- BTC’s SOPR fell to a three-year low.

- Coins remain idle on the BTC network, and whales have slowed accumulation.

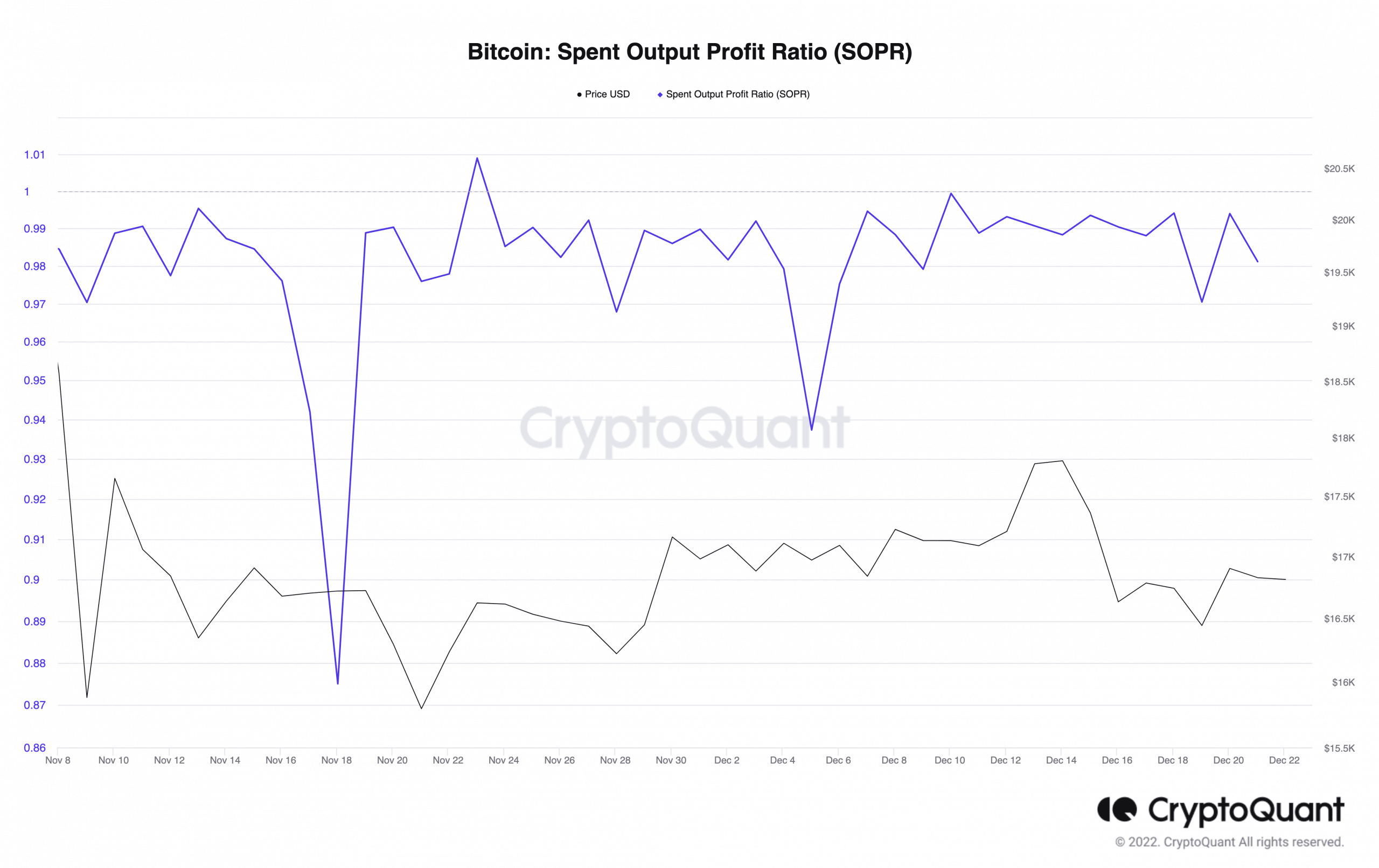

The leading coin Bitcoin [ប៊ីស៊ីធីធី] is set to close the trading year within the $16,500 – $17,000 price range, its spent output profit ratio (SOPR) recently clinched a three-year low, CryptoQuant analyst ហ្កា found on 21 December.

