Ahead of major tech earnings later, Meta results are lighting up the Nasdaq Composite

COMP

for Thursday. The S&P 500

SPX,

is also up as investors take a glass-half full view of the Fed meeting.

Worried that investors are in the clutches of another Fed misread is the founder of LaDucTrading.com, Samantha LaDuc. “The market is not pricing either higher terminal rate or growth slowdown or recession. One or more of these assumptions is wrong. My bet: Fed goes higher for long. They don’t cut in 2023, unless they have a reason to,” she says.

MarketWatch last spoke to LaDuc, who specializes in timing major market inflections, last May when she បានព្យាករណ៍ the S&P 500 would finish 2022 around 3,800 — it finished at 3,859. Another call she nailed was her early 2022 warning of a coming “tech wreck,” predicting a 20% Nasdaq slump in 2022 — it ended the year down 33%.

នៅក្នុងរបស់យើង ការហៅនៃថ្ងៃ, LaDuc says cash is the place to be and that investors are “being paid to wait. They’re getting very favorable 4.5% on their sitting cash.”

Even though the dollar has lost 8% in the last 12 weeks, “the money you put in money-market funds is earning 4.5% right now, whereas before it was earning 0.4% or 0.5%,” she said in a Wednesday interview.

“So the Fed hiking has motivated a kind of paid-to-wait while the market stabilizes. I don’t think Treasurys are a safe bet for this year. I really can see no outperformance in bonds, and I think equities have more risk to the downside than upside,” said LaDuc.

She’s specifically worried about tech, saying the Nasdaq likely has one leg down left to go before the selloff is all over.

She explains that analysts are predicting an earnings recession through the fourth quarter of 2023, and not an economic recession. “They literally expect Q4 to pop up about 10% in earnings because of favorable comps— comparisons for the prior year.

“The problem with that is that the earnings analysis does not in any way, shape or form consider a recession, and it absolutely assumes moderate growth,” says LaDuc. “So we still have Goldilocks all priced in equities and priced into earnings.”

A growth to value rotation has been a key prediction for LaDuc since July 2020 when she started to call for “things over paper,” predicting a shift to oversold commodities, cyclicals and large-cap value plays with rates bottoming.

While that rotation “absolutely outperformed” in both 2021 and 2022, she says it will trade less well this year because inflation expectations have come down.

The bottom line? Rather than buy that stock market dip, investors should short the rip higher, she says.

Her last observation is tied to gold

GC00,

— and she says she’s not a gold bug, but that her trend indicators are now “firing” for the precious metal for the first time in years.

Gold can be a tough call because it has to be “timed perfectly” and typically isn’t an outperformer, apart from a 1970s ride higher as an inflation hedge. What has changed is that last year central banks bought the most gold last year since 1967.

“It’s the lack of counterparty risk that is driving the central bank desire for more control of gold that bears watching right now,” said LaDuc.

ទីផ្សារ

សមាសធាតុណាសាដាក

COMP

is surging on Meta boat-lifting, with the S&P 500

SPX,

also higher, but the Dow industrials

ឌីស៊ីអាយអេស។

slightly lower. Bonds

TMUBMUSD ១០ ឆ្នាំ

are steady, oil

CL.1,

is flat, with gold

GC00,

ប្រាក់

អេសអាយ ១០០,

and other metals

HG00,

PA00,

ឡើង។

ផោន

GBPUSD,

has bounced off lows after the Bank of England hiked interest rates by 50 basis points as expected. The European Central Bank made the same move, and said it will repeat that hike in March.

សម្រាប់ការអាប់ដេតទីផ្សារបន្ថែម បូករួមទាំងគំនិតពាណិជ្ជកម្មដែលអាចធ្វើសកម្មភាពបានសម្រាប់ភាគហ៊ុន ជម្រើស និងគ្រីបតូ។ ជាវប្រចាំទៅ MarketDiem ដោយអាជីវកម្មប្រចាំថ្ងៃរបស់វិនិយោគិន។

ការភ្ញាក់ផ្អើល

ភាគហ៊ុនមេតា

មេតា

are up 19% after the Facebook parent missed earnings, but gave upbeat 2023 revenue guidance and promised more buybacks.

មតិ: Zuckerberg and Intel are shipping the proceeds from their layoffs straight to Wall Street

And big names will report after the bell — Apple

អេអេសអិល

អក្ខរក្រម

ហ្គូហ្គោល

និង Amazon.com

AMZN,

ក្រុមហ៊ុន Ford

F,

ហ្គីលដ

សត្វព្រៃ

ហាងកាហ្វេ Starbucks

អេសប៊ីយូអេស។

និងក្រុមហ៊ុន Qualcomm

QCOM,

See previews for: ផ្លែប៉ោម , អក្ខរក្រម និង Amazon

Merck

MRK,

stock is down after profit disappointed, Honeywell

ហុន

is falling on a revenue pullback, Eli Lilly

អិល,

is falling for the same reason and Bristol Myers

ប៊ី,

បាននិយាយថាវា expects a revenue fall, but shares are steady..

ភាគហ៊ុន Baidu

ប៊ីឌីយូ

9888,

is higher after climbing in Hong Kong on Thursday’s news that BlackRock raised its stake in the Chinese internet-search giant to 6.6% at end of 2022.

