Stocks are in the green for Thursday, with Facebook parent Meta Platforms in the driver’s seat after less disastrous than feared results. Gains are a bit less than what stock futures were promising though.

With earnings, inflation, a COVID-19 resurgence and war all in the balance, any gained ground for stocks could easily disappear in another sell-the-rip move. Following weaker-than-expected growth data, Amazon and Apple results loom for after hours.

នៅលើរបស់យើង ការហៅនៃថ្ងៃ from TS Lombard’s chief U.S. economist, Steven Blitz, who sees the “golden era of Fed-controlled equity markets” coming to an end. (h/t ត្រចៀកផ្សារ).

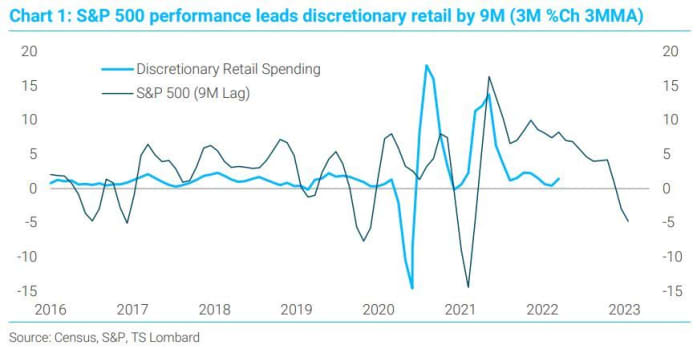

As Blitz explained, if equity market weakness continues, with the S&P 500

SPX,

down 12% year to date, consumers may slash spending by the end of this year, if not sooner.

“The Fed’s communicated policy trajectory was intended to weaken equities — equities and the dollar are the Fed’s main conduits to impact the economy and, in turn, inflation,” said the economist, in a recent note. “An acceleration of current market weakness adds to our expected near-term downswing in spending and, more critically, threatens to embed a much weaker outlook for spending heading into next year.”

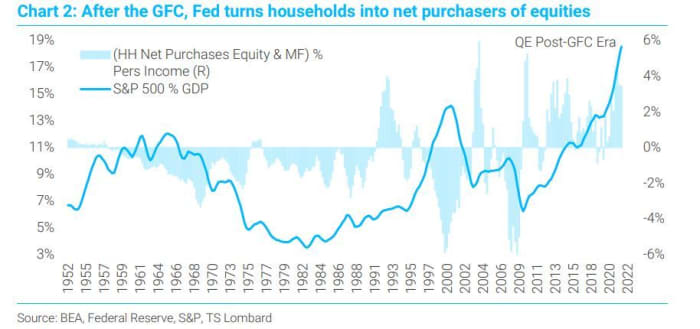

As for the connect between consumer spending and stock market performance, Blitz noted ties have tightened up since the global financial crisis of 2007-08, when households reacted by “long-tail deleveraging of their balance sheets.” He talked about how that sparked the Fed’s creation of an asset cycle centered on stocks, and households charged into equities because TINA [There is No Alternative] and the market only goes up, right?

His below chart shows how equities now, mostly, comprise a bigger chunk of household worth vs. early 2000. And as households sold into a late-90s rally instead of buying into the one that started in 2009, they are stuck with a higher cost-basis compared with the 2000 market crash. In short, they are more vulnerable to equity pullbacks.

The above chart notes, importantly, that young boomers (55 to 59) are most exposed to stocks — 46%, with the under 40 group least exposed at 3%. Generation X (40 to 54) owns 20%.

Why that matters?

“The combined 40-to-69 group accounted for 62% of consumer durables purchased since the economy bottomed in spring 2020. From here, it is easy to surmise that between satiated pent-up demand and falling equity valuations, consumer durable spending takes a hit,” he said.

Also consider that jump in cash relative to net worth as individuals age, said Blitz. The ratio is 15.4% for those 70 and over versus 11% for that young boomer crowd. “In other words, the 55 to 69 group likely begins to rebalance to cash, passively or actively. Regardless, equity market domestic demand shifts lower.”

The big question is how far will the Fed be willing to go to undermine confidence in its put — that is, market and investor belief that the central bank will step in to halt a slide in stocks.

“The Fed could very well end up undermining their future ability to drive household balances back into equities for the next upturn. The Fed’s ability will already be compromised to a point, anyway, by aging baby boomers rebalancing toward cash — a rebalancing aided by higher inflation and policy rates returning a yield to cash,” Blitz said.

