- PCE Price Index increased by 0.6% in January, up 4.7% compared to a year ago.

- The red-hot inflation could tip Fed to continue raising rates, impacting the crypto market.

Inflation rose in January, which could push the Fed to continue hiking rates, potentially impacting the crypto market. According to the Bureau of Economic Analysis (BEA), a U.S. government agency, the ការចំណាយលើការប្រើប្រាស់ផ្ទាល់ខ្លួន (PCE) Price Index increased by 0.6%, up 4.7% from a year ago.

អាន ការព្យាករណ៍តម្លៃ [BTC] របស់ Bitcoin 2023-24

Why PCE is a big trigger even for crypto

The Fed reportedly prefers the PCE over the Consumer Price Index (CPI) to gauge inflation. One of the main reasons behind PCE preference is its broader scope and ability to gauge the economy’s strength.

It also tracks how price changes influence spending behavior. Additionally, the PCE Price Index (PCEPI) tracks price changes and inflation over time.

On the other hand, CPI doesn’t factor in the difference in spending patterns across households and hardly accounts for price changes in rural or remote settings.

That said, it is worth noting that PCE and PCEPI rose by 1.8% and 0.6%, respectively, in January. It implies that the Fed could be put in a position to consider hiking rates further, thus confirming the higher-for-longer rate narrative that spread market uncertainty in the past few days.

U.S. equities and crypto markets performance after the PCE data

U.S. equities markets already closed in the red on Friday (24 February), as bearish sentiment swept the market. According to ហិរញ្ញវត្ថុ google, Nasdaq and S&P 500 declined by 1.69% and 1.05%, respectively.

The crypto markets were in the red too. Bitcoin (BTC) saw over $45 million worth of long positions wrecked in the past 24 hours, នេះបើយោងតាម to Coinalyze.

Additionally, BTC dropped below $24K, and the overall crypto market cap fell by over 3% in the same period, នេះបើយោងតាម ទៅ Coinmarketcap ។

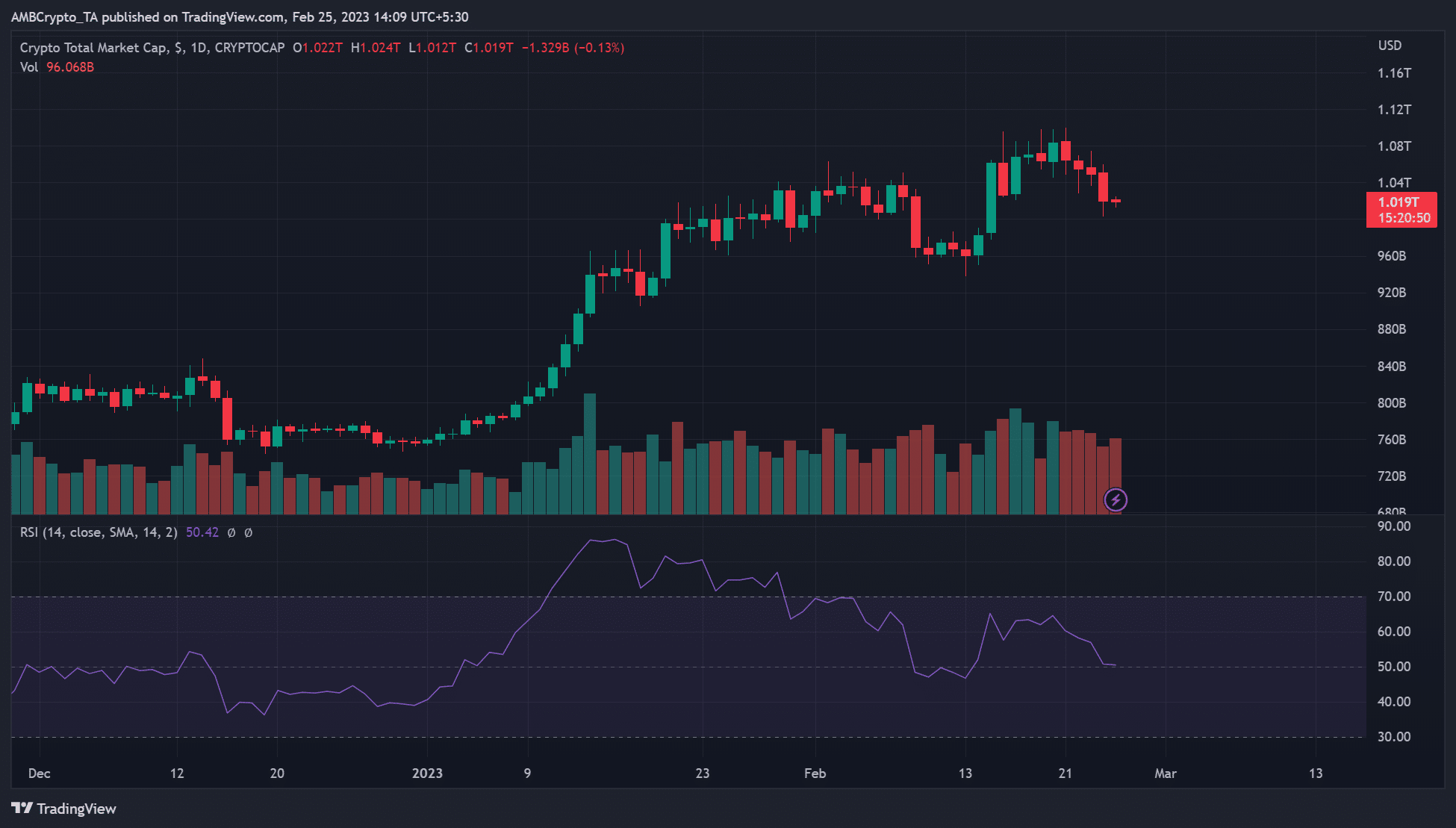

Collectively, the crypto market has dropped from $1.1T to $1.02T between Tuesday (February 21) and at the time of writing, according to aggregated data on TradingView.

Is your portfolio in green? Check out the ការគណនាប្រាក់ចំណេញ BTC

What does March hold for crypto?

If the Fed takes a hawkish stance in the March meeting due to the high inflation rate in January, the recent uptrend momentum could be slowed. The crypto market could correct most of the recent gains seen in the past two months if BTC breaks below the $23K psychological level.

Simply put, the Federal Open Market Committee’s meeting in March could affect the crypto market’s overall performance in Q1, 2023. A likely hawkish stance could undermine the recent gains, and tip bears to rule the market.

Source: https://ambcrypto.com/pce-price-index-and-what-to-expect-from-the-crypto-market-in-march/