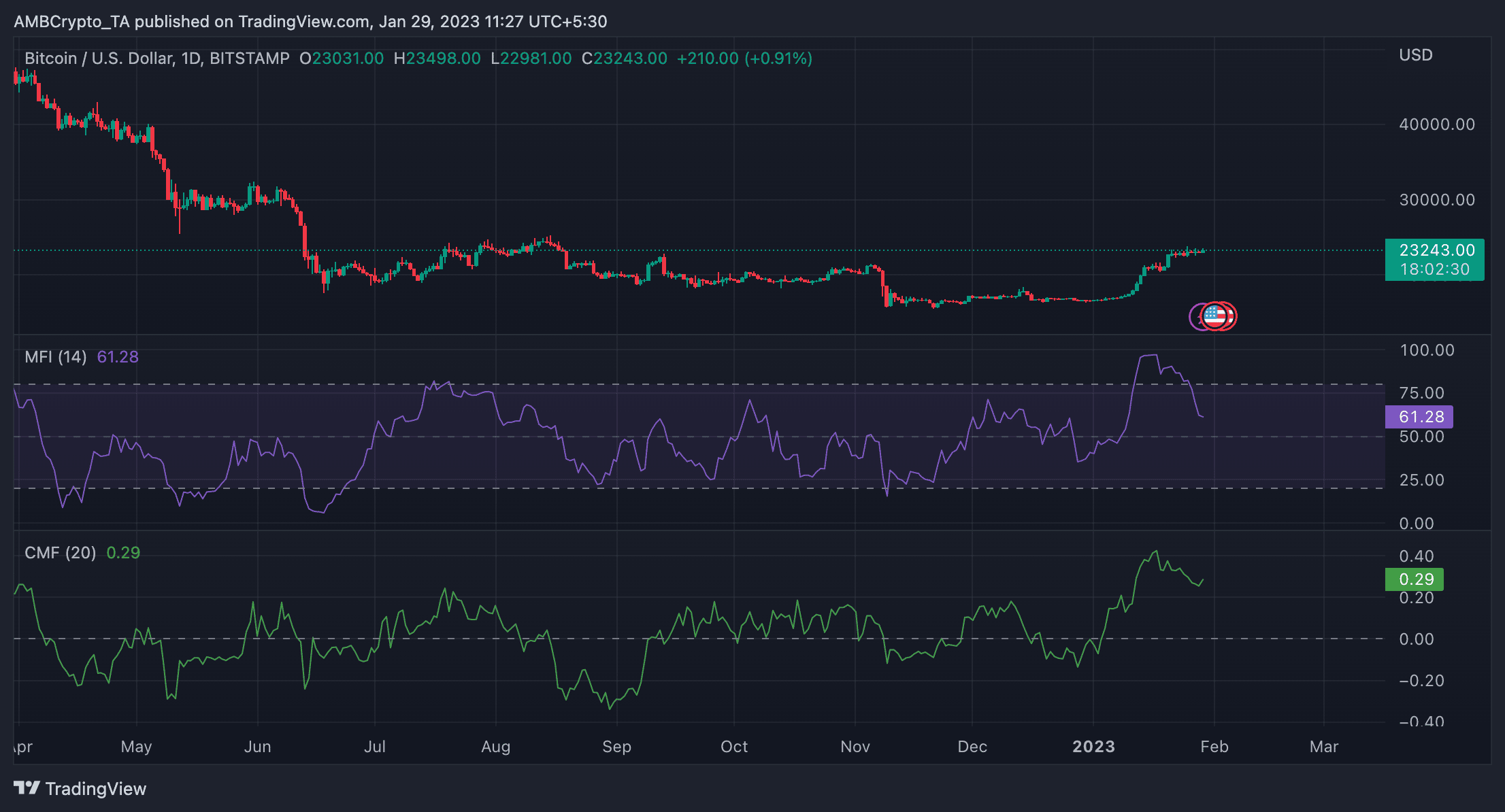

An analysis of BTC’s Money Flow Index (MFI) and Chaikin Money Flow (CMF) indicators raised more concerns as these technical indicators have been trending downwards since 21 January.

The tight range of BTC’s price combined with downtrends in the MFI and CMF suggested a lack of buying momentum and potential for increased selling pressure.

This also showed that the market was likely to break down from the tight range to the downside.

Source: https://ambcrypto.com/bitcoins-btc-imminent-price-reversal-might-be-on-the-cards/