Adani Group companies market cap losses are up to $105 billion after the Indian conglomerate canceled a $2.5 billion share sale, as fallout from a scathing report from U.S. short seller Hindenburg Report continues to take toll.

Weekly jobless claims came in at a lower-than-expected 183,000, while unit labor costs rose 1.1% in the fourth quarter, under expectations for a 1.5% gain. Factory orders are coming at 10 a.m.

ល្អបំផុតនៃគេហទំព័រ

‘The Last of Us’ in real life? Rising temperatures may be spreading fungal infections, research says

As China and the U.S. both woo resource-laden Indonesia, Beijing has the edge.

ក្រុមប្រឹក្សាភិបាលមហាវិទ្យាល័យ revises AP course in African American studies thrust into spotlight by Florida Gov. DeSantis.

គំនូសតាង

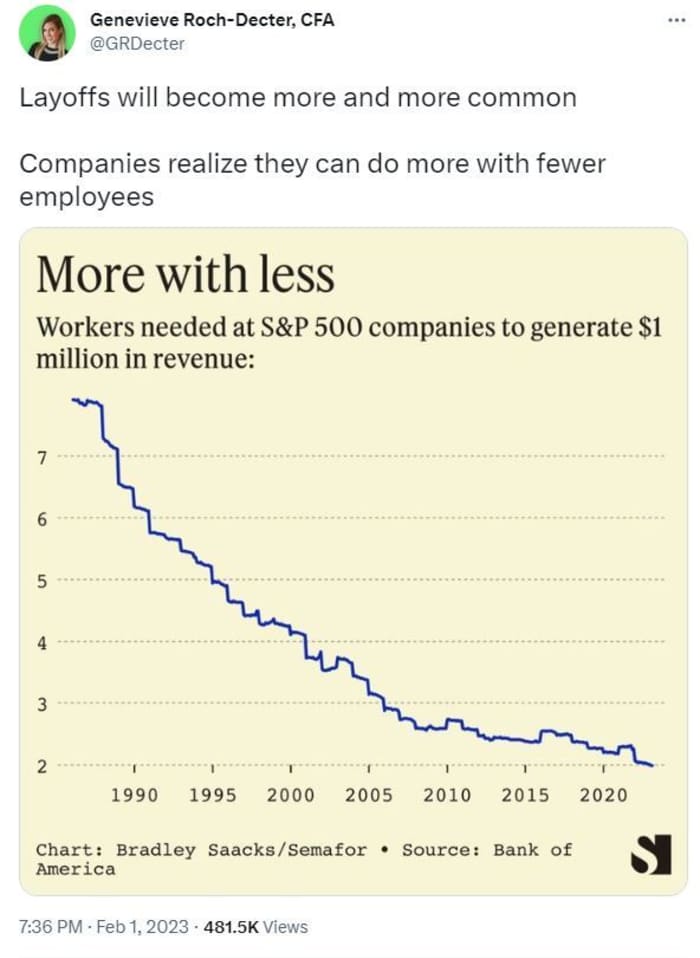

Get used to companies shedding workers?

@GRDecter

សញ្ញាធីក

ទាំងនេះគឺជាអ្នកស្វែងរកកំពូលនៅលើ MarketWatch នៅម៉ោង 6 ព្រឹកខាងកើត៖

| Ticker | ឈ្មោះសុវត្ថិភាព |

| TSLA, | ក្រុមហ៊ុន tesla |

| មេតា | វេទិកាមេតា |

| ប៊ីប៊ីប៊ី, | បន្ទប់ទឹកគ្រែនិងលើស |

| អេអឹមខេ, | អេអឹមខេកំសាន្ត |

| GME, | GameStop |

| APE | AMC Entertainment Holdings បានចែករំលែក ព្រឹត្ដិការណ៍ |

| AMZN, | Amaazon.com |

| CVNA | កាវ៉ាណា |

| អេអេសអិល | ផ្លែប៉ោម |

| នីអូ, | NIO |

ចៃដន្យអាន

Reporter’s deadpan ode to surviving gloomy February ទៅមេរោគ.

With no more king…Australia strips Charles III off its banknotes

How Punxsutawney Phil can be a stock market indicator

ត្រូវដឹងចាប់ផ្តើមពីដំបូងហើយត្រូវបានធ្វើបច្ចុប្បន្នភាពរហូតដល់កណ្តឹងបើកប៉ុន្តែ ចុះឈ្មោះនៅទីនេះ ដើម្បីបញ្ជូនវាទៅប្រអប់អ៊ីមែលរបស់អ្នក។ កំណែអ៊ីមែលនឹងត្រូវផ្ញើចេញនៅម៉ោងប្រហែល ៧ និង ៣០ នាទីព្រឹកខាងកើត។

សូមស្តាប់ គំនិតថ្មីល្អបំផុតនៅក្នុងផតខាស់ប្រាក់ ជាមួយអ្នកយកព័ត៌មាន MarketWatch លោក Charles Passy និងសេដ្ឋវិទូ Stephanie Kelton ។

Source: https://www.marketwatch.com/story/this-trader-nailed-two-big-market-calls-in-2022-she-says-investors-are-being-paid-to-wait-so-should-steer-clear-of-stocks-for-2023-11675338394?siteid=yhoof2&yptr=yahoo