The CEO of leading on-chain analytics firm CryptoQuant says one metric is flashing a massive red flag for Bitcoin (BTC) bulls.

Ki Young Ju tells his 292,600 Twitter followers that historical data ការបង្ហាញ Bitcoin could plummet all the way down to $14,000.

“So here’s hopium for bears.

If BTC crashed so hard due to the macro crisis and all Bitcoiner institutions go underwater, it could go $14,000 based on historical maximum drawdown.”

នៅពេលសរសេរ Bitcoin is down 3.58% and priced at $29,240. A move to the analyst’s bearish price target suggests a 52% downside risk for BTC.

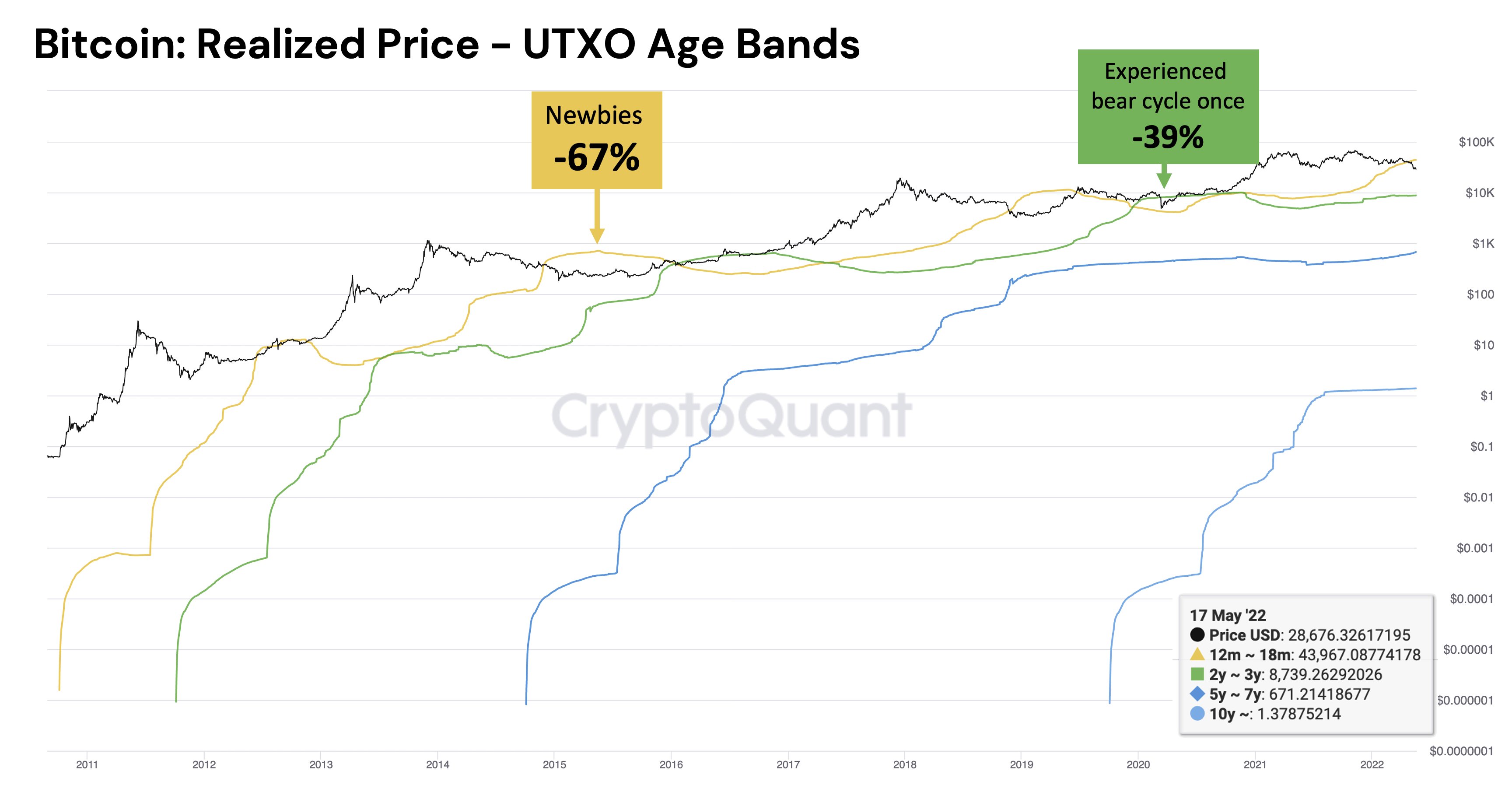

According to the quant analyst, the most recent Bitcoin investors will likely be deep underwater should market prices fall into his worst-case scenario.

