រឿងនេះគឺ ដើម បោះពុម្ពផ្សាយ TKer.co

Stocks kicked off the new year on a positive note, with the S&P 500 climbing 1.4% last week. The index is now up 8.9% from its October 12 closing low of 3,577.03 and down 18.8% from its January 3, 2022 closing high of 4,796.56.

ទន្ទឹមនឹងនេះដែរ market’s many bears got more company.

Michael Kantrowitz, the chief investment strategist at Piper Sandler, expects the S&P 500 to tumble to 3,225 by year end, សារព័ត៌មាន Bloomberg បានរាយការណ៍ on Wednesday. This call makes him the most bearish of Wall Street’s top stock market forecasters.

Byron Wien, the legendary former chief investment strategist at Morgan Stanley and current vice chairman at Blackstone, បានព្រមានកាលពីថ្ងៃពុធ that financial markets could slide during the first half of the year before rallying again.

“Despite Fed tightening, the market reaches a bottom by mid-year and begins a recovery comparable to 2009,“ Wien សរសេរ.

Will the bears be proven right this year? ប្រហែល.

ប៉ុន្តែការពិតនោះ។ so much of Wall Street is bearish may actually produce the opposite result.

“Wall Street is bearish,” Savita Subramanian, head of U.S. equity strategy at BofA, wrote on Wednesday. “This is bullish.“

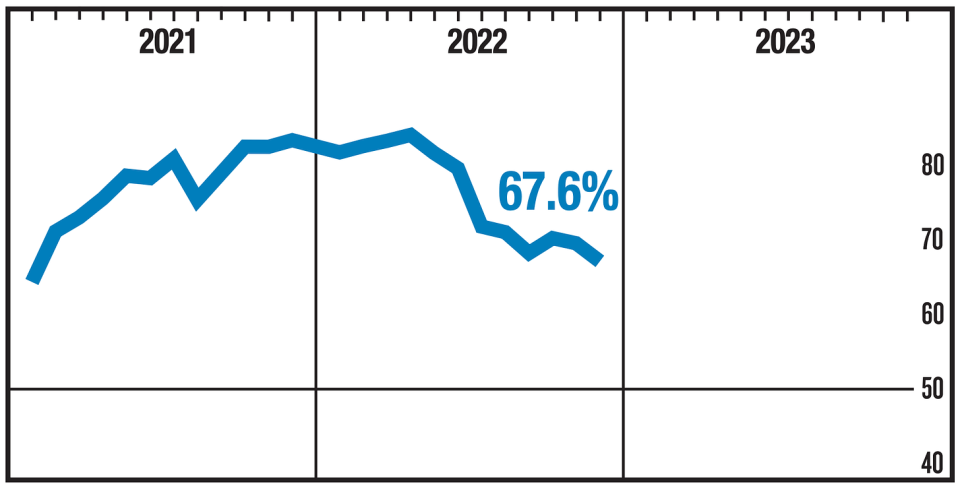

Subramanian was referring to the contrarian signal from BofA’s proprietary “Sell Side Indicator,” which tracks average recommended allocation to stocks by U.S. sell-side strategists. While it doesn’t currently reflect “extreme bearishness,” it’s at a level that “suggests an expected price return of +16% over the next 12 months (~4400 for the S&P 500).”

Subramanian’s official target for the S&P 500 is 4,000, which is on the bearish end of Wall Street. Though she has warned against being out of the market at a time when the consensus expects lower prices.

Going into 2022, Wall Street was caught wrong-footed by being too bullish ahead of what became a historic bear market.

Will the consensus be right this time with their bearishness?

We do however know that the stock market goes up in most years.

And longer term investors should remember the odds of generating a positive return improves for those who can put in the time.

