Digital assets manager CoinShares says large institutional investors are pouring money into Bitcoin (BTC អ) at rates not seen in the last six months.

នៅក្នុងរបាយការណ៍លំហូរទ្រព្យសកម្មឌីជីថលចុងក្រោយបំផុតរបស់ខ្លួនប្រចាំសប្តាហ៍ CoinShares រកឃើញ that institutional investors are pouring money into the digital asset markets after a long dry spell.

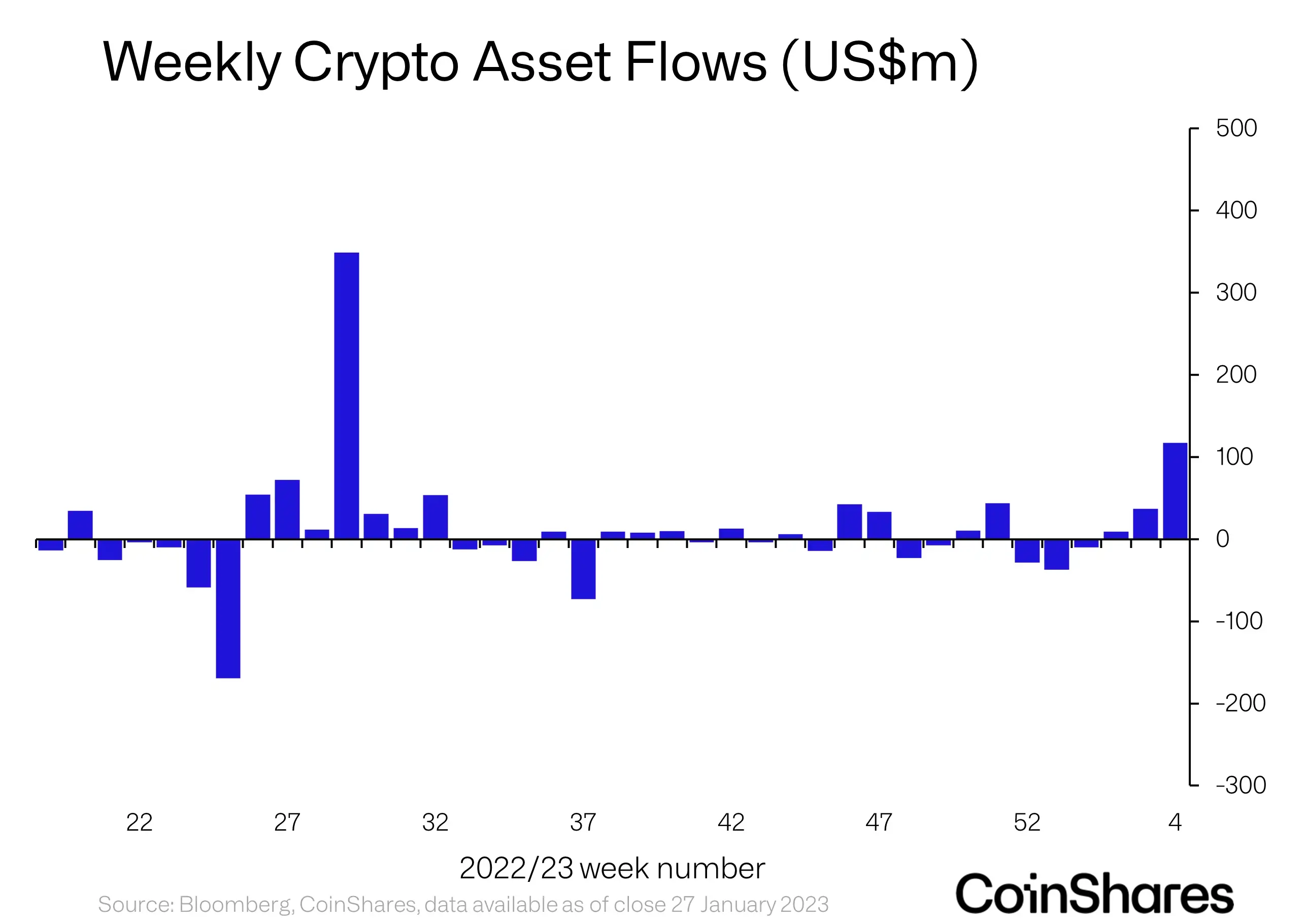

“Digital asset investment products saw US$117m inflows last week, the largest since July 2022, while total asset under management (AuM) have risen to US$28bn, up 43% from their November 2022 lows.

The focus was almost entirely on Bitcoin, which saw US$116m inflows last week, although there were also minor inflows into short-bitcoin of US$4.4m.”

Short BTC products, which aim to profit on downward moves of the leading cryptocurrency by market cap, saw $4.4 million in inflows last week as traditional BTC products took in $116 million.

While BTC and other altcoin investment products had solid inflows, CoinShares says multi-asset investment products, those investing in more than one digital asset, saw outflows for the ninth week in a row.

“Multi-asset investment products saw outflows for the 9th consecutive week totaling US$6.4m, suggesting investors are preferring select investments. This was evident in altcoins as Solana, Cardano and Polygon all saw inflows, while Bitcoin Cash, Stellar and Uniswap all saw minor outflows.”

Ethereum (សាកលវិទ្យាល័យ ETH) investment products saw inflows of $2.3 million. Solana (SOL) products took in $1.1 million. Polygon (ម៉ាទីក) products enjoyed inflows of $200,000.

កុំនឹក Beat - ជាវប្រចាំ ដើម្បីទទួលបានការដាស់តឿនអ៊ីមែលតាមអ៊ីមែលដែលផ្ញើដោយផ្ទាល់ទៅប្រអប់ទទួលរបស់អ្នក

ពិនិត្យ សកម្មភាពតម្លៃ

តាមយើងនៅលើ Twitter, Facebook និង Telegram

surf ឌឹដហូមលាយប្រចាំថ្ងៃ

ការបដិសេធ: មតិដែលបានសម្តែងនៅឌឹដហូមដស៍មិនមែនជាដំបូន្មានវិនិយោគទេ។ វិនិយោគិនគួរតែប្រឹងប្រែងដោយយកចិត្តទុកដាក់មុនពេលធ្វើការវិនិយោគដែលមានហានិភ័យខ្ពស់នៅក្នុង Bitcoin, cryptocurrency ឬទ្រព្យសម្បត្តិឌីជីថល។ សូមណែនាំថាការផ្ទេរនិងការធ្វើពាណិជ្ជកម្មរបស់អ្នកគឺជាហានិភ័យផ្ទាល់របស់អ្នកហើយការបាត់បង់ណាមួយដែលអ្នកអាចទទួលរងគឺជាទំនួលខុសត្រូវរបស់អ្នក។ Daily Hodl មិនបានផ្តល់អនុសាសន៍ឱ្យទិញឬលក់រូបិយប័ណ្ណគ្រីបថលឬទ្រព្យសម្បត្តិឌីជីថលទេហើយក៏មិនមែនជាអ្នកផ្តល់ប្រឹក្សាផ្នែកវិនិយោគផងដែរ។ សូមកត់សម្គាល់ថាឌឹដេវហូដចូលរួមក្នុងទីផ្សារសម្ព័ន្ធ។

រូបភាពពិសេស៖ Shutterstock/Yurchanka Siarhei/Panuwatccn

Source: https://dailyhodl.com/2023/01/30/institutions-pour-capital-into-bitcoin-btc-at-highest-rate-since-july-of-last-year-coinshares/