Stocks are set to get a major bump on Thursday, thanks to blowout results from Tesla, which go some way in easing the sting over Netflix disappointment.

With earnings sharply in focus for now, market attention on the biggest war in Europe since World War II has faded some. While financial markets have moved past the initial shock of Russia’s brutal invasion of its neighbor Ukraine, it remains a massive, unresolved conflict.

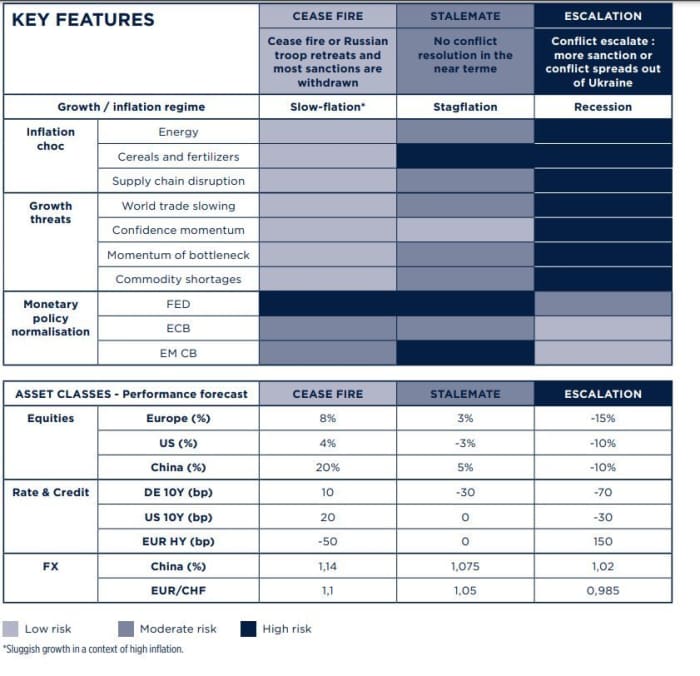

Bringing that back into focus for investors is our ការហៅនៃថ្ងៃ from Edmond de Rothschild strategists, who lay out three possible scenarios for the conflict’s end. They all involve higher inflation, but varying degrees of economic and market risk.

The most optimistic outcome laid out by Michaël Nizard, head of multiasset, and fund manager Delphine Arnaud, involves a cease-fire and pullout of Russian troops from most of Ukraine — leaving Moscow to focus on Crimea and Donbas. Russian President Vladimir Putin would get to boast of victories for the May 9 holiday marking his country’s defeat of Nazi Germany in 1945 at the end of WWII.

Commodity prices would ease as vital Ukraine agricultural work resumes, easing the risk of wheat shortages for emerging countries. Energy prices would fall to preinvasion levels, helping reduce inflation and some easing of sanctions on Russia would also boost production circuits.

“A decline in risk aversion on the markets and the shock on consumer confidence would make it possible to envisage economic growth in 2022 close to the level expected at the beginning of the year,” said the pair, predicting U.S. markets could bounce 4%, Europe 8% and China 20%.

The second scenario envisages a stalemate, which could drag past the summer. “Although investors, like the media, gradually turn their attention away from the war in Ukraine, considering that the worst has already been priced in, the headlines would regularly return to the fore with events that could lead to fears of a shift of the conflict to a darker scenario,” said Nizard and Arnaud.

They raised the prospect of slowing activity in Europe, rationing, stoppages of agricultural work in Ukraine causing food shortages and unrest for emerging countries. A stalemate would lead to a 3% drop for U.S. markets, though modest gains for Europe and China.

They left the worst for last, a scenario in which the conflict escalates, as sanctions fail to work against Russia, or China boosts support to Moscow.

“In this scenario, our fears are a disruption of European gas supply via Ukrainian gas pipelines, NATO military intervention and an escalation of sanctions between the U.S. and China. Global growth would collapse and risk assets would see a 15% to 30% decline,” they said.

