Last week was one of the worst in the past few years for bond prices, sending two benchmark short- and long-dated bond ETFs to one of their best weeks for inflows in recent memory.

The yield on five-year Treasury bills rose nearly 15% last week, with the 10- and 30-year yield rising 10.7% and 4%, respectively. Those three increases bring yields to levels not seen since the spring of 2019, when the federal funds rate was at 2.4%.

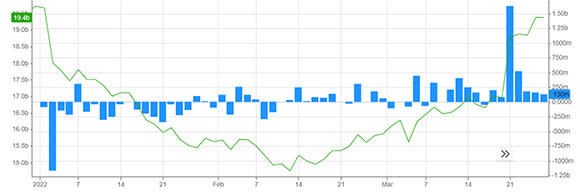

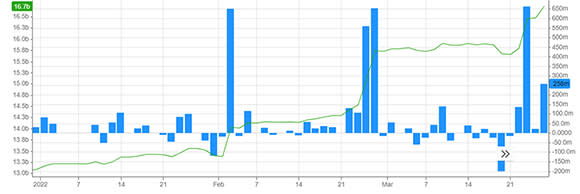

Those moves have sent money to the extreme ends of the maturity curve, with the iShares 20 + ឆ្នាំរតនាគាររតនាភិបាល ETF (TLT) adding more than $2.6 billion and the iShares Short Treasury Bond ETF (SHV) more than $1 billion last week to top the inflows leaderboard for U.S.-listed ETFs.

TLT ។

(សម្រាប់ទិដ្ឋភាពធំសូមចុចលើរូបភាពខាងលើ)

ស៊ីអេស

(សម្រាប់ទិដ្ឋភាពធំសូមចុចលើរូបភាពខាងលើ)

The key spread between five- and 30-year Treasurys inverted this Monday for the first time since 2006 as investors piled into the bet that the Federal Reserve will hike its target funds rate at the cost of economic expansion.

A yield curve inverts when the yield of a shorter-maturing bond rises above the longer-maturing bond yield, and often comes before recessions.

A key catalyst is the swath of Fed speakers pushing the theme of raising rates to fight inflation at all costs, with Fed Chair Jerome Powell saying last week that the labor market is “very strong” and the Fed will use its tools to restore price stability. On Friday, New York Fed President John Williams said that the central bank will use half-point hikes if needed.

With the prospect of higher rates on the way, bondholders are dumping their assets to make room for newly issued Treasurys with higher coupon rates.

Staggering Estimate

Goldman Sachs last week made a prediction for two 50 basis point hikes from the next two Fed meetings, while Citi economists on Friday made a staggering estimate of the next Fed meetings producing four half-point hikes on route to a target rate of 2.75% by the end of the year and higher in 2023.

Those calls sent the five-year yield up a staggering 19 basis points on Friday alone, with the 10-year yield up 13.8 basis points that day.

“Everything in this rate-hiking cycle is certainly happening a lot more condensed and a lot faster than I think a lot of people anticipated coming into the year,” said David Dowden, a portfolio manager with the team behind the New York Life Investments’ MacKay line of active bond funds.

The yield spikes are in part a function of lower liquidity in the exchange-less bond markets, but that’s not the same case with highly tradable ETFs, where bets on the direction of yields can be placed faster by buying shares versus directly trading bonds.

“That does potentially spike volatility in the near term because people are willing to trade it, making those short-term bets on rate views,” said John Lawlor, also of MacKay. “As a longer-term investor, I think in the end it balances out.”

Andy Brenner, head of international fixed income at National Alliance Securities, expects inflation to cool but remain above the Fed’s 2% target in the summer once base effects fall. However, the size of bond ETFs as a competitor to holding bonds directly could change the calculus on where rates go.

“You’ve never experienced a bond bear market with ETFs as a significant part of the conversation as you have … right now,” he said.

ទាក់ទង Dan Mika នៅ [អ៊ីមែលការពារ]ហើយធ្វើតាមគាត់ Twitter

រឿងដែលបានណែនាំ

permalink | © រក្សាសិទ្ធិ 2022 ETF.com ។ រក្សារសិទ្ធគ្រប់យ៉ាង

Source: https://finance.yahoo.com/news/comes-next-bond-etfs-yields-181500690.html