ពិនិត្យមើលចរន្តម៉ាក្រូ🔀

មានចំណុចទិន្នន័យគួរឱ្យកត់សម្គាល់មួយចំនួនពីសប្តាហ៍មុនដើម្បីពិចារណា៖

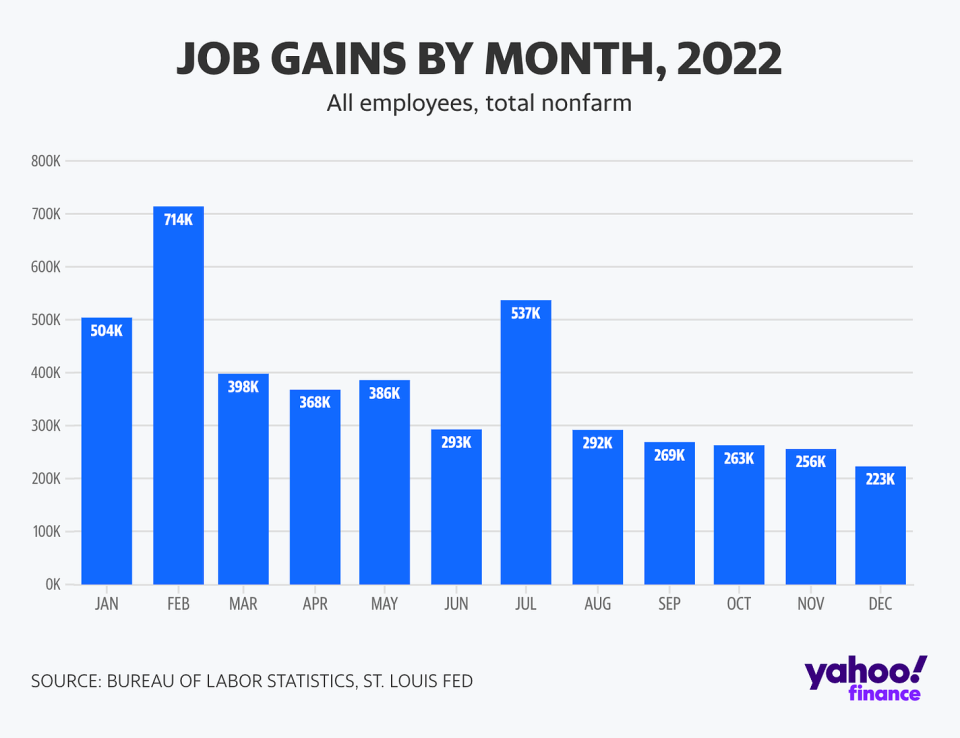

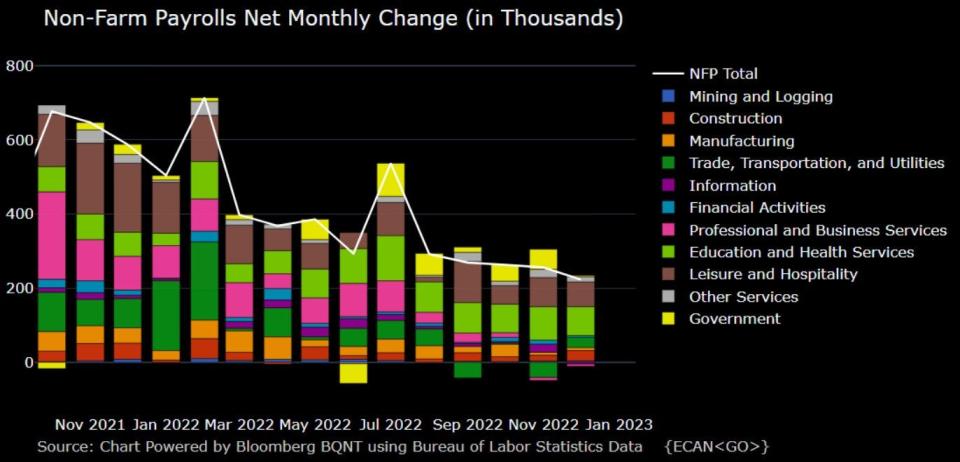

🚨 កំណើនការងារ។ យោងទៅតាម ទិន្នន័យ BLS released Friday, U.S. employers added 223,000 jobs in December, stronger than the 203,000 gain អ្នកសេដ្ឋកិច្ចរំពឹងទុក. Over the course of 2022, employers added a whopping 4.5 million jobs.

Almost all major industry categories reported gains. The information sector, which includes the tech industry, saw job losses. For more context on these losses, read: "Don’t be misled by no-context reports of big tech layoffs 🤨"

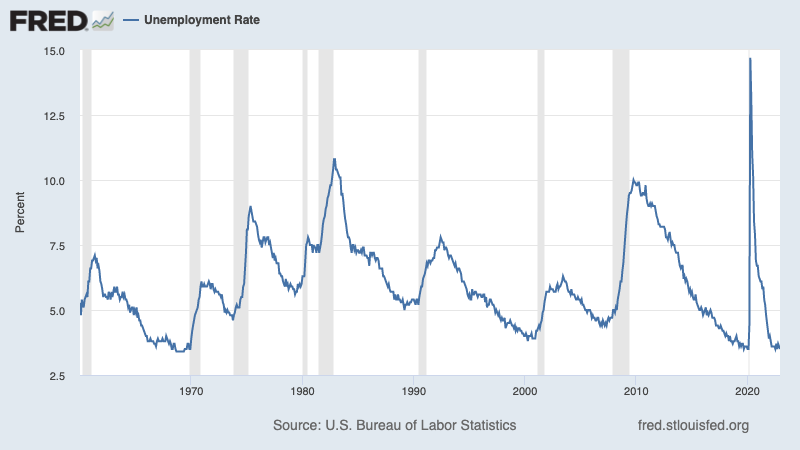

📉Unemployment rate tumbles. The unemployment rate fell to 3.5% (or 3.468% unrounded) from 3.6% in the prior month. This is the lowest rate since 1969.

