អ្នកកាន់ Bitcoin (BTC) មានភាពលំបាកក្នុងឆ្នាំ 2022 ប៉ុន្តែវាជាឆ្នាំដ៏លំបាកមួយសម្រាប់ការជីកយករ៉ែ BTC - ភាគហ៊ុននៃការជីកយករ៉ែបានធ្លាក់ចុះជាង 80% ហើយការក្ស័យធនរបស់ក្រុមហ៊ុនរុករករ៉ែបានធ្វើឱ្យទីផ្សារធ្លាក់ចុះ - ប៉ុន្តែការធ្លាក់ចុះដ៏អាក្រក់បំផុតនៃអ្នករុករករ៉ែអាចចប់។ ការវិភាគ CryptoSlate ។

ជាមួយនឹងតម្លៃ BTC ចុះ 75% ពីកម្រិតខ្ពស់គ្រប់ពេលវេលារបស់វា (ATH) អត្រា hash ក៏ឈានដល់កម្រិតខ្ពស់គ្រប់ពេលដែរ ដោយសារអ្នករុករករ៉ែបានបង្កើនកិច្ចខិតខំប្រឹងប្រែងដើម្បីធានាបាននូវប្រាក់ចំណេញក្នុងវិបត្តិថាមពល។

BTC Miner capitulation decreasing

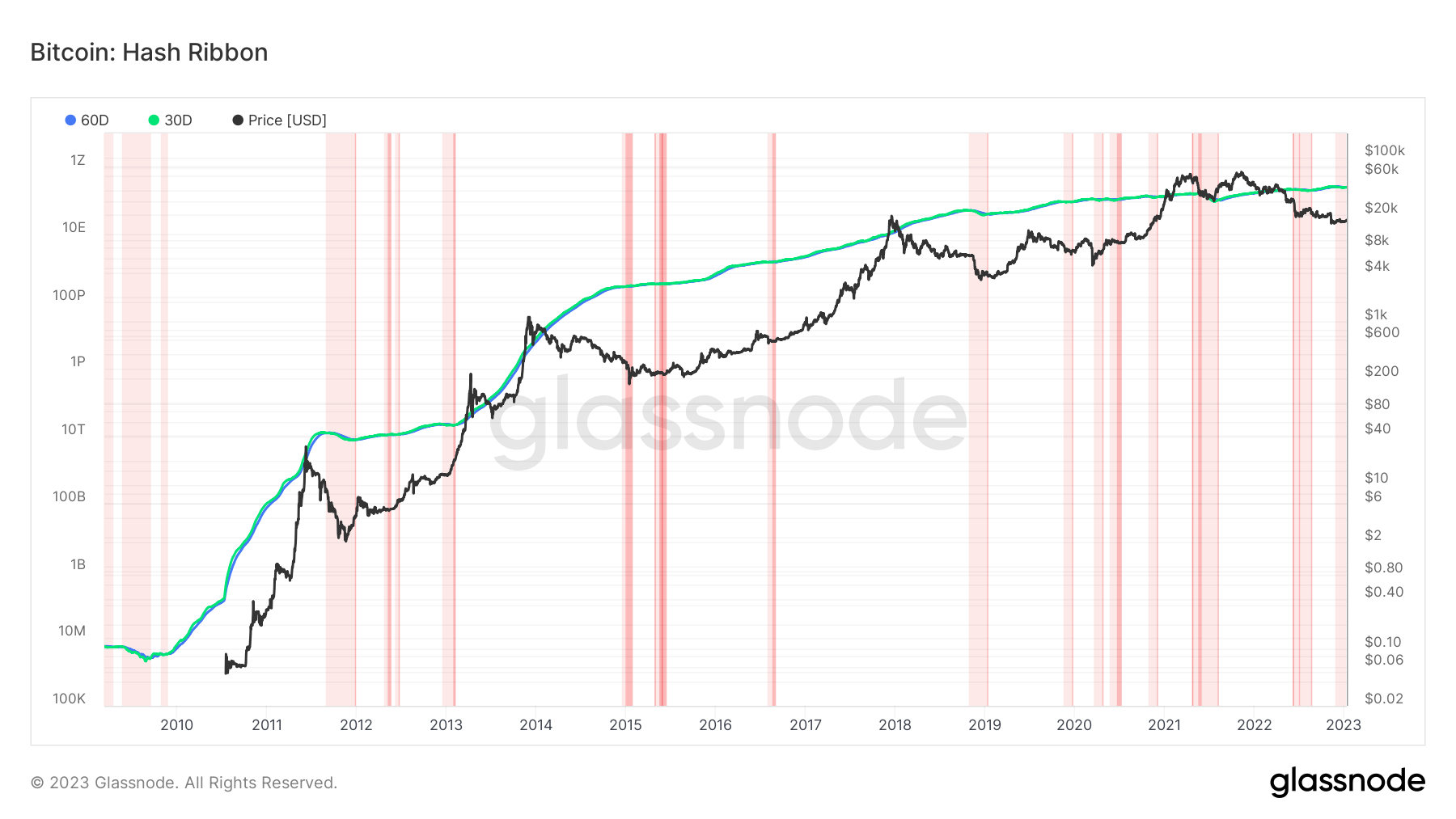

គំនូសតាងសូចនាករ Hash Ribbon ខាងលើបង្ហាញថា ភាពអាក្រក់បំផុតនៃការជីកយករ៉ែត្រូវបានបញ្ចប់នៅពេលដែល 30-day moving average (MA) ឆ្លងកាត់ 60-day MA — ប្តូរពីតំបន់ពន្លឺ-ក្រហមទៅងងឹត-ក្រហម។

When this paradigm shift occurs, a switch from negative to positive price momentum is expected, which historically reveals good buying opportunities (switching from dark-red back to white).

It is suggestive that the worst of miner capitulation is almost over as BTC turns bullish and breaks out towards $19,000, according to Glassnode data in the chart above analyzed by CryptoSlate.

