- Last week, Royal Caribbean Group (NYSE:RCL) reported its fourth quarter 2022 results.

- $RCL stock is up 41.75% year-to-date so far this year.

Royal Caribbean Group (NYSE:RCL) operates a fleet of cruise ships. It also operates as a global cruise holding company headquartered in Miami, FLorida, United States. It controls and operates the global cruise brands such as Royal Caribbean International, Celebrity Cruises, Silversea Cruises, and Hapag-Lloyd Cruises.

$RCL Stock Price Analysis in one-week

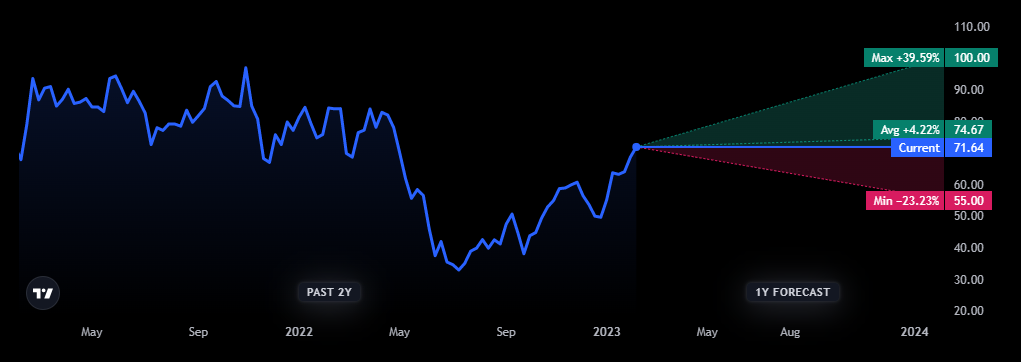

In the last one week, $RCL stock noted an increase of around 5.23%. The stock gave its one-week high at $76.28, which was after its fourth quarter 2022 results. However, $RCL closed at $71.64 on its last trading with a decrease of almost 2.57%. In recent one month $RCL ភាគហ៊ុន increased by almost 20.96%, according to the data sourced from Tradingview.

RCL has the current market cap of $18.281 Billion. Its next earnings date is April 27th, and the estimation is -$0.73. The total revenue of RCL for the last quarter is $2.60 Billion, and it’s 13.00% lower compared to the previous quarter. The net income of Q4 22 is -$500.21 Million.

RCL earnings for the last quarter are -$1.12 whereas the estimation was -$1.33 which accounts for 16.08% surprise. Its revenue for the same period amounts to $2.60 Billion despite the estimated figure of $2.61 Billion. Estimated earnings for the next quarter are -$0.73, and revenue is expected to reach $2.74 Billion.

The technical analysis summary for RCL based on the most popular technical indicators including moving averages, oscillators, and pivots stating a “buy.” Additionally, its price target as the 15 analysts offering one year price forecasts for RCL have a maximum estimate of $100.00 and a minimum estimate of $55.00.

RCL’s Fourth Quarter 2022 Results

The fourth quarter 2022 results “highlights the Load Factors were in line with guidance at 95%, with Caribbean sailings reaching 100%, and holiday sailings close to 110%.” As per the report, the Total revenues per passenger cruise day were noted an increase of almost 3.5% and 4.5% in Constant Currency, compared to the fourth quarter of 2019.

Moreover, the Total revenues were $2.6 Billion, Net Loss was $(500.2) million or $(1.96) per share, Adjusted Net Loss was $(284.9) million or $(1.12) per share, and Adjusted EBITDA was $409.3 million. RCL recorded a loss contingency of $130 Million in the fourth quarter.

ការមិនទទួលខុសត្រូវ

ទស្សនៈ និងគំនិតដែលសរសេរដោយអ្នកនិពន្ធ ឬមនុស្សដែលមានឈ្មោះក្នុងអត្ថបទនេះគឺសម្រាប់តែគំនិតព័ត៌មានប៉ុណ្ណោះ ហើយពួកគេមិនបង្កើតហិរញ្ញវត្ថុ ការវិនិយោគ ឬដំបូន្មានផ្សេងទៀតទេ។ ការវិនិយោគ ឬជួញដូរភាគហ៊ុនកើតឡើងជាមួយនឹងហានិភ័យនៃការបាត់បង់ហិរញ្ញវត្ថុ។

Source: https://www.thecoinrepublic.com/2023/02/13/rcl-stock-price-analysis-after-its-fourth-quarter-2022-results/