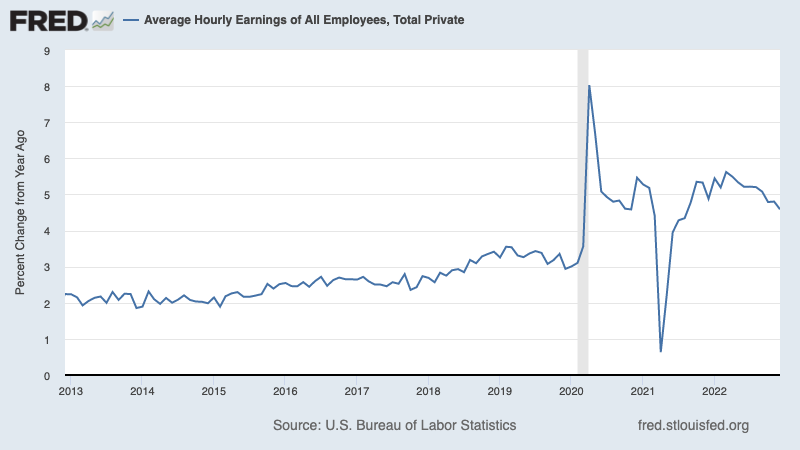

💰 Wage growth cools. Average hourly earnings in December increased by 0.3% month-over-month, cooler than the 0.4% rate expected. On a year-over-year basis, average hourly earnings were up 4.6%, which was lower than the 5.0% expected. For more on why this matters, read: “A key chart to watch as the Fed tightens monetary policy 📊“

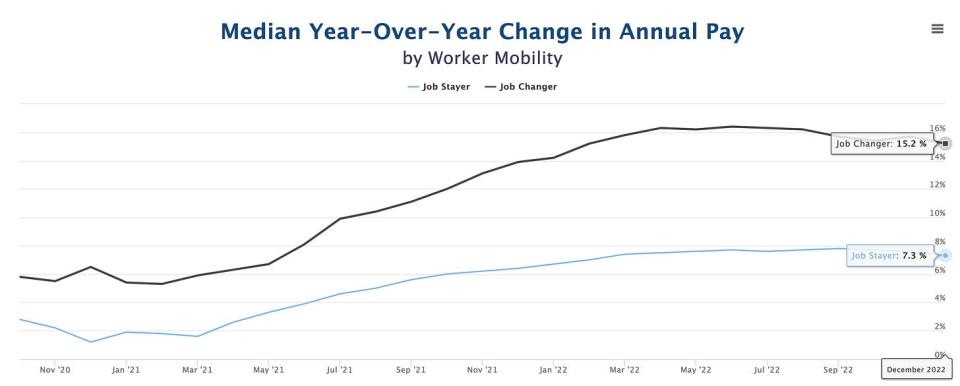

📈 Job switchers get better pay។ យោងទៅតាម ADP បាន, which tracks private payrolls and employs a different methodology than the BLS, annual pay growth in December for people who changed jobs was up 15.2% from a year ago. For those who stayed at their job, pay growth was 7.3%.

