It’s tight quarters in Wall Street’s bear sleuth these days.

Goldman Sachs just downgraded their 2022 U.S. growth forecast (to 2.4% from 2.6%) and 2023 (to 1.6% from 2.2%), as senior chairman Lloyd Blankfein warned of “very, very high” risks for a U.S. recession.

“If I were running a big company, I would be very prepared for it. If I was a consumer, I’d be prepared for it,” he said នៅចុងសប្តាហ៍.

ដូចគ្នានេះផងដែរ one of the most bullish banks on Wall Street headed into this year, Goldman cut its end-2022 S&P 500 target to 4,300. Their new baseline forecast assumes no recession, but if that happens, expect a drop to 3,600, they say.

“Although S&P 500 firms posted much better-than-expected 1Q EPS growth of 11%, investors have been mauled by a 18% near-bear market plunge since the index peaked on January 3rd,” said chief U.S. equity strategist David Kostin, in a note.

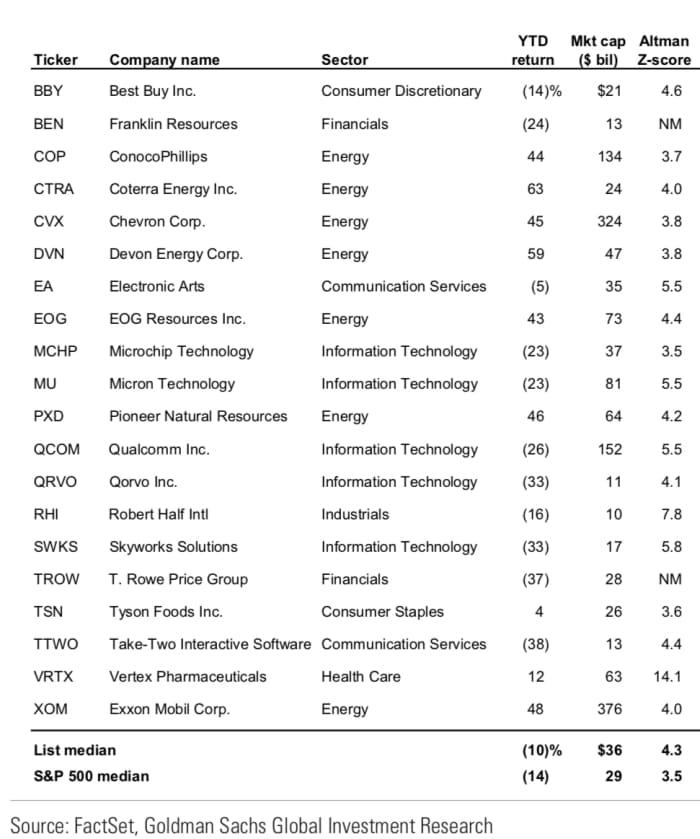

Their consolation prize and our ការហៅនៃថ្ងៃ is a list of 20 stocks with valuations below previous bear market lows.

Those companies also have size and liquidity — an above-average market cap is needed for uncertain times — and balance sheet strength, meaning they are typically less sensitive to an economic slowdown because they can withstand a fall in credit market liquidity, said Kostin and the team.

As for that attractive valuation, the metric is explained like this: the price/earnings multiple after a 20% haircut to expected 2023 earnings is below the forward p/e at the bottom of either or both of the March 2009 and March 2020 bear markets.

“Importantly, given the different real interest rate environments, the highlighted stocks are more attractively valued today on a yield gap basis relative to the rest of the index than they were in either 2009 or 2020,” said Kostin and the team.

And the stocks on this list, after a potential 20% reduction in 2023 EPS, would still have 2021-2023E compound annual growth earnings per share growth rate of 4% compared with -2% for the median S&P 500 company.

មិនបានផ្ទៀងផ្ទាត់

អាន: ‘Nowhere to hide?’ What’s next as stocks slump toward bear market amid stagflation fears

ការភ្ញាក់ផ្អើល

It’s da svidanya to Russia for McDonald’s

អេឌីស៊ីឌី,

as the fast-food giant announced plans to ចេញពីប្រទេស and sell its business there, which could cost it up to $1.4 billion. McDonald’s also wants to secure jobs for its 62,000 workers there.

