A crypto analytics firm says traders have become “optimistic” on Bitcoin and a pair of large-cap altcoins.

Santiment is detailing a breakdown of trader’s sentiment on specific large-cap crypto assets.

The company’s analysis shows that starting on approximately March 10th, traders began to see upside potential for BTC, as well as the payments asset XRP និង លុយកាក់ (BNB), which is the native token of the crypto exchange Binance and the core crypto asset of Binance Smart Chain.

In addition, the company calls out Polkadot (DOT) as a crypto asset with specifically negative sentiment among traders.

“A comparison of crypto’s top assets by market cap reveals Bitcoin, XRP and Binance Coin are showing signs of traders expecting price rises.

Meanwhile, Polkadot is one of the few top caps where trader sentiment is more negative than usual.”

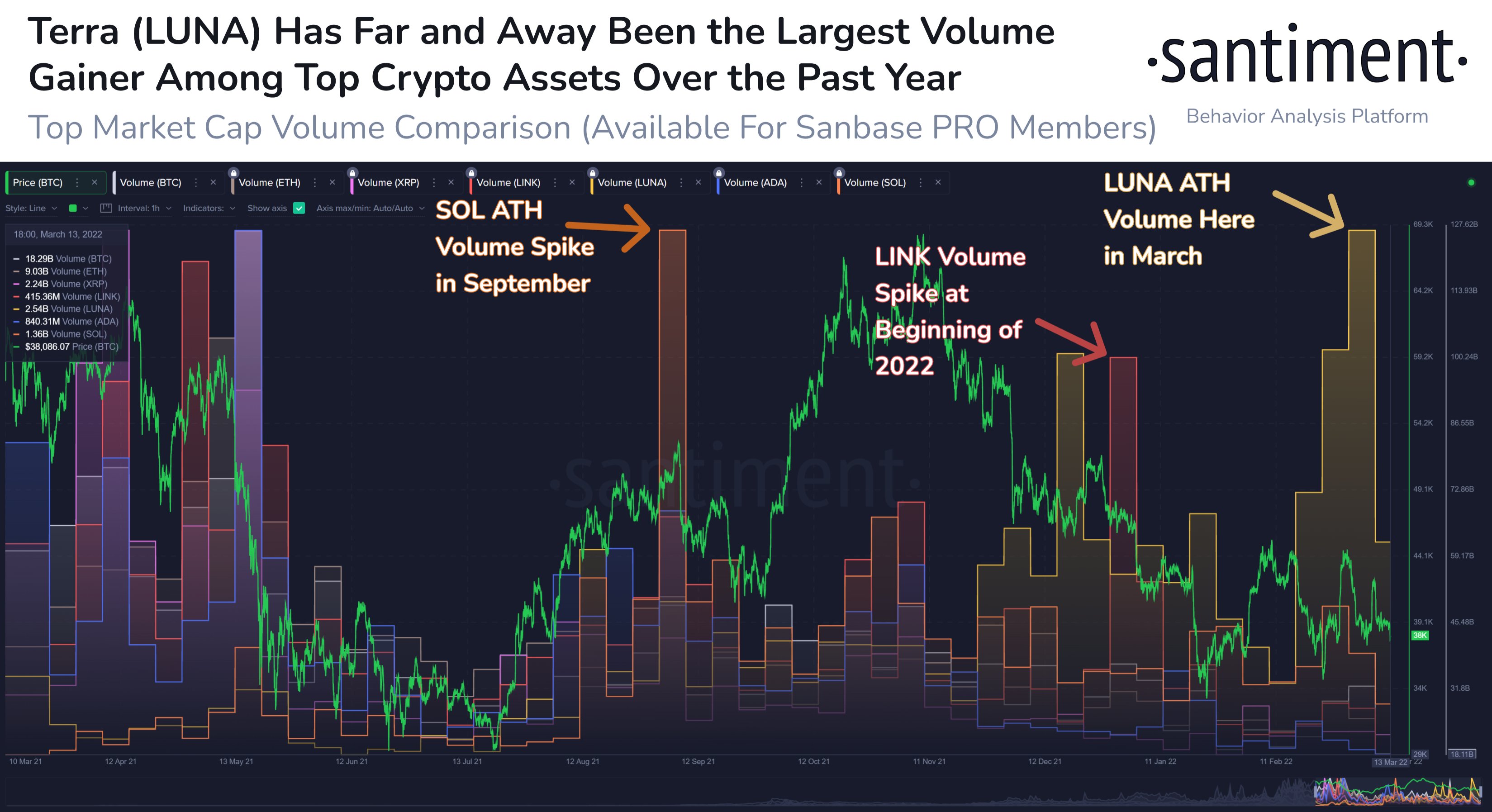

Looking back, Santiment says two Ethereum (ETH) rivals have taken volume away from Bitcoin (BTC) in the last 12 months.

The firm says that the Ethereum ដៃគូប្រកួតប្រជែង តារ៉ា (LUNA) និង សូឡាណា (SOL) have exponentially grown in volume as both crypto assets registered all-time highs over the past year.

“The past year has seen major changes in trading interest. It’s been well documented that LUNA and SOL have emerged into the top 10 market cap assets with very high volume. But this has come at the expense of BTC and ETH seeing their volume drop off.”