“We can wonder whether the financial markets have actually priced in the new status of the European economy, that of a war economy.”

Here’s their chart summing up those views:

ការភ្ញាក់ផ្អើល

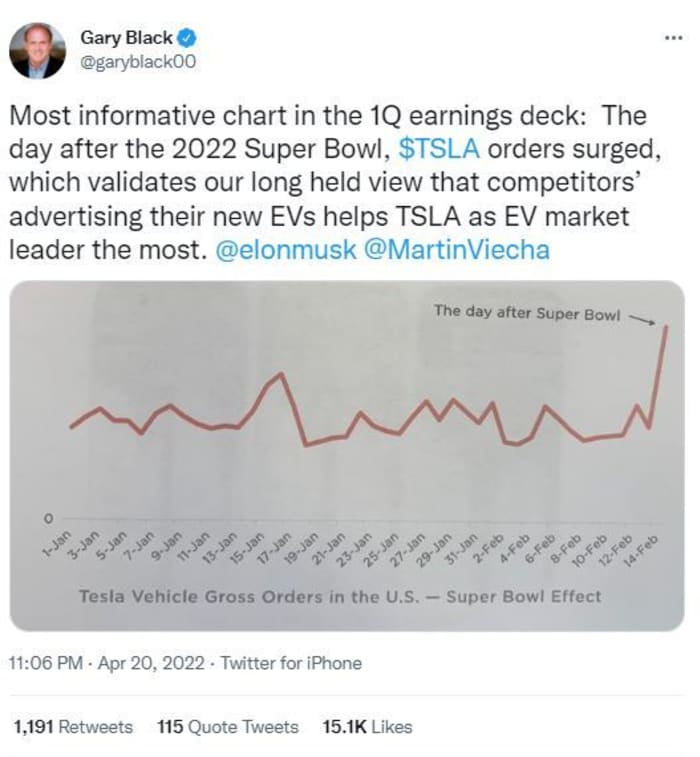

ក្រុមហ៊ុន tesla

TSLA,

shares are climbing after the electric-vehicle maker posted a blowout first-quarter profit, with sales up 81% despite supply-chain problems. CEO Elon Musk also promised a robotaxi for 2024.

មតិ: Tesla rides higher prices to fatter profit, as Elon Musk complains about costs

Hedge-fund manager Bill Ackman has thrown in the towel on Netflix shares

អិនអេហ្វអិល

which logged their worst drop since 2004 on earnings gloom. Shares are down another 4% as one research house predicts a 50% drop ahead,

ក្រុមហ៊ុនអាកាសចរណ៍អាមេរិច

អេអេល

shares are up 10% after លទ្ធផលរំភើប. Xerox

XRX,

are sinking 14% after the tech giant reported an unexpected loss. ខ្ទាស់

SNAP

លទ្ធផលគឺបន្ទាប់ពីបិទ។

ការទាមទារគ្មានការងារធ្វើប្រចាំសប្តាហ៍ បានធ្លាក់ចុះដល់ 184,000, near a 53-year low, while the Philadelphia Federal Reserve manufacturing survey came in softer. Leading economic indicators are still to come. Fed Chair Jerome Powell and European Central Bank President Christine Lagarde will join a global economy panel discussion. We’ll also hear from St. Louis Fed President James Bullard.

Russian forces were ordered by Putin not to storm the last Ukrainian stronghold in the besieged city of Mariupol, but block it “so that not even a fly comes through.” That’s a massive worry for the thousands of the soldiers and civilians sheltering in a massive steelworker factory.