BTC miner supply sell pressure abating

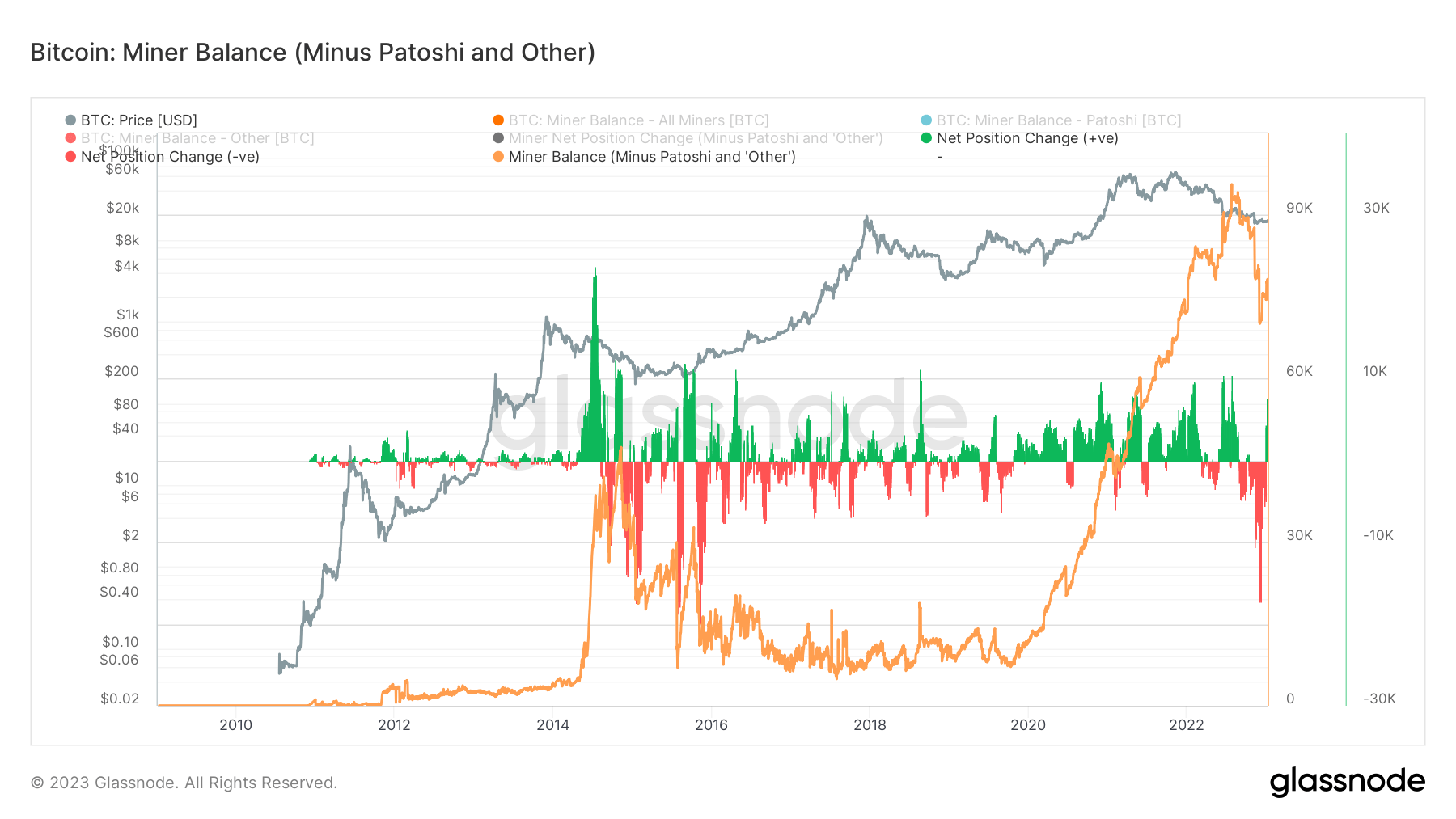

The total supply of BTC currently held in miner wallets has hit roughly 1.8 million BTC after a drawdown of roughly 30,000 BTC. This doesn’t directly indicate that the BTC was sold