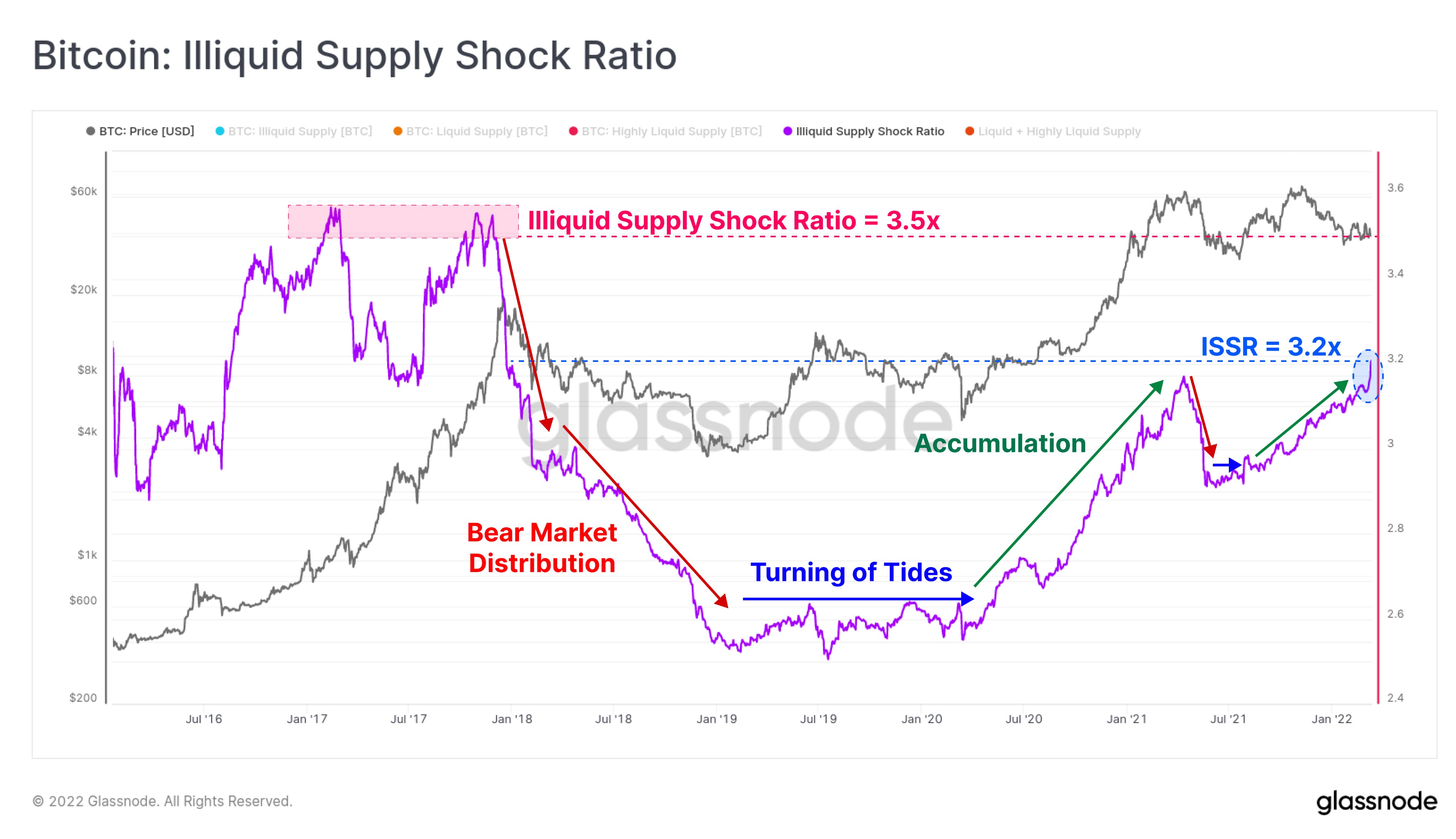

ទោះបីជា Bitcoin has seen its volume decline in the past months, Santiment says that traders still The optimism among Bitcoin traders comes as fellow intelligence firm Glassnode reports a rise in the amount of BTC that’s being transferred to owners who tend to hold their coins for the long haul.

“Illiquid BTC អ supply represents coins held in wallets with little to no history of spending. It is now 3.2x larger than liquid and highly liquid supply combined.”

According to Glassnode, the illiquid supply shock ratio (ISSR) is a metric that attempts to ទស្សន៍ទាយ the probability of supply shock forming, where fewer coins are available to meet current demand trends.

When large amounts of coins move out of liquid circulation, the ISSR trends higher indicating the possibility of BTC price rally if supply dwindles.

ពិនិត្យ សកម្មភាពតម្លៃ