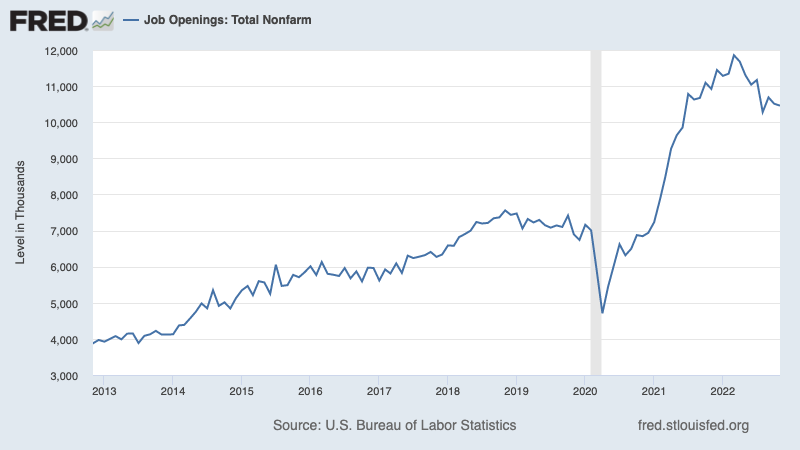

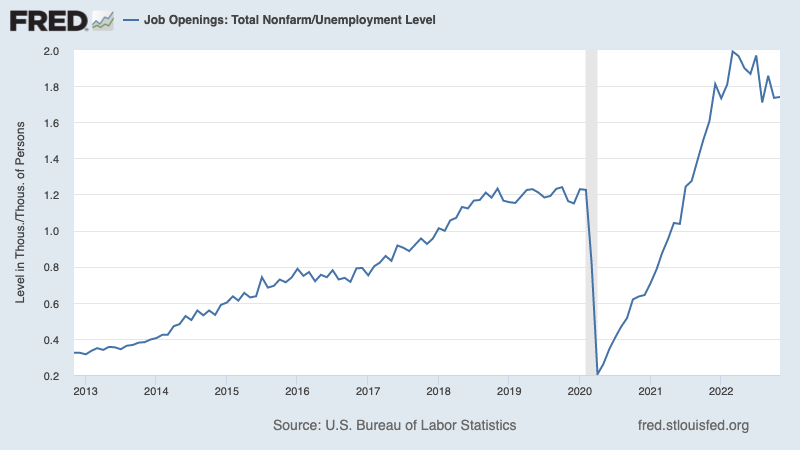

👍 There are lots of job openings។ យោងទៅតាម ទិន្នន័យ BLS released Wednesday, U.S. employers had 10.46 million job openings listed in November, down modestly from 10.51 million openings in October. While openings are below the record high of 11.85 million in March, they remain well above pre-pandemic levels.

ក្នុងអំឡុងពេលនេះ, there were 6.01 million people unemployed. That means there were 1.74 job openings per unemployed person in November. This is down from 1.99 in March, but it still suggests there are lots of opportunities out there for job seekers.

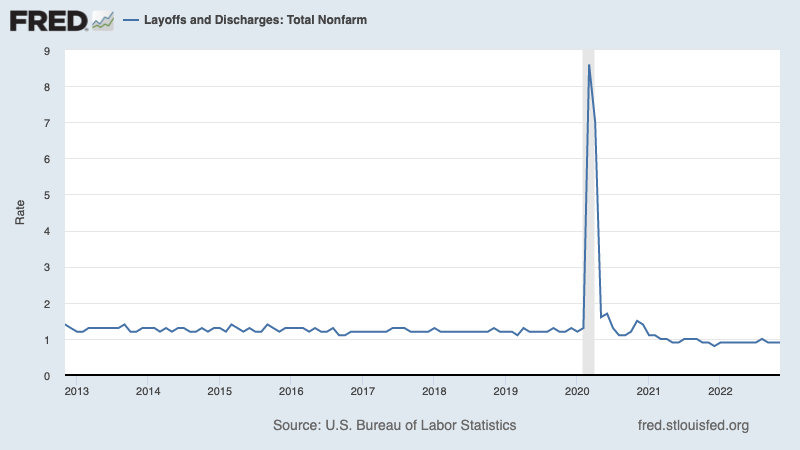

👍 Layoff activity is low។ នេះ layoff rate (i.e., layoffs as a percentage of total employment) stood at 0.9% in November, unchanged from its October level. It was the 21st straight month the rate was below its pre-pandemic lows.

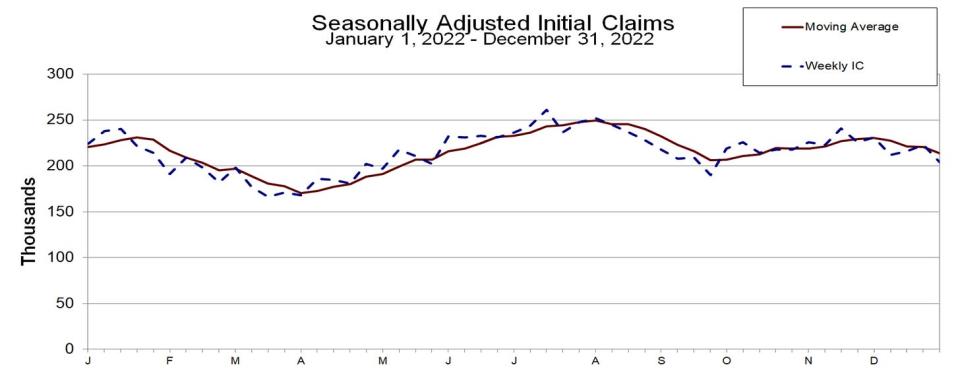

💼 ការទាមទារគ្មានការងារធ្វើនៅតែមានកម្រិតទាប។ ការទាមទារដំបូងសម្រាប់អត្ថប្រយោជន៍អត់ការងារធ្វើ fell to a three-month low of 204,000 during the week ending Dec. 31, down from 223,000 the week prior. While the number is up from its six-decade low of 166,000 in March, it remains near levels seen during periods of economic expansion.

