U.S. stock futures rose as investors returned from the festive break in a generally bullish mood.

តើការជួញដូរភាគហ៊ុន-សន្ទស្សន៍អនាគតយ៉ាងដូចម្តេច

- អេសអេស & ភី ៥០០ នាពេលអនាគត

អេស .៣៦០,

+ 0.84%

កម្រិតខ្ពស់ 41 ពិន្ទុ ឬ 1.1% ដល់ 3902 - Dow Jones ឧស្សាហកម្មអនាគតអនាគត

YM00,

+ 0.78%

gained 332 points, or 1%, to 33617 - Nasdaq 100 អនាគត

NQ00,

+ 0.99%

កើនឡើង 122 ពិន្ទុ ឬ 1.1% ដល់ 11144

នៅថ្ងៃសុក្រមធ្យមភាគឧស្សាហកម្មដុនចូន

ឌីស៊ីអាយអេស។

ធ្លាក់ចុះ ២១៨.៤៥ ពិន្ទុឬ ០,៩១% ដល់ ២៣.៦៦៤.៦៤ អេសអេសអេសភីភី

SPX,

បានធ្លាក់ចុះ ៤១ ពិន្ទុឬ ០,៩១%ដល់ ៤៤៣៣ និង Nasdaq Composite

COMP

dropped 12 points, or 0.11%, to 10466. The Nasdaq Composite fell 33.1% in 2022, the largest one year percentage decline since 2008.

អ្វីដែលជំរុញទីផ្សារ

After Wall Street’s S&P 500 benchmark dropped nearly 20% in 2022, equity investors appeared determined on Tuesday to start the new year of trading on a positive note.

Activity in index futures was choppy, however, with the S&P 500 contract wobbling in a 55 point range in early-hours action — volatility that illustrated the uncertainty still pervading the market.

“The calendar year may have changed, but the themes remain the same as the U.S. and U.K. markets reopen for 2023,” said Richard Hunter, head of markets at Interactive Investor.

“Recessionary concerns will again top the agenda, underpinned by high inflation and rising interest rates. This in turn could point to a troubled January as investors search for positive indications that the tightening policies of the central banks may begin to ease given weakening economic data,” Hunter added.

Indeed, the International Monetary Fund greeted the new year with a warning that a third of the global economy will suffer recession in 2023, a downturn that will likely trim corporate profits.

In addition, a burst of fresh strength in the dollar

ឌីស៊ីអ៊ី

on Tuesday – a common reaction to global economic slowdown worries – was likely to further crimp earnings of U.S. multinationals.

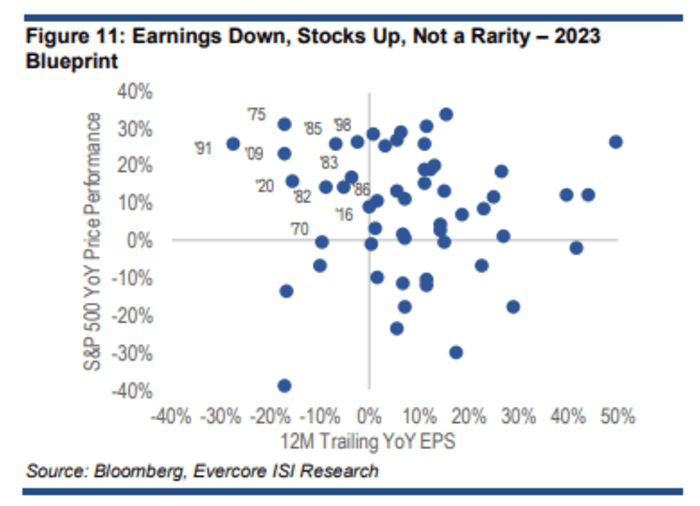

Still, Julian Emanuel , strategist at Evercore ISI, reckoned that such concerns don’t necessarily mean stocks can’t rally.

“Forecasting an earnings recession in 2023 to accompany the economic recession that now seems inevitable, along with a 2023 year end S&P 500 price target of 4,150, would seem impossible,” he said in a note to clients.

“Yet not only is there a long history of earnings down/stocks up years (1970, 1982 and 1985 stand out, but there is also the tendency for strong stock/bond return years to follow historically forceful tightening cycles (1982, 1985) particularly in years (1995) following ‘havoc being wreaked’ on a 60/40 portfolio such as 2022’s declines.” Emanuel added.

ប្រភព៖ Evercore ISI

U.S. economic updates set for release on Tuesday include the December S&P U.S. manufacturing PMI at 9:45 a.m. and the November reading of construction spending at 10 a.m., both times Eastern.

Source: https://www.marketwatch.com/story/dow-futures-jump-more-than-300-points-as-traders-start-2023-on-a-bullish-note-11672739402?siteid=yhoof2&yptr=yahoo