Bank holding company KeyCorp (KEY) seemed to be in the eye of the recent turmoil in the banking sector as the share price of the regional bank name has quickly cut in half in a few weeks.

Let’s review the condition of the charts and indicators.

In this daily bar chart of KEY, below, I can see that the shares were trading around $20 in early February and briefly below $10 on Monday. Prices broke their October lows and were in a “free fall” for a day.

Trading volume was huge. The daily On-Balance-Volume (OBV) line has made a new low for the move down and the Moving Average Convergence Divergence (MACD) oscillator has moved below the zero line for an outright sell signal.

In the weekly Japanese candlestick chart of KEY, below, I can see a falling window (gap in a downtrend) and a large lower shadow on the most recent candle. A window or gap will tend to act as resistance until prices close above the gap or window. The 40-week moving average line is pointed down and could provide resistance on bounces.

The weekly OBV line has been weak since early 2022. The MACD oscillator has crossed to the downside for a fresh sell signal.

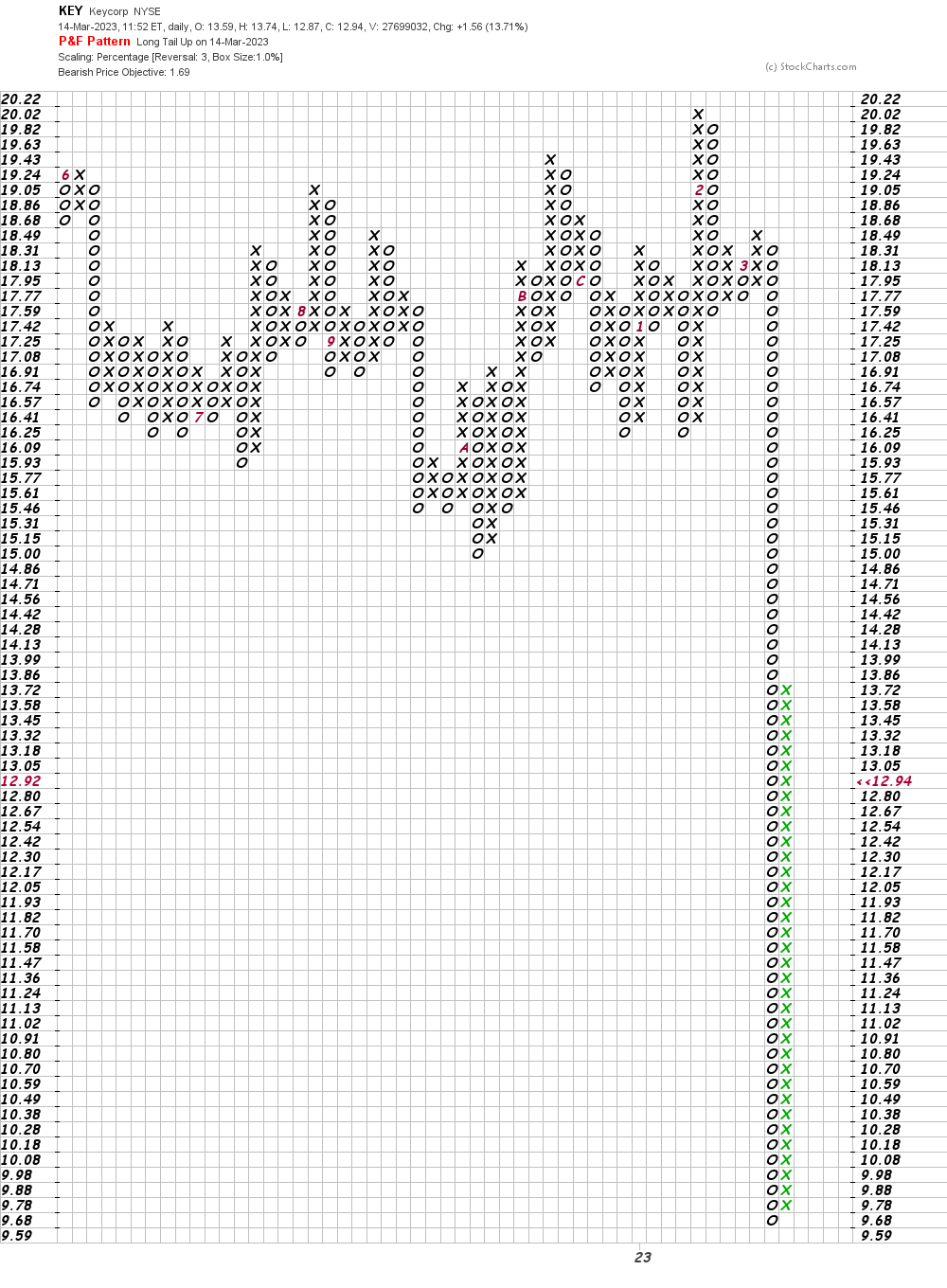

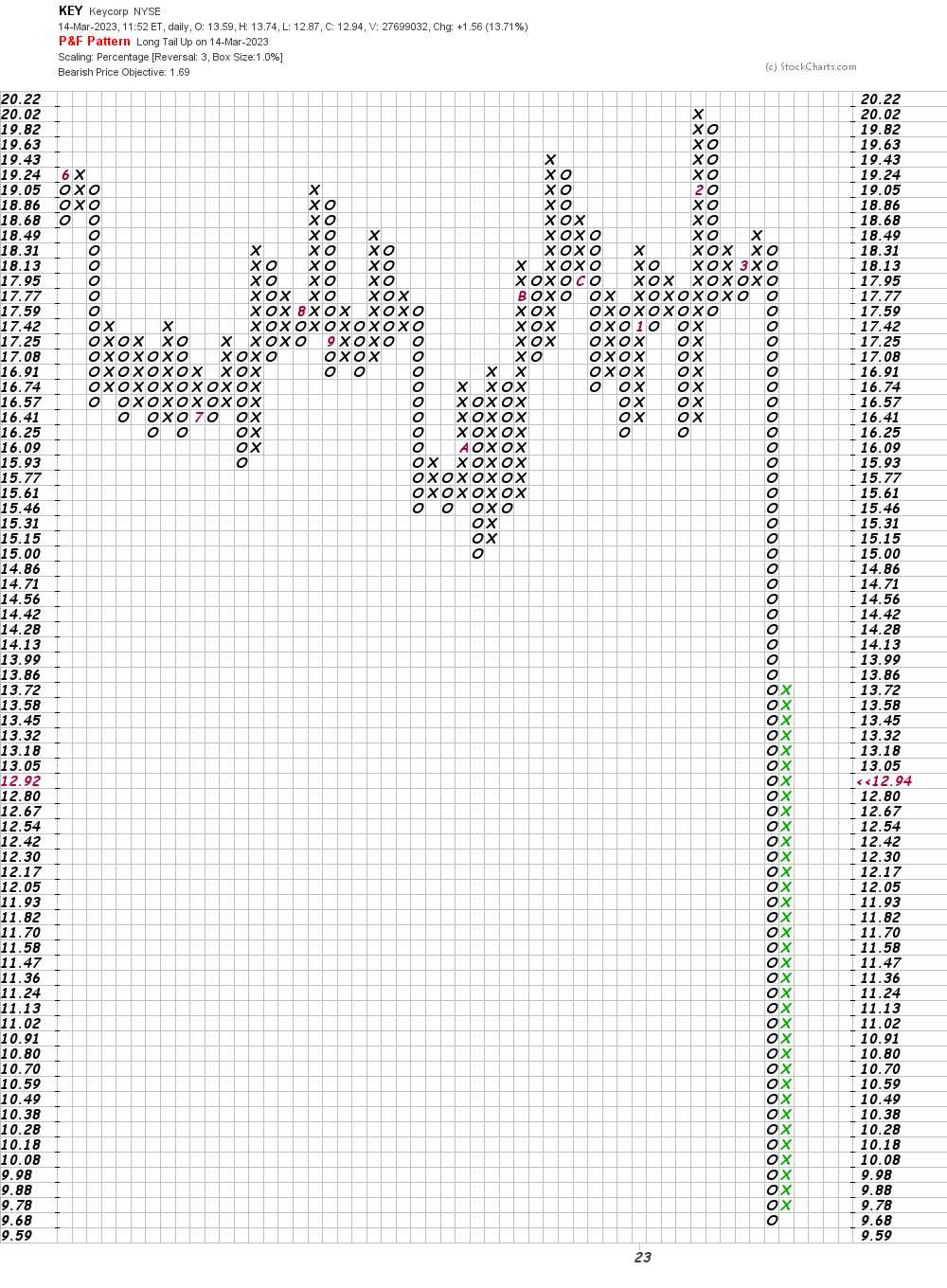

In this daily Point and Figure chart of KEY, below, I can see a dramatic downside move with a price target in the $2 area.