but could, in fact, have been moved to another wallet for long-term storage.

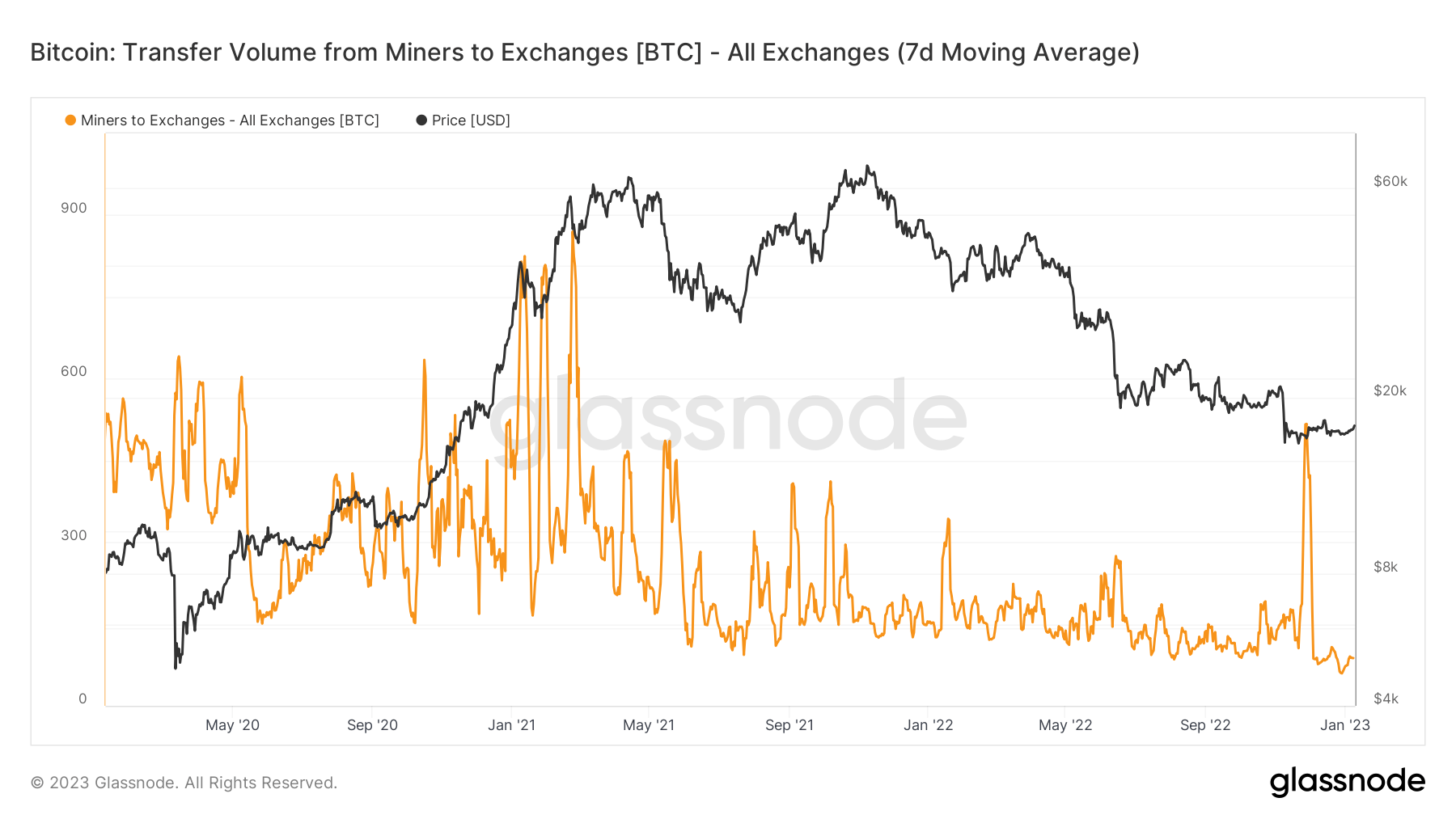

Meanwhile, miner spending has drastically decreased as transfer volume from miners to exchanges falls greatly, as shown in the chart below.