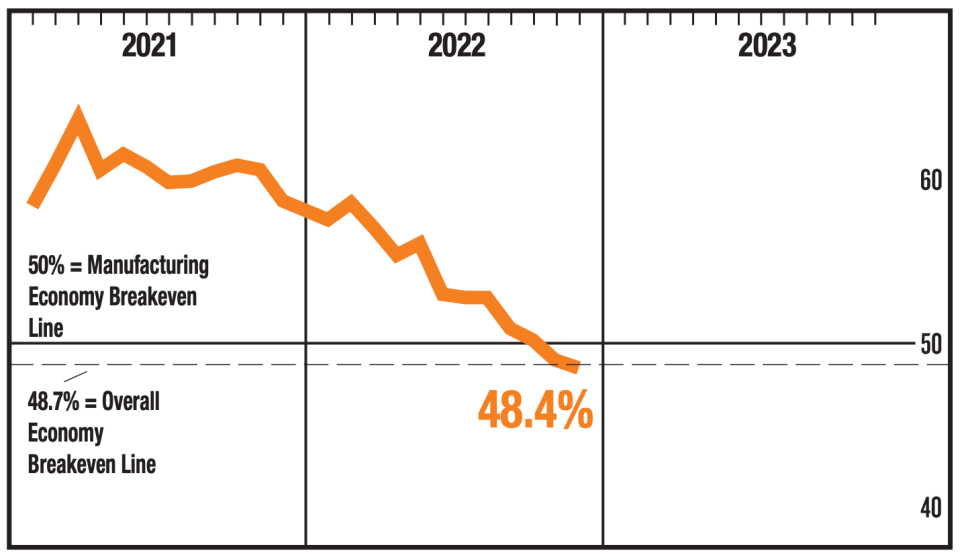

🛠 Manufacturing cools. នេះ ISM’s Manufacturing PMI fell to 48.4 in December from 49.0 in November. A reading below 50 signals contraction in the sector.

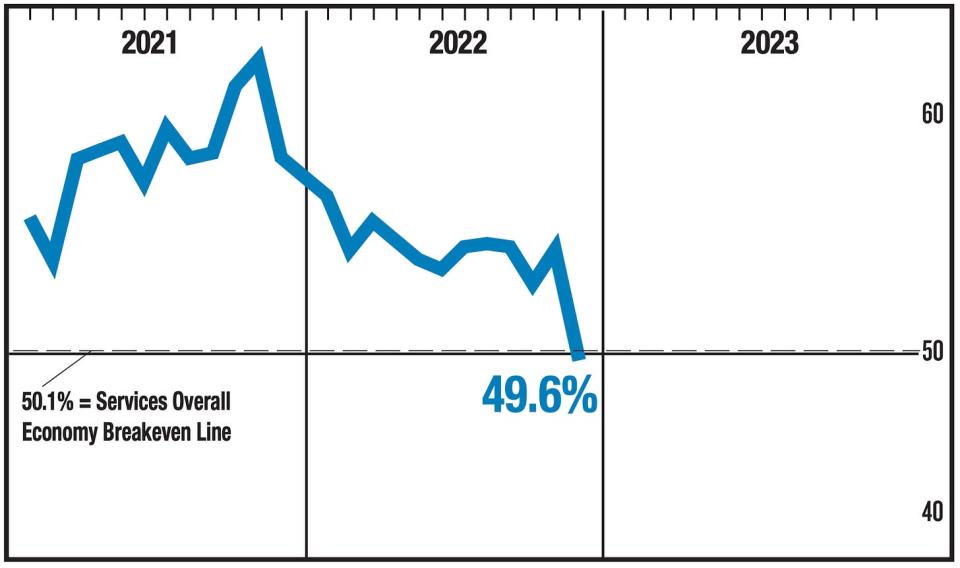

📉 Services cool. នេះ ISM’s Services PMI fell to 49.6 in December from 56.5 in November. A reading below 50 signals contraction in the sector.