របស់ក្រុមហ៊ុន Tesla ។

TSLA,

Elon Musk said Twitter’s

TWTR,

legal team has accused him of breaking a nondisclosure agreement over bots, following his Friday announcement that a $44 billion deal for the social media group is on hold.

Stringent COVID lockdowns triggered slumping retail sales and industrial production in China, both data sets the weakest since March 2020, points out Deutsche Bank.

It’s a big week for retailer results, with Walmart

WMT,

(សូមមើល មើលជាមុន), Home Depot

HD,

និងគោលដៅ

ធីជីធី

on tap. Take-Two Interatcive

ធីធីធីអូអូ

will report results after Monday’s close.

The Empire State Manufacturing index showed surprising weakness in May. The week’s other big data will be Tuesday’s release of retail sales for April.

Gaming platform Twitch said it removed a video of the horrific shooting deaths of 10 people in Buffalo in less than two minutes, though other social platforms aren’t as fast.

ទីផ្សារ

មិនបានផ្ទៀងផ្ទាត់

ស្តុកអាមេរិក

អេស .៣៦០,

NQ00,

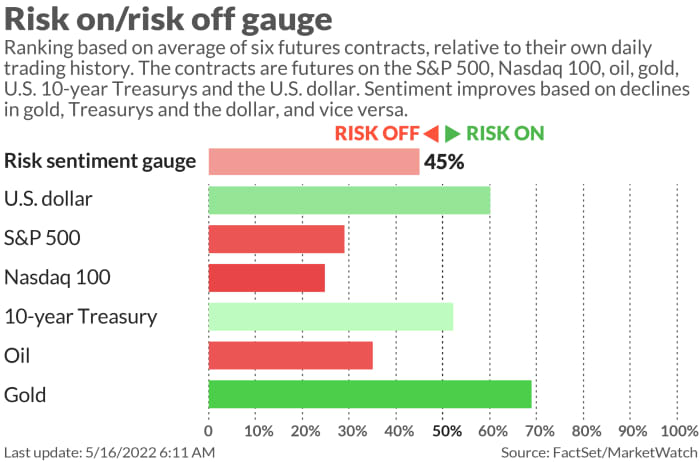

មាន trading lower after that China data, oil prices

CL១៥០,

BRN00,

are down, while Treasury yields

TMUBMUSD ១០ ឆ្នាំ

TMUBMUSD ១០ ឆ្នាំ

are flat to weaker. The dollar

ឌីស៊ីអ៊ី

និងមាស

GC00,

are lower, and bitcoin

BTCUSD,

is weaker, trading just under $30,000 with most cryptocurrencies under modest pressure.

អាន: Crypto investor Barry Silbert offers sympathy and advice to those who have lost fortunes last week

សញ្ញាធីក

ទាំងនេះគឺជាអ្នកស្វែងរកកំពូលនៅលើ MarketWatch នៅម៉ោង 6 ព្រឹកម៉ោងខាងកើត៖

ចៃដន្យអាន

Goldman Sachs’ senior bankers have been told to take all the vacation they want

A Thai beach cove made famous by Leonardo di Caprio កំពុងបើកដំណើរការឡើងវិញ. But you may not be visiting anytime soon.

ត្រូវដឹងចាប់ផ្តើមពីដំបូងហើយត្រូវបានធ្វើបច្ចុប្បន្នភាពរហូតដល់កណ្តឹងបើកប៉ុន្តែ ចុះឈ្មោះនៅទីនេះ ដើម្បីបញ្ជូនវាទៅប្រអប់អ៊ីមែលរបស់អ្នក។ កំណែអ៊ីមែលនឹងត្រូវផ្ញើចេញនៅម៉ោងប្រហែល ៧ និង ៣០ នាទីព្រឹកខាងកើត។

ចង់បានច្រើនទៀតសម្រាប់ថ្ងៃខាងមុខ? ចុះឈ្មោះសម្រាប់ ដឹខេមរុនប្រចាំថ្ងៃការធ្វើបទសម្ភាសន៍ពេលព្រឹកសំរាប់វិនិយោគិនរួមទាំងការអត្ថាធិប្បាយផ្តាច់មុខពីអ្នកនិពន្ធបារុននិង MarketWatch ។

Source: https://www.marketwatch.com/story/gloomy-goldman-offers-20-safety-stocks-with-valuations-below-the-previous-2-bear-markets-11652700051?siteid=yhoof2&yptr=yahoo