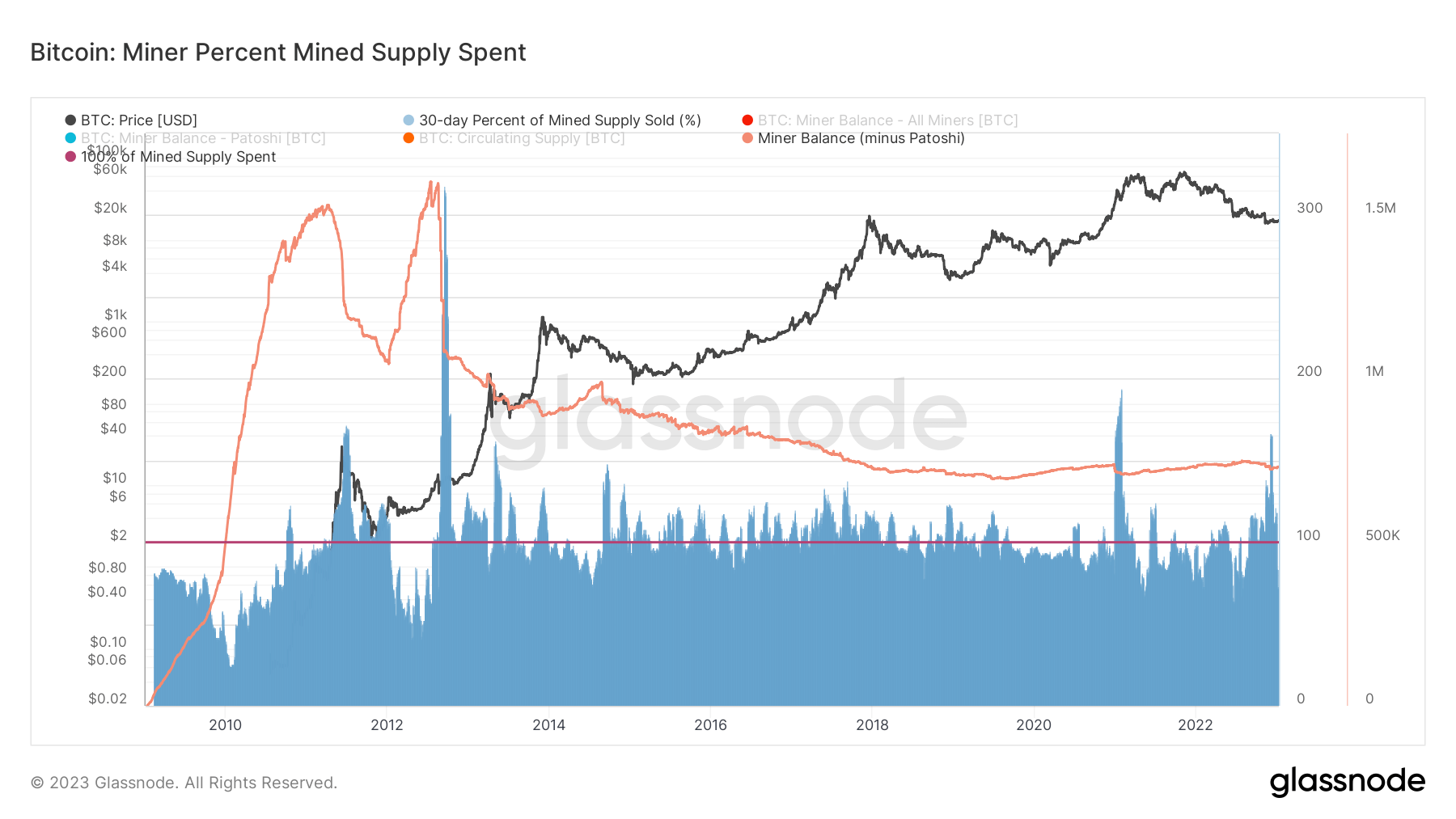

Miner sell pressure has reached its lowest in the last three years as less than 100 BTC is being sold on a seven-day MA. When compared to the vicious drawdown in 2022 — where miners were spending more BTC than was being mined — all charts indicate selling pressure is set to switch to buy pressure.

Source: https://cryptoslate.com/research-btc-hash-ribbon-indicator-signals-miner-capitulation-could-be-almost-over/