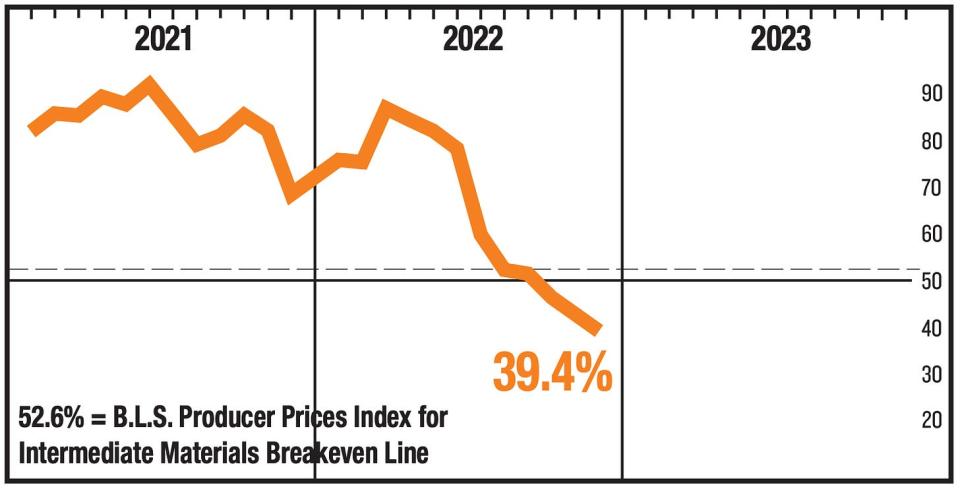

📉 Surveys say prices are cooling. ISM Manufacturing PMI Prices Index fell deeper into contraction.

The ISM Services PMI Prices Index suggests prices are still rising, but at a decelerating rate.

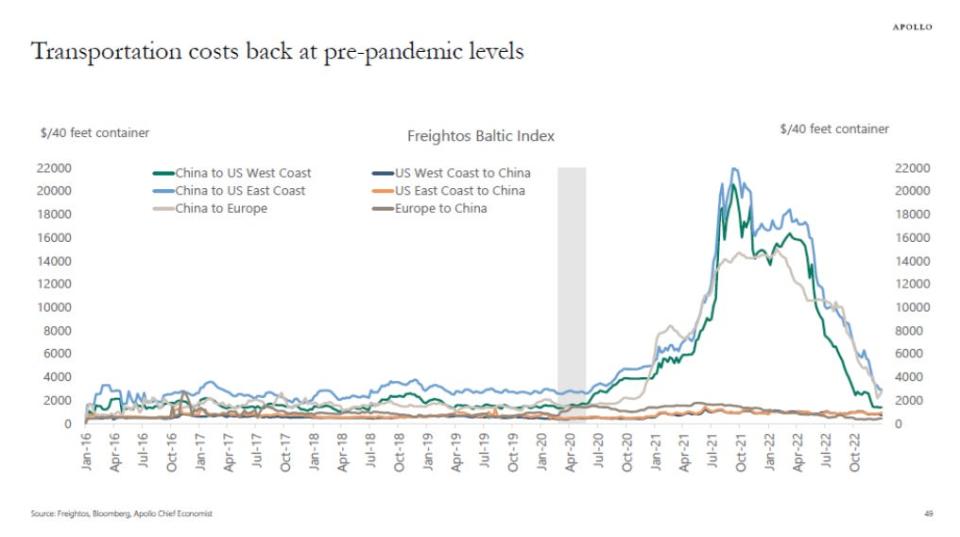

⛓️ “Supply chains are back to normal.” From Apollo Global’s chief economist Torsten Slok: “Supply chains are back to normal, and the price of transporting a 40-feet container from China to the US West Coast has declined from $20,000 in September 2021 to $1,382 today, see chart below. This normalization in transportation costs is a significant drag on goods inflation over the coming months.“