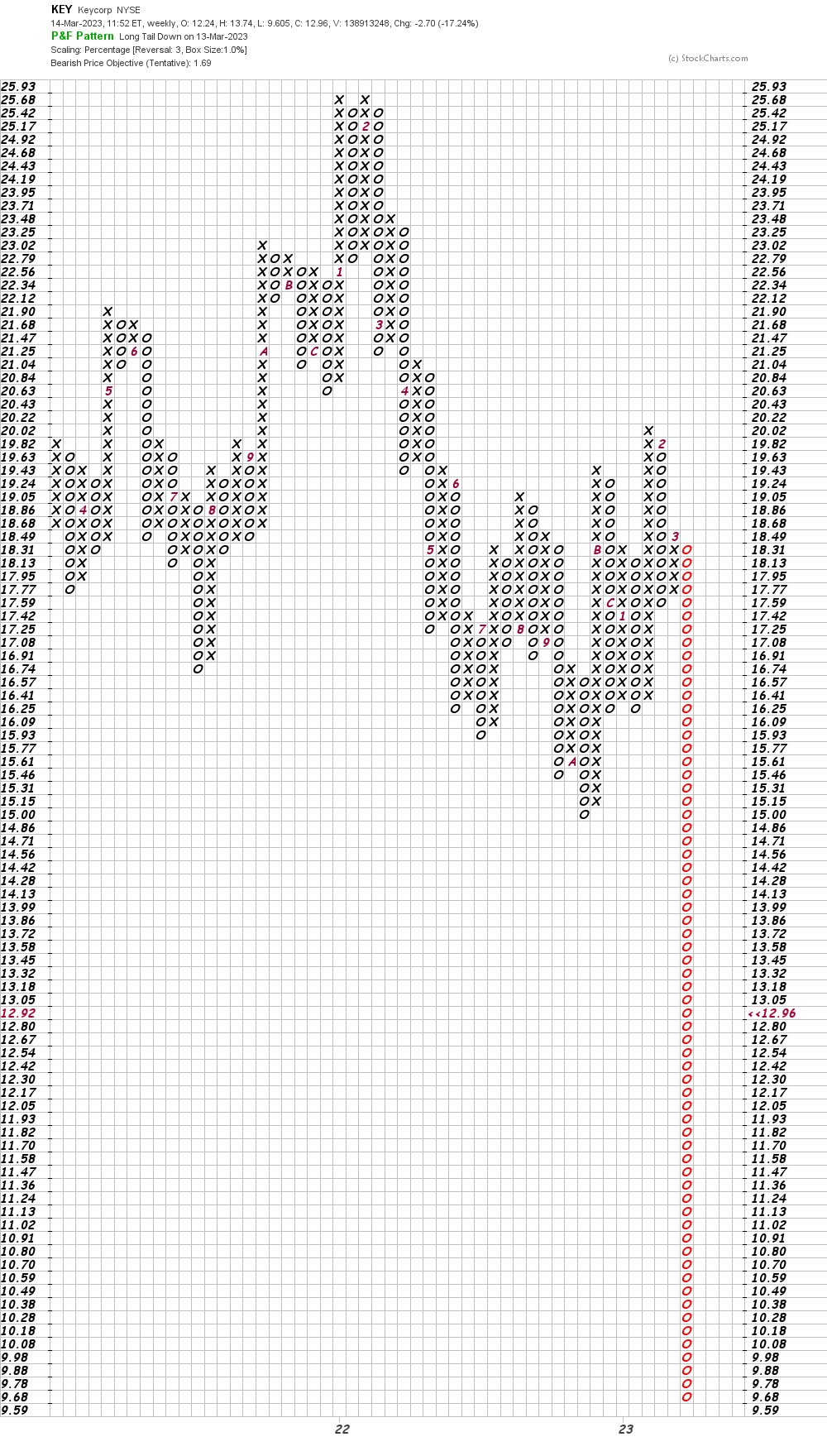

In this second Point and Figure chart of KEY, below, I used weekly price data. Here the software again gives us a downside price target in the $2 area.

យុទ្ធសាស្ត្រខាងក្រោម៖ The sharp declines in the banking industry are pretty amazing. In a bull market these corrections should be bought but in a weak environment the answer isn’t cut and dry. Keep your powder dry for now.

ទទួលបានការដាស់តឿនតាមអ៊ីមែលរាល់ពេលដែលខ្ញុំសរសេរអត្ថបទសម្រាប់លុយពិត។ ចុច“ + តាមដាន” នៅក្បែរបន្ទាត់ភ្ជាប់របស់ខ្ញុំទៅនឹងអត្ថបទនេះ។

Source: https://realmoney.thestreet.com/investing/financial-services/let-s-unlock-keycorp-s-plunge-to-see-if-it-opens-the-door-to-opportunity-16118325?puc=yahoo&cm_ven=YAHOO&yptr=yahoo