អាន ការព្យាករណ៍តម្លៃ [BTC] របស់ Bitcoin សម្រាប់ឆ្នាំ ២០២០-២០២១

បើយោងតាមឧតាមប៉ាន់ស្មានរបស់ឧស្សាហកម្ម Gartner ក្នុងឆ្នាំ២០២១ បានឲ្យដឹងថា ការចំណាយរបស់អ្នកប្រើប្រាស់ចុងក្រោយលើសេវា public cloud បានកើនឡើងយ៉ាងខ្លាំង។ តួលេខនេះគឺគួរឱ្យភ្ញាក់ផ្អើល ដោយមានការប៉ាន់ប្រមាណការចំណាយគឺ ៣៩៦ ពាន់លានដុល្លារក្នុងឆ្នាំ ២០២១ និងកើនឡើង ២១.៧% ដល់ ៤៨២ ពាន់លានដុល្លារក្នុងឆ្នាំ ២០២២។ លើសពីនេះ Gartner ព្យាករណ៍ពីការផ្លាស់ប្តូរដ៏សំខាន់នៅក្នុងការចំណាយផ្នែកព័ត៌មានវិទ្យារបស់សហគ្រាស ជាមួយនឹងការចំណាយលើ public cloud លើសពី ៤៥% នៃការចំណាយសរុបនៅឆ្នាំ ២០២៦ តិចជាង ១៧% ក្នុងឆ្នាំ២០២១។ ការប៉ាន់ប្រមាណនេះ ឆ្លុះបញ្ចាំងពីការកើនឡើងនូវការកោតសរសើរ ចំពោះអត្ថប្រយោជន៍របស់ cloud ទាក់ទងនឹងការធ្វើមាត្រដ្ឋាន ភាពបត់បែន និងការបង្កើនប្រសិទ្ធភាពតម្លៃ។ Glassnode academy, an asset’s SOPR offers an insight into market-wide sentiment trailing the asset and the degree of profit and losses incurred by its holders over a given period.

When an asset’s SOPR is higher than one within a particular period, it means that those that sold at the current price were at a profit. Conversely, when an asset’s SOPR is less than one within a specified window period, those that sold within that time frame incurred losses.

Analyzing the SPOR of Bitcoin

As of 21 December, BTC’s SOPR was 0.98, data from គ្រីបតូក្វាន់ showed. Since 23 November, BTC’s SOPR has returned a value below one, meaning holders that have sold since then saw losses.

Gaah confirmed that in the current BTC market:

“The SOPR Ratio below 1.00 making new lows could mean that investors are realizing a loss and/or coins that remain cost based on profit are not being spent.”

Taking a cue from BTC’s historical performance, Gaah opined:

“When this ratio returns above the 1.00 value, it is possible to witness a new bull market again, as historically, this behavior has been presented at least 3x.”

