Sometimes, it’s hard getting workers of a certain generation to do much of anything at all.

Here’s one: “Currently, I’m going in every day, and I’m looking at my screen, but I’m pretty much taking a break.”

Granted, that’s not a woke 20-something but Stanley Druckenmiller, the 68-year-old investing legend who runs the Duquesne Family Office and managed money for George Soros. He has a reason for his inactivity.

“I’ve lived through enough bear markets, that if you get aggressive in a bear market on the short side, you can get your head ripped off in rallies,” he said, according to a clip from the 2022 Sohn Investment Conference that was aired នៅលើស្ថានីយទូរទស្សន៍ CNBC.

Druckenmiller said, យោងទៅតាម Bloomberg News’ account, that it’s possible the first leg of the bear market has ended. “But I think it’s highly, highly probable that the bear market has a ways to run.” His rationale is simple enough — there has never been a soft landing when inflation has been above 4.5%.

At the end of the first quarter, his top positions were South Korean online marketplace Coupang

ស៊ី។ ខេ។ អេ។

ក្រុមហ៊ុន Microsoft

MSFT,

miner Freeport-McMoRan

FCX,

Amazon.com

AMZN,

និងឈេហ្វរ៉ុន

CVX,

according to his 13-F filing. The Freeport-McMoRan and Chevron holdings fit with his comment that he has owned key commodities including oil, gold and copper this year, while betting against fixed income and stocks.

According to Bloomberg, Druckenmiller will look to bet against the dollar

ឌីស៊ីអ៊ី

sometime in the next six months, as he also expects to short stocks again.

ការភ្ញាក់ផ្អើល

U.S. consumer price growth accelerated to 1% in May, the Labor Department reported on Friday, topping consensus expectations. Core price growth stayed at 0.6%. Over the last 12 months, prices have gained 8.6%, the fastest inflation rate since 1981.

ភាគហ៊ុនអនាគតរបស់អាមេរិក

អេស .៣៦០,

NQ00,

slumped after the report was released, with the S&P 500 contract losing nearly 2%, while the yield on the 10-year Treasury

TMUBMUSD ១០ ឆ្នាំ

កើនដល់ ០,៦៩៥% ។

Shortly after the open, the University of Michigan’s consumer sentiment index is due for release.

Japan’s Ministry of Finance, the Bank of Japan and the Financial Services Agency on Friday expressed concern over the yen’s

USDJPY,

recent rapid weakening.

ក្រុមហ៊ុន Netflix Inc

អិនអេហ្វអិល

Roblox

RBLX,

និង eBay

អ៊ីបេយ

were among a host of internet stocks that Goldman Sachs has downgraded to sell. Netflix, eBay, and Frontdoor

FTDR,

which also was downgraded, each fell 4%.

The U.K. Competition and Markets Authority said it is consulting on the launch of a probe into Apple

អេអេសអិល

និងហ្គូហ្គល

ហ្គូហ្គោល

market power in mobile browsers. Apple, the regulator said, has also blocked the emergence of cloud gaming services on its App Store, while the regulator is launching an enforcement action against Google for how users can make in-app payments.

DocuSign

ឌីអូយូ,

shares slumped 26% in premarket action, as the electronic-documents company missed on fiscal first-quarter earnings and trimmed its billings guidance.

កំពូលអ្នកសរសេរសំបុត្រ

នេះគឺជានិមិត្តសញ្ញាលក់ភាគហ៊ុនសកម្មបំផុតនៅម៉ោង 6 ព្រឹកខាងកើត។

| Ticker | ឈ្មោះសុវត្ថិភាព |

| TSLA, | ក្រុមហ៊ុន tesla |

| GME, | GameStop |

| អេអឹមខេ, | អេអឹមខេកំសាន្ត |

| នីអូ, | NIO |

| បាប៊ី, | ក្រុមហ៊ុន Alibaba |

| AMZN, | Amazon.com |

| អេអេសអិល | ផ្លែប៉ោម |

| AMD, | Advanced Micro Devices |

| IMPP, | អធិរាជប្រេងឥន្ធនៈ |

| អិនអេឌីឌី | nvidia បាន |

គំនូសតាង

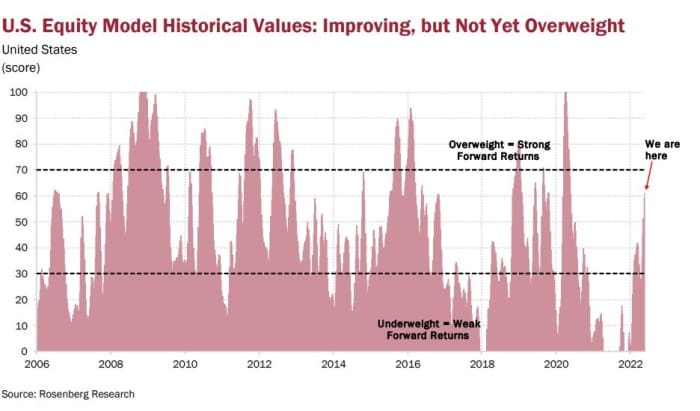

David Rosenberg, the veteran Wall Street strategist who has been pessimistic on markets for some time, is becoming a bit more positive. The founder of Rosenberg Research writes that the combination of euphoric sentiment, stretched positioning and excessive valuations are being unwound, although he expects the drawdown in stocks to continue. His equity model has improved to a level suggesting above-average returns of 13.8% over the next 12 months. “As such, for investors that started the year underweight U.S. stocks (as our model recommended), we believe it makes sense to increase exposure somewhat,” he says.

ចៃដន្យអាន

Here’s a look at why it’s so expensive to make a nuclear power plant.

A relaunch of McDonald’s

អេឌីស៊ីឌី,

restaurants in Russia, under a new, as-yet undisclosed name, is set for Sunday.

Baby formula is one thing, but now there’s a looming shortage of Sriracha sauce.

ត្រូវដឹងចាប់ផ្តើមពីដំបូងហើយត្រូវបានធ្វើបច្ចុប្បន្នភាពរហូតដល់កណ្តឹងបើកប៉ុន្តែ ចុះឈ្មោះនៅទីនេះ ដើម្បីបញ្ជូនវាទៅប្រអប់អ៊ីមែលរបស់អ្នក។ កំណែអ៊ីមែលនឹងត្រូវផ្ញើចេញនៅម៉ោងប្រហែល ៧ និង ៣០ នាទីព្រឹកខាងកើត។

ចង់បានច្រើនទៀតសម្រាប់ថ្ងៃខាងមុខ? ចុះឈ្មោះសម្រាប់ ដឹខេមរុនប្រចាំថ្ងៃការធ្វើបទសម្ភាសន៍ពេលព្រឹកសំរាប់វិនិយោគិនរួមទាំងការអត្ថាធិប្បាយផ្តាច់មុខពីអ្នកនិពន្ធបារុននិង MarketWatch ។

Source: https://www.marketwatch.com/story/stanley-druckenmiller-fears-a-recession-but-isnt-betting-against-stocks-heres-why-11654858664?siteid=yhoof2&yptr=yahoo