ទីផ្សារ

ភាគហ៊ុន

ឌីស៊ីអាយអេស។

COMP

មាន ខ្ពស់ជាមួយនឹងទិន្នផលមូលបត្របំណុល

TMUBMUSD ១០ ឆ្នាំ

surging and oil prices

CL១៥០,

BRN00,

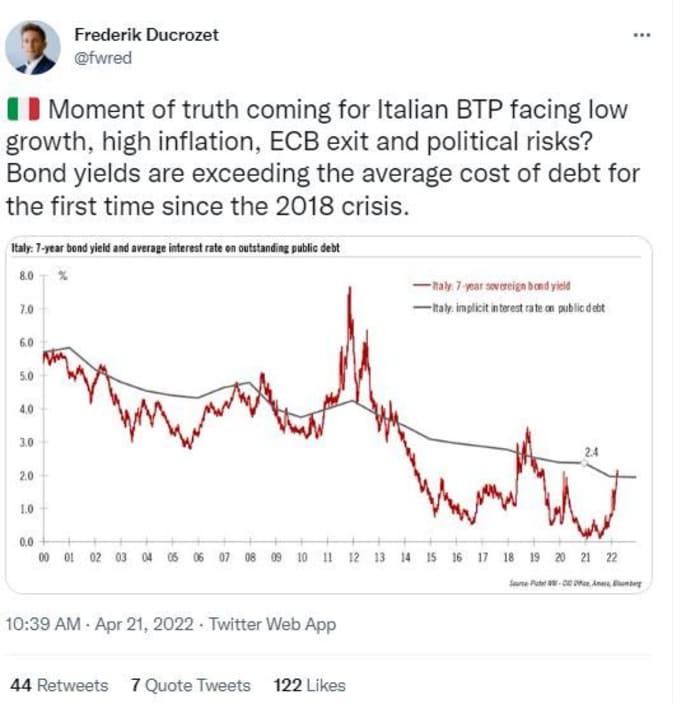

getting a lift. The euro

EURUSD,

and European bond yields

TMBMKDE-១០Y,

are up as a string of ECB officials talked up July rate increases. Asia saw a mixed session, with gains in Tokyo, but sharp losses for China stocks

SHCOMP,

សញ្ញាធីក

These were the most-searched tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | ឈ្មោះសុវត្ថិភាព |

| TSLA, | ក្រុមហ៊ុន tesla |

| អិនអេហ្វអិល | ក្រុមហ៊ុន Netflix Inc |

| GME, | GameStop |

| អេអឹមខេ, | អេអឹមខេកំសាន្តហូលឌីង |

| MULN | រថយន្ត Mullen |

| នីអូ, | NIO |

| អេ។ | អាតេរីន |

| អេអេសអិល | ផ្លែប៉ោម |

| អិនអេឌីឌី | nvidia បាន |

| TWTR, |

ចៃដន្យអាន

Never too old. For her 96th birthday, the U.K.’s Queen Elizabeth II will get her very own $75 Barbie.

ពូទីន រាយការណ៍ stopped his eldest daughter from flying out of Russia. She apparently had no plans to return.

ត្រូវដឹងចាប់ផ្តើមពីដំបូងហើយត្រូវបានធ្វើបច្ចុប្បន្នភាពរហូតដល់កណ្តឹងបើកប៉ុន្តែ ចុះឈ្មោះនៅទីនេះ ដើម្បីបញ្ជូនវាទៅប្រអប់អ៊ីមែលរបស់អ្នក។ កំណែអ៊ីមែលនឹងត្រូវផ្ញើចេញនៅម៉ោងប្រហែល ៧ និង ៣០ នាទីព្រឹកខាងកើត។

ចង់បានច្រើនទៀតសម្រាប់ថ្ងៃខាងមុខ? ចុះឈ្មោះសម្រាប់ ដឹខេមរុនប្រចាំថ្ងៃការធ្វើបទសម្ភាសន៍ពេលព្រឹកសំរាប់វិនិយោគិនរួមទាំងការអត្ថាធិប្បាយផ្តាច់មុខពីអ្នកនិពន្ធបារុននិង MarketWatch ។

Source: https://www.marketwatch.com/story/as-putin-eyes-a-date-to-declare-victory-heres-a-ukraine-scenario-that-could-slam-stocks-by-another-10-11650539901?siteid=yhoof2&yptr=yahoo