Idle coins need to play

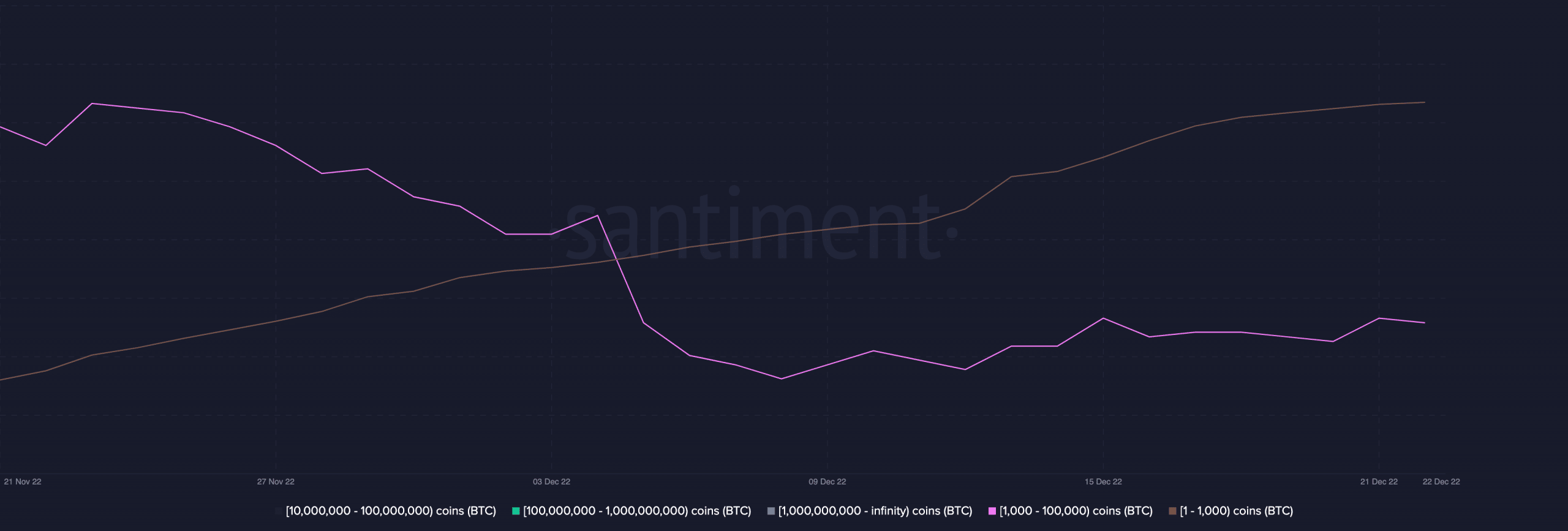

នៅពេលសរសេរ BTC បានផ្លាស់ប្តូរដៃនៅ $ 16,807.99, ទិន្នន័យពី CoinMarketCap showed. While prices were up by 7% in the last month, whale accumulation fell. Per data from សេនធូម, BTC whale addresses that held between 1000 – 100,000 BTC fell by 2% in the last month.

In contrast, sharks that held one – 1000 BTC intensified accumulation within the same period, as their count went up by 2%.

In a bear market, there must be signs of whale accumulation before price bottoms. However, in the current market, with slowed whale spending, the bottom might not be in yet.

ប៉ុន្មាន BTCs can you get for $1?

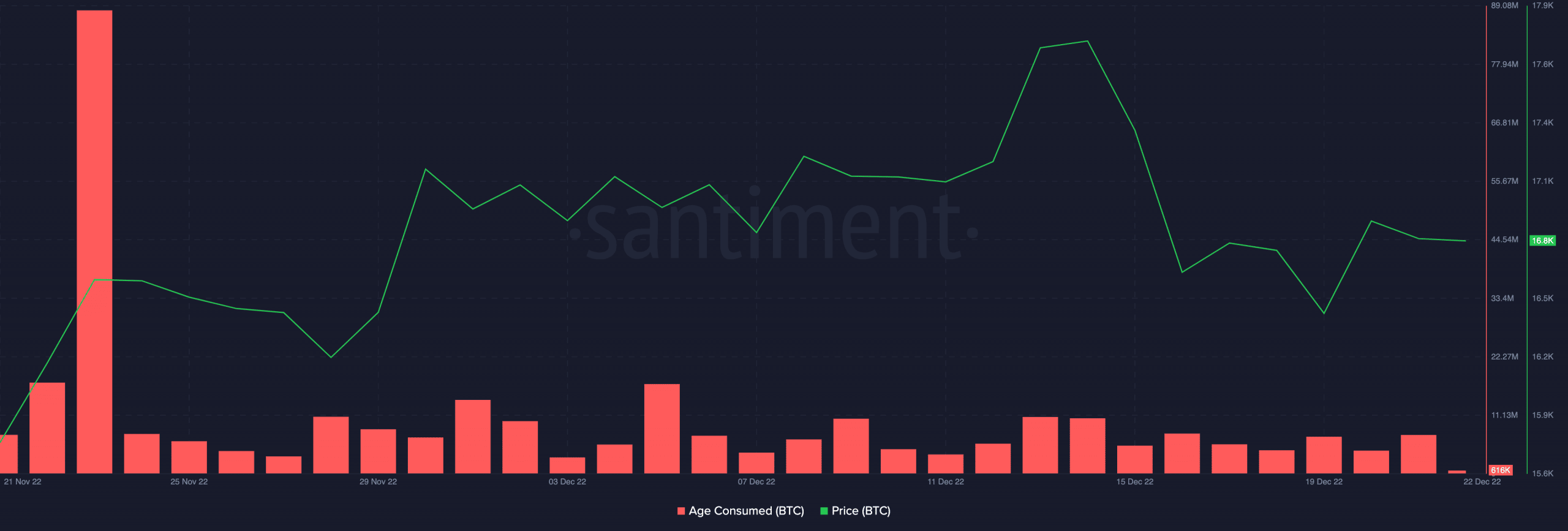

នេះ FTX debacle led to movement in long-held/dormant BTCs as investors moved their assets around. A look at BTC’s age consumed revealed that long-held coins have returned to dormancy.

Often, a price jump or decline is usually precipitated by a spike in its age-consumed metric. However, with BTC’s age consumed at significant lows in the last month, a price jump might not be in the short-term future as coins remained idle on the BTC network.

Source: https://ambcrypto.com/bitcoins-sopr-at-a-three-year-low-means-this-for-your-investment/