“Bitcoin maximum drawdown in worst-case scenario.

Newbies down 67%.

Experienced one bear cycle – down 39%.

Experienced two bear cycles – profit guaranteed.

Experienced three bear cycles – profit guaranteed.

Today, newbies who joined last year are in -34% loss.”

Ki Young Ju next ការផ្ដល់ឱ្យ the average entry price for each generation of Bitcoin investors over its 11 years in existence by following the UTXO age bands metric, which បទ the potential price level where long-term holders accumulated BTC.

# ប៊ីធាក់ OG’s Entry Price:

1st gen – $1.3

2nd gen – $653

3rd gen – $8,717

4th gen – $43,582I’m the 3rd gen. Hang in there, 4th gen. pic.twitter.com/iWkEwFO4zV

- គីយ៉ុងជូ (@ki_young_ju) ថ្ងៃទី 14 ខែ ឧសភា ឆ្នាំ 2022

The analyst also recently សង្កេត that institutional investors are now the dominant force in Bitcoin trading.

“Retail investors are leaving the crypto market. Not bad for accumulating Bitcoin with institutions, but still worried about overall volume, which is significantly decreased compared to last year.”

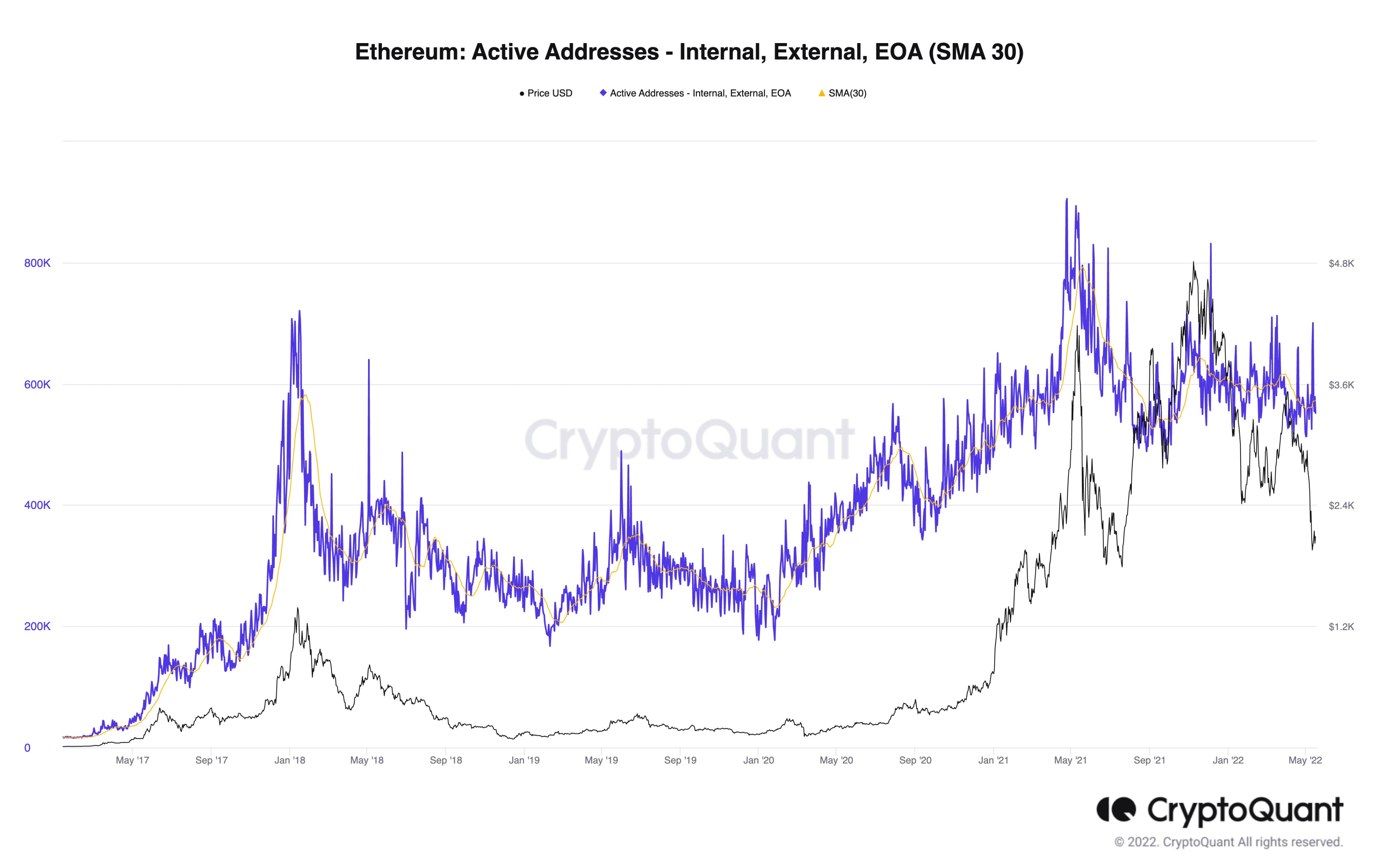

The CryptoQuant CEO next looks at leading smart contract platform Ethereum (ETH). He គំនួសពណ៌ that the ETH ecosystem remains strong despite a massive decline in price due to heavy interest in new blockchain niches like decentralized finance (DeFi), non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs) and play-to-earn blockchain games (GameFi).

