- US inflation data for September was released on October 13th.

- Persistent inflation signals more Fed rate hikes.

- Data on unemployment claims were also released.

The U.S. Bureau of Labor Statistics (BLS) released Consumer Price Index (CPI) data for the month of September. Here’s a round-up of how monthly and annual inflation data affected the market. Also, data on unemployment claims was released at the same time yesterday.

Inflation increased since August and dropped marginally since September 2021

| Inflation rates for September (data for August) | ||

| ប្រចាំខែ | ប្រចាំឆ្នាំ | |

| ចំណងជើង | ៧៩,៨៨% (៧៩,១៧%) | ៧៩,៨៨% (៧៩,១៧%) |

| ស្នូល | ៧៩,៨៨% (៧៩,១៧%) | ៧៩,៨៨% (៧៩,១៧%) |

Core inflation rose by 6.6%, annually, which is a 40-year high. Core inflation is the inflation rate for a basket of consumer goods excluding food and energy. Food and energy components of baskets are highly volatile unlike other items. អតិផរណា reported raw is actually called ‘headline inflation’. Core inflation is considered to be a better measure of consumer price changes.

‘All Urban’ Consumer prices rose by 0.4% in September and 8.2% over the last 12 months. The annual rate was slightly lesser than the year ending in August (8.3%). The annual rate was 0.1% higher than a Bloomberg survey involving 51 economists. All Urban consumers represent 93% of the total U.S. population.

Transportation services, shelter (housing), food, motor vehicle insurance, new vehicles, household furnishings and operations, education and medical care led the monthly increase while Gasoline offset the increase in September.

ថាមពល អតិផរណា rate rose 19.8% over the past 12 months ending September which was led by piped gas (natural gas) prices (33.1% increase). The price of Fuel Oil which is an energy commodity rose by 58.1% (not seasonally adjusted data).

228,000 initial claims for unemployment insurance were filed in the U.S. between October 1 to October 7. This is 9000 more than the previous week signaling a rise in unemployment.

Impact on Bitcoin, Gold and the US markets

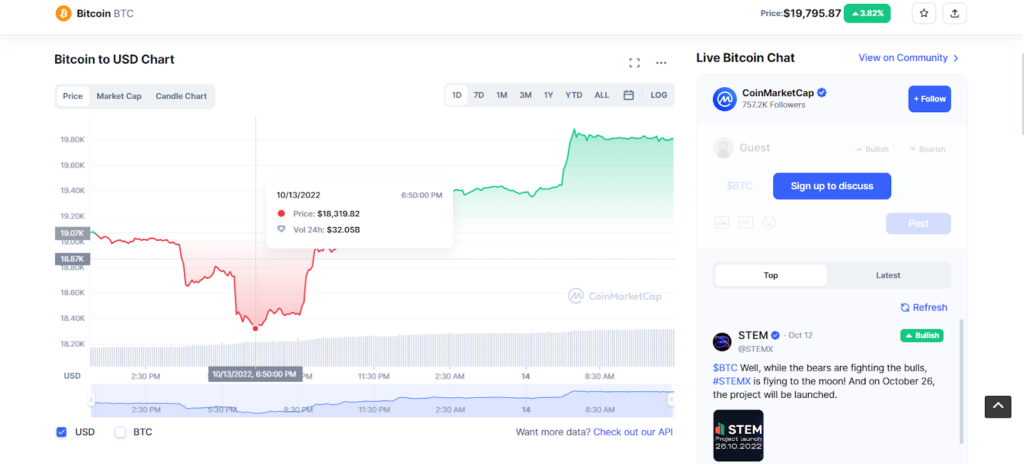

BTC/USD prices fell by 2.1% within an hour after the release. Its lowest price after the data release was $18,319.82 at 6:50 pm (ET), after which it bounced back and gained, steadily, over its previous day price. At the time of writing, BTC was priced at $19,802.41 (8.09% higher than lowest price post-release).

Gold prices closed 1.81% lower, almost within the hour. At the time of writing, the price was 0.47% short of the pre-release level, changing hands at $1666.22 per ounce.

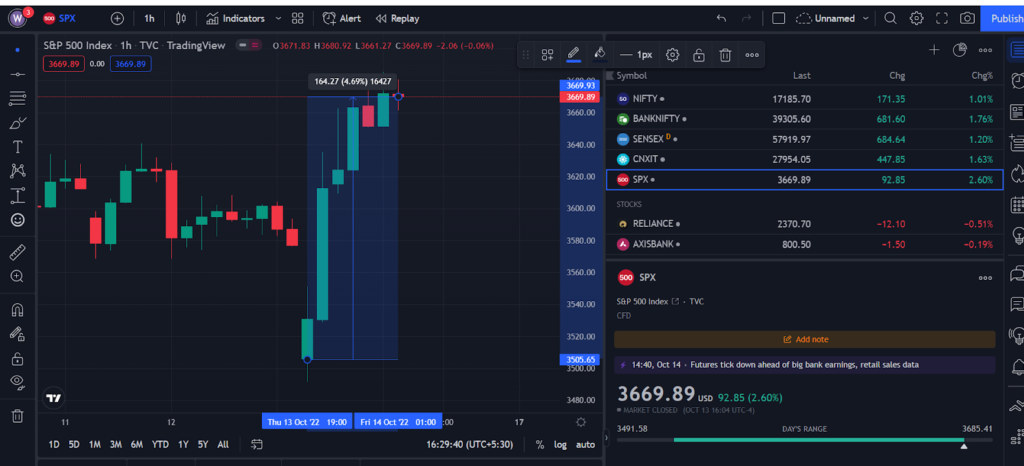

Examined from an hourly perspective, major US market indices showed gap-downs after markets opened an hour after the data release.

The S&P 500 witnessed a gap-down of 2.03%. However, at the end of today’s session, it closed 4.06% higher than today’s opening price. The bearish sentiment reflected till 22:00 hours before the bears made a comeback. At the time of writing, the index rallied 3.78%. The Dow Jones Industrial Average also showed a gap-down (1.68%) when the markets opened. However, Dow recovered quickly, closing at 6.6% higher than yesterday’s closing price.

The data was released at 8:30 am ET

Given that prices have not reduced, the Federal Reserve is likely to raise interest អត្រាការប្រាក់ again. This year, the Fed has already increased rates by 300 points or 3 percentage points. Fed Chairman Jerome Powell vowed to raise interest rates as long as inflationary pressures persisted. The next FOMC meeting is likely to be held in the first week of November.

Source: https://www.thecoinrepublic.com/2022/10/14/us-september-inflation-data-is-in-btc-gold-and-key-market-indices-show-upside-trends/