អាន: នេះជារបៀបដែល S&P 500 ត្រូវធ្លាក់ចុះដើម្បីចូលទៅក្នុងការកែតម្រូវទីផ្សារភាគហ៊ុនផ្សេងទៀត។

ការភ្ញាក់ផ្អើល

Caterpillar

ស៊ី,

stock is surging on results, while Merck

MRK,

also lifted on its earnings. Eli Lilly

អិល,

is rallying on a beatរួមជាមួយ McDonald's

អេឌីស៊ីឌី,

Twitter shares are rallying after topping user-growth forecasts in first report since Tesla

TSLA,

CEO Elon Musk’s takeover bid. Qualcomm

QCOM,

is also up on upbeat results. Apart from Apple

អេអេសអិល

(មើលជាមុន) and Amazon

AMZN,

(មើលជាមុន), Gilead

សត្វព្រៃ

and VeriSign will report after the close.

Stock in Facebook parent Meta Platforms

អេហ្វប៊ី

is surging on an earnings beat, even as sales were the slowest in a decade. Teladoc stock

TDOC

គឺធ្លាក់ចុះ 41% បន្ទាប់ពី a weak earnings outlook and a huge impairment charge.

មតិ: Facebook earnings weren’t as bad as feared, but they were still pretty bad

First-quarter U.S. gross domestic product came in weaker than expected with a 1.4% drop, from a 6.9% rise in the fourth quarter. Weekly jobless claims fell by 5,000. Coming up Friday, the Fed’s favorite inflation gauge.

Russian attacks in eastern Ukraine have picked up, as the European Union tries to keep members from caving to Moscow’s demands for gas payments in rubles, after Poland and Bulgaria were cut off. International Planned Parenthood, meanwhile, has sent thousands of morning-after pills into Ukraine, as reports of rapes by Russian soldiers rise.

ទីផ្សារ

ភាគហ៊ុន

ឌីស៊ីអាយអេស។

SPX,

មាន ខ្ពស់, led by those for the Nasdaq Composite

COMP

ជាទិន្នផលមូលបត្របំណុល

TMUBMUSD ១០ ឆ្នាំ

TMUBMUSD ១០ ឆ្នាំ

rise , while oil

CL១៥០,

BRN00,

is រអិល. ដុល្លារ

ឌីស៊ីអ៊ី

is surging against major rivals, with the Japanese yen

USDJPY,

គ្រាន់តែចុច Key a two-decade low on a dovish Bank of Japan stance and unlimited bond buying vow.

សញ្ញាធីក

ទាំងនេះគឺជាសន្លឹកឆ្នោតដែលត្រូវបានស្វែងរកច្រើនបំផុតនៅលើ MarketWatch គិតត្រឹមម៉ោង 6 ព្រឹកម៉ោងខាងកើត។

| Ticker | ឈ្មោះសុវត្ថិភាព |

| TSLA, | ក្រុមហ៊ុន tesla |

| GME, | GameStop |

| TWTR, | |

| អេអឹមខេ, | អេអឹមខេកំសាន្ត |

| នីអូ, | NIO |

| អេអេសអិល | ផ្លែប៉ោម |

| អេ។ | អាតេរីន |

| ស៊ីអិនអិន | Cenntro អគ្គិសនី |

| អិនអេហ្វអិល | ក្រុមហ៊ុន Netflix Inc |

| អិនអេឌីឌី | NVIDIA |

ចៃដន្យអាន

4,500-year-old goddess of beauty statue, complete with snake crown, found in Gaza strip.

The earth’s least-developed country grew 200 million trees.

ត្រូវដឹងចាប់ផ្តើមពីដំបូងហើយត្រូវបានធ្វើបច្ចុប្បន្នភាពរហូតដល់កណ្តឹងបើកប៉ុន្តែ ចុះឈ្មោះនៅទីនេះ ដើម្បីបញ្ជូនវាទៅប្រអប់អ៊ីមែលរបស់អ្នក។ កំណែអ៊ីមែលនឹងត្រូវផ្ញើចេញនៅម៉ោងប្រហែល ៧ និង ៣០ នាទីព្រឹកខាងកើត។

ចង់បានច្រើនជាងនេះនៅថ្ងៃក្រោយ? ចុះឈ្មោះសម្រាប់កាសែតបារុនប្រចាំថ្ងៃការធ្វើបទសម្ភាសន៍ពេលព្រឹកសំរាប់វិនិយោគិនរួមទាំងការអត្ថាធិប្បាយផ្តាច់មុខពីអ្នកនិពន្ធបារុននិង MarketWatch ។

Source: https://www.marketwatch.com/story/the-fed-may-turn-investors-into-stock-haters-just-in-time-for-the-next-upturn-boomers-may-lead-the-revolt-says-this-strategist-11651144710?siteid=yhoof2&yptr=yahoo