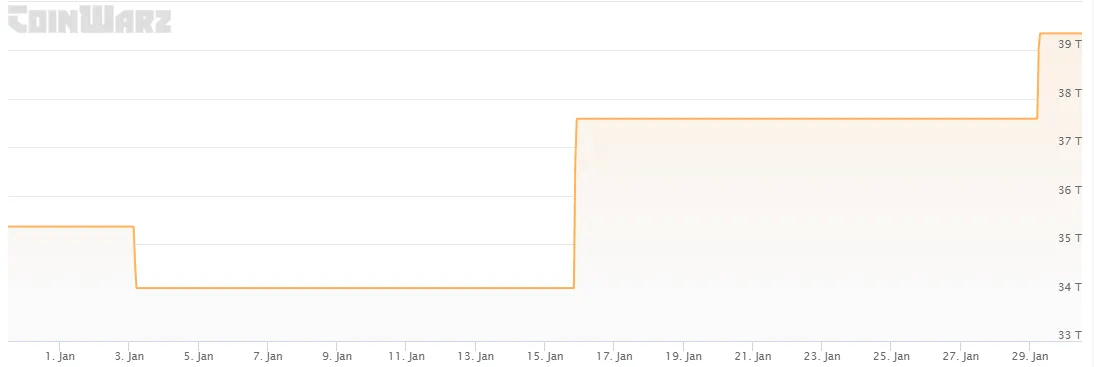

Mining Bitcoin has become significantly more difficult over the past few days. Its mining difficulty is up to a new peak of 39.35 trillion, which rose by 4.68% from 37.59 trillion on Sunday.

Mining difficulty refers to how much computing power it takes to mine one BTC. It adjusts every two weeks depending on the number of miners connected to the network; when there are more miners, it becomes harder but easier if they leave.

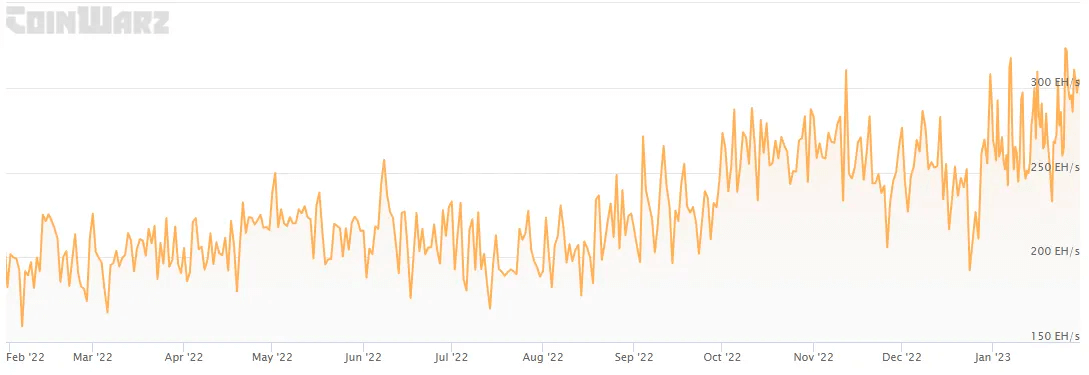

Due to the number of miners on the network and more computing power, mining difficulty has increased steadily throughout the past 12 months, even with occasional dips, such as in December 2022. By January 30, 2022, statistics from CoinWarz revealed mining difficulty to be at 26.24 EH/s; however, it is now up by around 50%, settling at a level of 39.35 EH/s. Indeed, this sharp rise demonstrates that despite temporary hiccups here and there, mining complexity continues to march toward higher levels.

Bitcoin’s hash rate is currently 305.81 ExaHashes per second (EH/s), a lower number than the all-time high of 348.7 EH/S seen on January 6th, 2021. This means miners make over 305 quintillion codebreaking attempts every second to solve PoW computational equations to អណ្តូងរ៉ែ Bitcoin. This time last year, Bitcoin’s hash rate was 182.37 EH/s when compared to the present BTC hash rate.

Despite the noticeable rise of អត្រាហាសរបស់ Bitcoin and mining difficulty in 2022, its price has failed to keep up; according to ទិន្នន័យ CoinGecko, it dropped from $38,232 on January 30th, 2022, all the way down to $23,211 today—amounting to a 39.3% decrease.

Bitcoin mining difficulty mounting

Unfortunately, this could be detrimental to those in the Bitcoin mining industry. A higher mining difficulty means that more powerful machines and computers might be needed to generate the same amount of Bitcoin, increasing costs significantly.

If the price of Bitcoin does not increase proportionally to the mining difficulty, it can make mining an economically unviable venture.

The news of bankruptcy and debt restructuring has been tragically frequent lately. In December 2022, Core Scientific—one of the most prominent publicly-traded mining companies in the United States, was declared bankrupt. As if that weren’t enough, Greenidge Generation announced their shaky future as being “in substantial doubt.” It’s not just falling Bitcoin prices and increasing miner difficulties causing these issues; industrial energy prices have also increased by 16% since 2021, which has posed a huge problem for miners operating fleets of power-consuming machines.

Source: https://www.cryptopolitan.com/mining-bitcoin-just-got-a-lot-harder-see-why/