Wall Street analysts are the types who get to the airport with hours to spare. Year-ahead previews come in before Thanksgiving, so it can’t be too huge a surprise that Morgan Stanley has released its mid-year outlook just 11 days into May.

Not that anyone has seen what 2022 had in store — the worst bond market performance in decades, a surge in commodities, a war in Ukraine — but Morgan Stanley’s outlook was closer to the mark than most, certainly better than the other Wall Street firm with Morgan in its name. It came into the year flagging mid-to-late cycle challenges, warning about high valuations, tightening policy and inflation higher than most are used to. All of that sounds about right.

ពីបណ្ណសារ៖ Here’s what Wall Street analysts see for the U.S. stock market in 2022

The bank is still banging that drum. “With strong labor markets, tightening policy, a flat curve, and our economists forecasting slower global growth with a downside skew, we think that a ‘late-cycle’ flavor to the market continues, supporting light overall positioning and a premium for portfolio defense/diversification,” say the strategists led by Andrew Sheets.

In practice, that means Morgan Stanley expects the S&P 500

SPX,

to keep falling, to 3,900 by the second quarter of 2023, though it’s more optimistic elsewhere. Its top trade recommendation is being long Japanese equities, as the firm says recent currency weakness should boost Japanese corporate earnings.

The weakness in both the U.K. and Australian currencies, as well as the commodity rally, also makes them optimistic toward U.K. and Australian stocks. In the U.S. , the firm likes the defensive sectors of healthcare and utilities. In commodities, Morgan Stanley prefers oil over gold, as it sees $130 per barrel Brent

BRN00,

by the third quarter, and aluminum over copper.

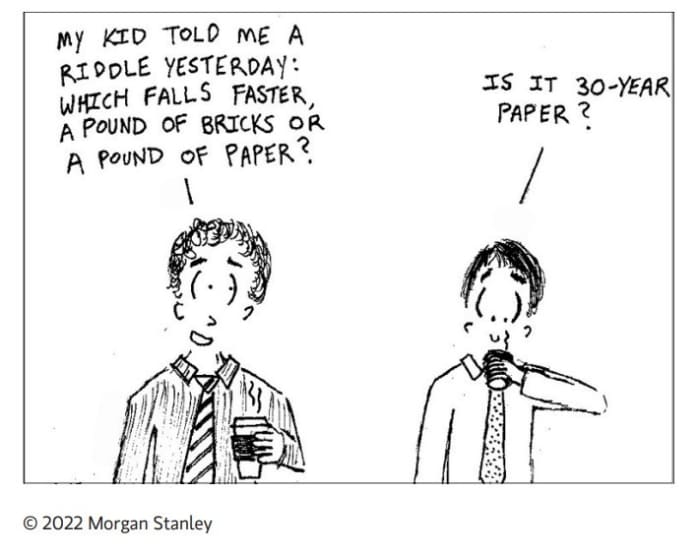

Probably the most useful graphic the firm provided was this cartoon:

ការភ្ញាក់ផ្អើល

U.S. consumer price growth slowed to 0.3% in April, the Labor Department reported on Wednesday, but core price growth accelerated to a faster-than-forecast 0.6%. Over the last 12 months, prices have gained 8.3%.

Market gains quickly evaporated, with stock futures

អេស .៣៦០,

NQ00,

turning lower.

ទិន្នផលលើរតនាគាររយៈពេល ១០ ឆ្នាំ

TMUBMUSD ១០ ឆ្នាំ

កើនដល់ ០,៦៩៥% ។

European Central Bank President Christine Lagarde said she expects the central bank’s asset purchase program will end “early” in the third quarter, and that the first rate hike could come as early as a few weeks afterwards. The ECB’s governing council has a meeting on July 21.

Coinbase

ស៊ី,

shares skidded 14% in premarket trade as the crypto trading app reported worse-than-forecast revenue on declining volume. Also in the crypto space, the so-called algorithmic stablecoin TerraUSD fell as low as 30 cents on the dollar.

កម្មវិធីយូនីធី

U,

shares plunged on weak guidance. The day’s big earnings report, from Walt Disney

ឌី,

comes after the close of trading.

ការប្រកួតស៊ុយអែត

SWMA

recommended a $16 billion cash offer from Philip Morris International

នាយករដ្ឋមន្រ្តី,

កំពូលអ្នកសរសេរសំបុត្រ

Here were the most active stock market tickers as of 6 a.m. Eastern on MarketWatch.

| Ticker | ឈ្មោះសុវត្ថិភាព |

| TSLA, | ក្រុមហ៊ុន tesla |

| GME, | GameStop |

| អេអឹមខេ, | អេអឹមខេកំសាន្ត |

| នីអូ, | នីអូ |

| ស៊ី, | Coinbase សកល |

| អេអេសអិល | ផ្លែប៉ោម |

| AMZN, | Amazon.com |

| អិនអេឌីឌី | nvidia បាន |

| យូ។ អេ។ ធី។ | កាន់កាប់ភាគហ៊ុន |

| បាប៊ី, | ក្រុមហ៊ុន Alibaba |

ចៃដន្យអាន

The ‘Wagatha Christie’ feud — a spat between the wives of two English soccer players — gets its day in court.

This woman purchased an asset with a អត្រាកំណើនប្រចាំឆ្នាំ 8.85%. (It’s a 106-year-old living in a house now worth £550,000.)

Expat New Yorkers are driving up the rents in Miami, to the chagrin of the natives.

ត្រូវដឹងចាប់ផ្តើមពីដំបូងហើយត្រូវបានធ្វើបច្ចុប្បន្នភាពរហូតដល់កណ្តឹងបើកប៉ុន្តែ ចុះឈ្មោះនៅទីនេះ ដើម្បីបញ្ជូនវាទៅប្រអប់អ៊ីមែលរបស់អ្នក។ កំណែអ៊ីមែលនឹងត្រូវផ្ញើចេញនៅម៉ោងប្រហែល ៧ និង ៣០ នាទីព្រឹកខាងកើត។

ចង់បានច្រើនទៀតសម្រាប់ថ្ងៃខាងមុខ? ចុះឈ្មោះសម្រាប់ ដឹខេមរុនប្រចាំថ្ងៃការធ្វើបទសម្ភាសន៍ពេលព្រឹកសំរាប់វិនិយោគិនរួមទាំងការអត្ថាធិប្បាយផ្តាច់មុខពីអ្នកនិពន្ធបារុននិង MarketWatch ។

Source: https://www.marketwatch.com/story/morgan-stanleys-done-better-than-most-forecasting-markets-during-this-turbulent-year-heres-what-it-says-is-coming-next-11652265963?siteid=yhoof2&yptr=yahoo