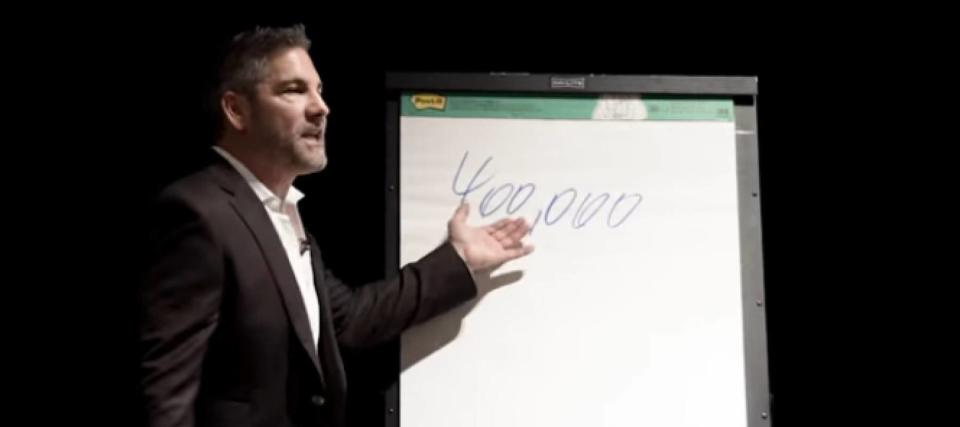

If you make $400,000 a year, would you be proud?

Not if you’re real estate mogul and social media influencer Grant Cardone, who goes by the nickname of Uncle G.

“If I made $400 grand a year, I would be embarrassed with myself as a husband, a father, basically as a human being,” he says in a video on his YouTube channel.

“$400 grand. How do you make sense of $35,000/month? You guys haven’t done the math. You have not done the math because you cannot live on $400 grand a year.”

The motivational speaker also points out that he can’t even live on $2.7 million a year because his plane “eats $2.7 million a year.”

កុំនឹក

Most people don’t have a private jet. And according to the Census Bureau, the median household income in the U.S. was $70,784 in 2021 — so there’s probably no need to be “embarrassed” if you are making $400,000 a year.

Still, the motivational speaker is right in that we could all use some extra money.

So here’s a look at three ways how you can boost your income. In this economic climate, every bit counts.

ប្តូរការងារ

Switching jobs may seem daunting given the massive layoffs we see in the headlines these days.

But analysis from the Pew Research Center reveals that switching jobs could be a clever way to boost your income. The data suggests that half of workers who changed jobs from April 2021 to March 2022 saw a real increase of 9.7% or more in their pay compared to a year earlier. A real increase is an increase after taking into account inflation’s erosion effect on money.

Meanwhile, the median worker who stayed in the same job over this period saw their real earnings decline by 1.7%.

This means if you’re looking to put more bread on the table, leaving your current role or employer for better opportunities may be your best bet at getting the salary increase you’re hoping for.

ការប្រញាប់ប្រញាល់មួយចំហៀង

If you don’t want to change jobs, consider getting a side hustle — something you get paid for doing in addition to your full-time job. It allows you to earn extra income — and could even be a way of testing the entrepreneurial waters.

In fact, side gigs have already become popular. Data from the Bureau of Labor Statistics revealed that as of November, 4.5 million people were working a primary job full-time and a secondary job part-time. Moreover, 336,000 people were working two full-time jobs simultaneously.

អានបន្ថែម: កម្មវិធីវិនិយោគដ៏ល្អបំផុតនៃឆ្នាំ 2023 សម្រាប់ឱកាស 'ម្តងក្នុងមួយជំនាន់' (ទោះបីជាអ្នកជាអ្នកចាប់ផ្តើមក៏ដោយ)

មិនចាំបាច់ចាប់ផ្តើមធំទេ។

A simple side gig like tutoring could be worth $75-$90 an hour, while dog walking could net you as much as $1,000 a month.

Invest for passive income

To become a real high earner like Cardone, you’d probably have to do more than just dog walking. One way to achieve true wealth is to invest for passive income.

“It took me 20 years of trial and error before I achieved a multimillion-dollar net worth. I had to exercise tremendous discipline and invest as much money as possible into income-generating assets,” Cardone writes in an article for CNBC Make It.

“Now, I draw income from the 18 companies I started, and the 12,000 apartment units I own that make passive income.”

Indeed, well-chosen real estate assets can provide investors with a steady stream of rental income.

Moreover, real estate is a well-known hedge against inflation. As the price of raw materials and labor goes up, new properties are more expensive to build. And that drives up the price of existing real estate.

ជាការពិតណាស់ ខណៈពេលដែលយើងទាំងអស់គ្នាចូលចិត្តគំនិតនៃការប្រមូលប្រាក់ចំណូលអកម្ម ការធ្វើជាម្ចាស់ផ្ទះនឹងមកជាមួយនឹងភាពលំបាករបស់វា ដូចជាការជួសជុលក្បាលម៉ាសីនដែលលេចធ្លាយ និងការដោះស្រាយជាមួយអ្នកជួលដ៏លំបាក។

But these days, you don’t need to be a landlord to start investing in real estate. There are plenty of ការវិនិយោគលើអចលនទ្រព្យជឿជាក់ (REITs) that can get you started on becoming a real estate mogul.

អ្វីដែលត្រូវអានបន្ទាប់

អត្ថបទនេះផ្តល់ព័ត៌មានតែប៉ុណ្ណោះហើយមិនគួរបកស្រាយជាដំបូន្មានឡើយ។ វាត្រូវបានផ្តល់ជូនដោយគ្មានការធានាគ្រប់ប្រភេទ។

Source: https://finance.yahoo.com/news/real-estate-guru-grant-cardone-220000192.html