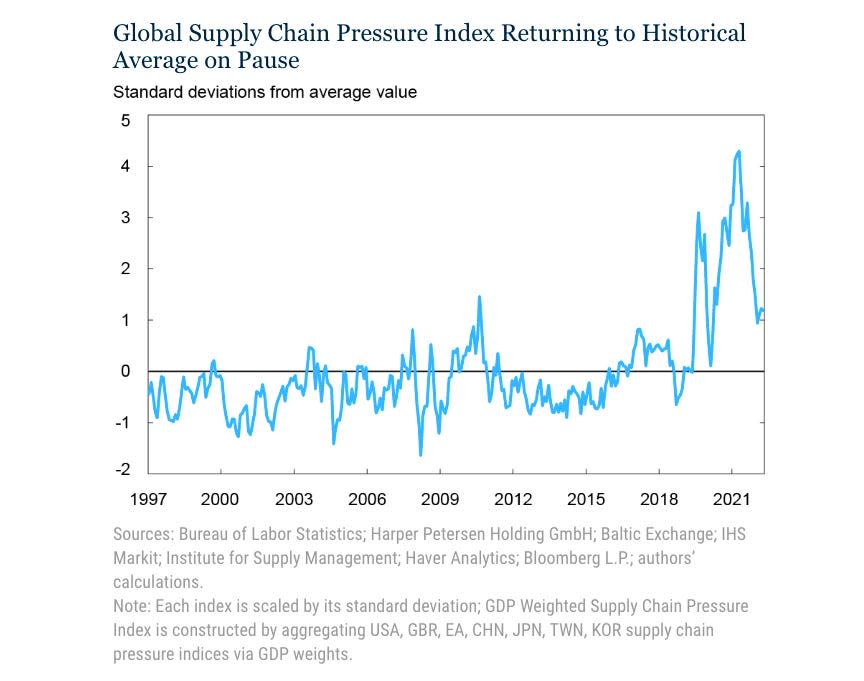

ធនាគារកណ្តាលញូវយ៉ក សន្ទស្សន៍សម្ពាធសង្វាក់ផ្គត់ផ្គង់សកល — a composite of various supply chain indicators — declined slightly in December and is hovering at levels seen in late 2020. From the NY Fed: “Global supply chain pressures decreased moderately in December, disrupting the upward trend seen over the previous two months. The largest contributing factors to supply chain pressures were rises in Korean delivery times and Taiwanese inventories, but these were more than offset by smaller negative contributions over a larger set of factors.“

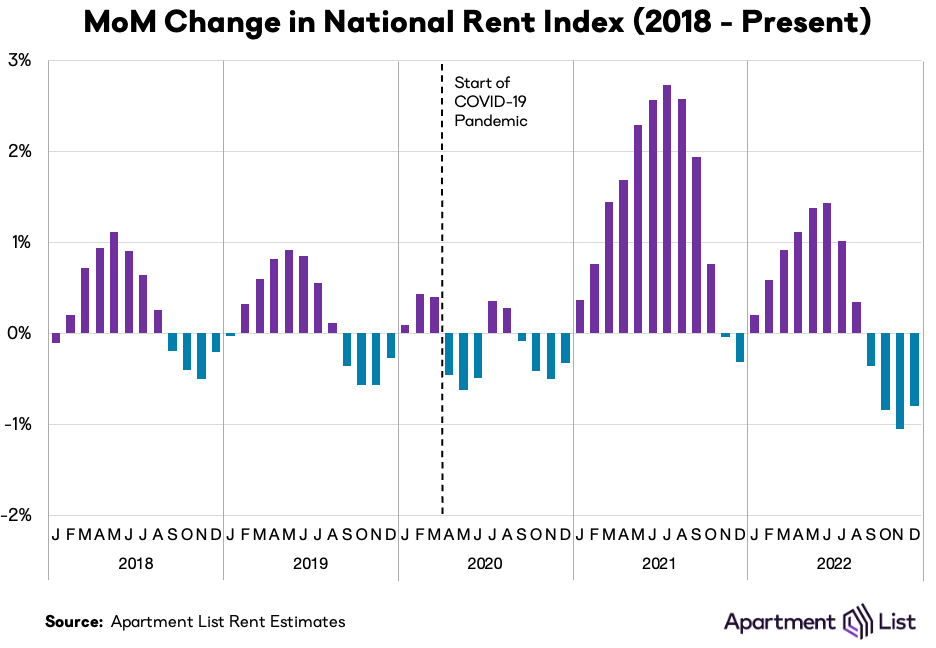

📉 ការជួលធ្លាក់ចុះ។ ពី បញ្ជីអាផាតមិន: “We estimate that the national median rent fell by 0.8 percent month-over-month in December. This is the fourth consecutive monthly decline, and the third largest monthly decline in the history of our estimates, which start in January 2017. The preceding two months (October and November 2022) are the only two months with sharper declines.“

➕ No more negative yielding debt។ ពី ទីភ្នាក់ងារ Bloomberg: “The world’s pile of negative-yielding debt has vanished, as Japanese bonds finally joined global peers in offering zero or positive income. The global stock of bonds where investors received sub-zero yields peaked at $18.4 trillion in late 2020, according to Bloomberg’s Global Aggregate Index of the debt, when central banks worldwide were keeping rates at or below zero and buying bonds to ensure yields were repressed.“