“ETH price dropped -56% from the top, but the number of active addresses just decreased by 7%.

If we consider each address as a user, Ethereum has 551,705 DAU (Daily Active Users) today.

These degens don’t care about ETH price but ape into DeFi, NFT, DAO, and GameFi projects.”

Ethereum is also down by 2.57%, changing hands for $1,965.

ពិនិត្យ សកម្មភាពតម្លៃ

កុំនឹក Beat - ជាវប្រចាំ ដើម្បីទទួលបានការដាស់តឿនអ៊ីមែលតាមអ៊ីមែលដែលផ្ញើដោយផ្ទាល់ទៅប្រអប់ទទួលរបស់អ្នក

តាមយើងនៅលើ Twitter, Facebook និង Telegram

surf ឌឹដហូមលាយប្រចាំថ្ងៃ

ការបដិសេធ: មតិដែលបានសម្តែងនៅឌឹដហូមដស៍មិនមែនជាដំបូន្មានវិនិយោគទេ។ វិនិយោគិនគួរតែប្រឹងប្រែងដោយយកចិត្តទុកដាក់មុនពេលធ្វើការវិនិយោគដែលមានហានិភ័យខ្ពស់នៅក្នុង Bitcoin, cryptocurrency ឬទ្រព្យសម្បត្តិឌីជីថល។ សូមណែនាំថាការផ្ទេរនិងការធ្វើពាណិជ្ជកម្មរបស់អ្នកគឺជាហានិភ័យផ្ទាល់របស់អ្នកហើយការបាត់បង់ណាមួយដែលអ្នកអាចទទួលរងគឺជាទំនួលខុសត្រូវរបស់អ្នក។ Daily Hodl មិនបានផ្តល់អនុសាសន៍ឱ្យទិញឬលក់រូបិយប័ណ្ណគ្រីបថលឬទ្រព្យសម្បត្តិឌីជីថលទេហើយក៏មិនមែនជាអ្នកផ្តល់ប្រឹក្សាផ្នែកវិនិយោគផងដែរ។ សូមកត់សម្គាល់ថាឌឹដេវហូដចូលរួមក្នុងទីផ្សារសម្ព័ន្ធ។

Featured Image: Shutterstock/kilshieds

Source: https://dailyhodl.com/2022/05/21/one-metric-indicates-bitcoin-btc-could-crash-by-over-50-as-macro-environment-worsens-says-cryptoquant-ceo/