This year’s stock-market rally has pushed the S&P 500 index to valuation levels that make it difficult for the index to climb much higher based on the current macroeconomic environment, according to Citigroup Inc.

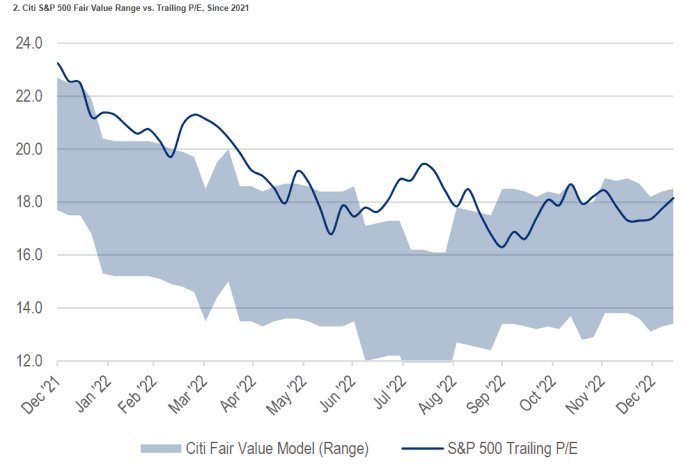

The S&P 500’s trailing price-to-earnings ratio is back to 18.2x, “dangerously close to the upper end of our fair value range,” Citi analysts said in a research report dated Jan 13. “We are comfortable with a 3700-4000 S&P 500 trading range call for now.”

U.S. stocks have rallied so far this month, with S&P 500 up 4.2% through Friday, as investors headed into a three-day weekend honoring Martin Luther King Jr. On Tuesday afternoon, the index

SPX,

was trading down 0.1% at around 3,994, according to FactSet data, at last check.

“For now, we suspect valuation could put a near-term cap on upside momentum,” the Citi analysts said. “Based on our fair value framework, valuations much above current levels are unsustainable unless there is a significant change in the macro backdrop.”

In Citi’s view, the S&P 500 is entering “a new, lower valuation regime” compared with the period seen since the global financial crisis of 2008.

“This implies index gains in this new environment will need to be ‘earned’ vis-à-vis near- and medium-term fundamental improvement, less so from macro tailwinds behind multiple re-rating triggered by lower interest rates,” the analysts wrote.

Citi’s fair value framework implies an S&P 500 price-to earnings multiple of 18.5x at the high end based on current rates and other “macro inputs” such as inflation and growth, according to the report.

“18-19x is pushing the fair value limits unless we get a more aggressive slowing in inflation, noticeably lower rates, coupled with other more sanguine macro readouts,” the analysts said.

The chart below shows Citi’s fair value range for the S&P 500 versus the index’s trailing price-to-earnings multiples since 2021.

CITI RESEARCH NOTE DATED JAN. 13, 2023

Pointing to recent client conversations, Citi analysts said there’s “very little conviction that interest rates are poised to fall much further below current levels.” That’s “aligned with a view that the Fed is unlikely to move from hawkish to dovish over any shorter time frame.”

The Federal Reserve has been rapidly raising interest rates to combat high inflation, with many investors expecting the Fed to potentially pause its rate hikes this year as the elevated cost of living in the U.S. shows signs of easing.

As rates rose last year, the S&P 500 tanked 19.4% in its worst performance since 2008.

“We are left with conviction in our ongoing view that rate-driven valuation headwinds may persist, implying greater importance on earnings trajectories,” the Citi analysts said.

“Sell-side consensus seems coalescing around a weak first half, strong second half narrative,” they wrote. “We are more constructive on the second half like many of our peers, but we do not see the same downside pressure to earnings, and upside lift from valuations that others expect.”

The analysts said that “this could hinder upside momentum” based on their expectation for a decline this year in the S&P 500’s earnings per share.

U.S. stocks were trading mixed Tuesday afternoon as investors digested fourth-quarter earnings results from Goldman Sachs Group Inc.

អេស។ អេស។

and Morgan Stanley. Morgan Stanley

អេស។

which beat earnings estimates, was the top performer in the S&P 500 on Tuesday afternoon with a gain of more than 7%, according to FactSet data, at last check.

អាន: Goldman Sachs misses its earnings estimate, while Morgan Stanley beats as profits drop

As for other major U.S. stock-market benchmarks, the technology-heavy Nasdaq Composite

COMP

was up 0.1% in Tuesday afternoon trading while the Dow Jones Industrial Average

ឌីស៊ីអាយអេស។

fell 1.1%, according to FactSet data, at last check.

“We estimate that 28% of the current S&P 500 value is based on future earnings growth, which is in line with longer-term averages,” the Citi analysts said. “We suspect earnings will be more resilient than feared.”

While Citi’s year-end target of 4,000 for the S&P 500 is below the median strategist expectation, its estimate for the index to see earnings per share of $216 is “above peers,” they wrote. “Said differently, we expect a market multiple closer to 18x at year-end versus others around 20x.”

អាន: Small-cap stocks outperform so far in 2023 as U.S. equities book second week of gains this year

Source: https://www.marketwatch.com/story/stock-market-rally-looks-unsustainable-as-s-p-500-enters-new-lower-valuation-regime-warns-citi-11673980230?siteid=yhoof2&yptr=yahoo