សាកទាំងអស់គ្នា 🤔

Inflation is cooling from peak levels. Nevertheless, inflation remains high and must cool by a lot more before anyone is comfortable with price levels. So we should expect the Federal Reserve ដើម្បីបន្តរឹតបន្តឹងគោលនយោបាយរូបិយវត្ថុដែលមានន័យថាលក្ខខណ្ឌហិរញ្ញវត្ថុកាន់តែតឹងតែង (ឧ. អត្រាការប្រាក់កាន់តែខ្ពស់ ស្តង់ដារផ្តល់ប្រាក់កម្ចីកាន់តែតឹងរ៉ឹង និងតម្លៃភាគហ៊ុនទាប)។ ទាំងអស់នេះមានន័យ ការវាយដំទីផ្សារនឹងបន្ត និងហានិភ័យ សេដ្ឋកិច្ចធ្លាក់ចុះ ចូលទៅក្នុងវិបត្តិសេដ្ឋកិច្ចនឹងកាន់តែខ្លាំង។

But it’s important to remember that while recession risks are elevated, អ្នកប្រើប្រាស់មកពីមុខតំណែងហិរញ្ញវត្ថុខ្លាំងណាស់។. មនុស្សអត់ការងារធ្វើ ទទួលបានការងារ. អ្នកដែលមានការងារទទួលបានការដំឡើងថ្លៃ។ ហើយមនុស្សជាច្រើននៅតែមាន ការសន្សំលើស ដើម្បីប៉ះ។ ជាការពិតណាស់ ទិន្នន័យចំណាយដ៏រឹងមាំបញ្ជាក់ពីភាពធន់នឹងហិរញ្ញវត្ថុនេះ។ ដូច្នេះហើយ ឆាប់ពេកក្នុងការបន្លឺសំឡេងរោទិ៍ពីទស្សនៈនៃការប្រើប្រាស់.

នៅចំណុចនេះ, ណាមួយ។ ការធ្លាក់ចុះទំនងជាមិនប្រែទៅជាវិបត្តិសេដ្ឋកិច្ចទេ។ បានផ្តល់ឱ្យថា សុខភាពហិរញ្ញវត្ថុរបស់អ្នកប្រើប្រាស់ និងអាជីវកម្មនៅតែរឹងមាំ.

ដូចរាល់ដង អ្នកវិនិយោគរយៈពេលវែងគួរចងចាំរឿងនោះ។ វិបត្តិសេដ្ឋកិច្ច និង ទីផ្សារខ្លាឃ្មុំ គឺគ្រាន់តែ ផ្នែកនៃកិច្ចព្រមព្រៀង នៅពេលអ្នកចូលទីផ្សារភាគហ៊ុនក្នុងគោលបំណងបង្កើតប្រាក់ចំណេញរយៈពេលវែង។ ខណៈពេលដែល ទីផ្សារមានឆ្នាំដ៏អាក្រក់ទស្សនវិស័យរយៈពេលវែងសម្រាប់ភាគហ៊ុន នៅតែវិជ្ជមាន.

សម្រាប់ព័ត៌មានបន្ថែមអំពីរបៀបដែលរឿងម៉ាក្រូកំពុងវិវត្ត សូមពិនិត្យមើលចរន្តម៉ាក្រូ TKer មុន »

សម្រាប់ព័ត៌មានបន្ថែមអំពីមូលហេតុដែលនេះជាបរិយាកាសមិនអំណោយផលមិនធម្មតាសម្រាប់ទីផ្សារភាគហ៊ុន សូមអាន "ការវាយដំទីផ្សារនឹងបន្តរហូតដល់អតិផរណាមានភាពប្រសើរឡើង 🥊«»

សម្រាប់ការមើលកាន់តែច្បាស់ថាយើងនៅកន្លែងណា និងរបៀបដែលយើងមកដល់ទីនេះ សូមអាន “បានពន្យល់ថា ភាពរញ៉េរញ៉ៃដ៏ស្មុគស្មាញនៃទីផ្សារ និងសេដ្ឋកិច្ច 🧩"

រឿងនេះគឺ ដើម បោះពុម្ពផ្សាយ TKer.co

Sam Ro គឺជាស្ថាបនិក TKer.co ។ តាមដានគាត់នៅលើ Twitter នៅ @ សារុន

អានព័ត៌មានហិរញ្ញវត្ថុនិងអាជីវកម្មចុងក្រោយពីយ៉ាហ៊ូហ្វាយនែន

ទាញយកកម្មវិធី Yahoo Finance សម្រាប់ ផ្លែប៉ោម or ប្រព័ន្ធប្រតិបត្តិការ Android

អនុវត្តតាមយ៉ាហ៊ូហិរញ្ញវត្ថុលើ។ Twitter, Facebook, Instagram, Flipboard, LinkedInនិង YouTube

Source: https://finance.yahoo.com/news/wall-streets-sleuth-of-bears-is-growing-162747143.html