កុំនឹក Beat - ជាវប្រចាំ ដើម្បីទទួលបានការដាស់តឿនអ៊ីមែលតាមអ៊ីមែលដែលផ្ញើដោយផ្ទាល់ទៅប្រអប់ទទួលរបស់អ្នក

តាមយើងនៅលើ Twitter, Facebook និង Telegram

surf ឌឹដហូមលាយប្រចាំថ្ងៃ

ការបដិសេធ: មតិដែលបានសម្តែងនៅឌឹដហូមដស៍មិនមែនជាដំបូន្មានវិនិយោគទេ។ វិនិយោគិនគួរតែប្រឹងប្រែងដោយយកចិត្តទុកដាក់មុនពេលធ្វើការវិនិយោគដែលមានហានិភ័យខ្ពស់នៅក្នុង Bitcoin, cryptocurrency ឬទ្រព្យសម្បត្តិឌីជីថល។ សូមណែនាំថាការផ្ទេរនិងការធ្វើពាណិជ្ជកម្មរបស់អ្នកគឺជាហានិភ័យផ្ទាល់របស់អ្នកហើយការបាត់បង់ណាមួយដែលអ្នកអាចទទួលរងគឺជាទំនួលខុសត្រូវរបស់អ្នក។ Daily Hodl មិនបានផ្តល់អនុសាសន៍ឱ្យទិញឬលក់រូបិយប័ណ្ណគ្រីបថលឬទ្រព្យសម្បត្តិឌីជីថលទេហើយក៏មិនមែនជាអ្នកផ្តល់ប្រឹក្សាផ្នែកវិនិយោគផងដែរ។ សូមកត់សម្គាល់ថាឌឹដេវហូដចូលរួមក្នុងទីផ្សារសម្ព័ន្ធ។

រូបភាពពិសេស៖ Shutterstock/tykcartoon/Tun_Thanakorn

Source: https://dailyhodl.com/2022/03/15/crypto-traders-are-bullish-on-bitcoin-xrp-and-binance-coin-but-bearish-on-one-large-cap-altcoin-santiment/