Big data analytics firm Palantir Technologies Inc. (PLTR) is scheduled to report their latest earnings after the close of trading Monday.

Let’s check out the charts and indicators before the print.

In the daily bar chart of PLTR, below, I can see that the shares are still in a downward drift. Prices have been making lower highs the past 12 months and lower lows in May and December. The shares trade below the declining 200-day moving average line but slightly above the 50-day moving average.

The On-Balance-Volume (OBV) line has moved sideways the past year and the trading volume has not been showing a rise. The Moving Average Convergence Divergence (MACD) oscillator is slightly above the zero line and crossing to the downside for a take profit sell signal.

In the weekly Japanese candlestick chart of PLTR, below, I see a bearish picture. The shares are in a longer-term downtrend and trade below the declining 40-week moving average line.

The weekly OBV line has been weak for the past 18-months or so. The MACD oscillator has been below the zero line for more than a year.

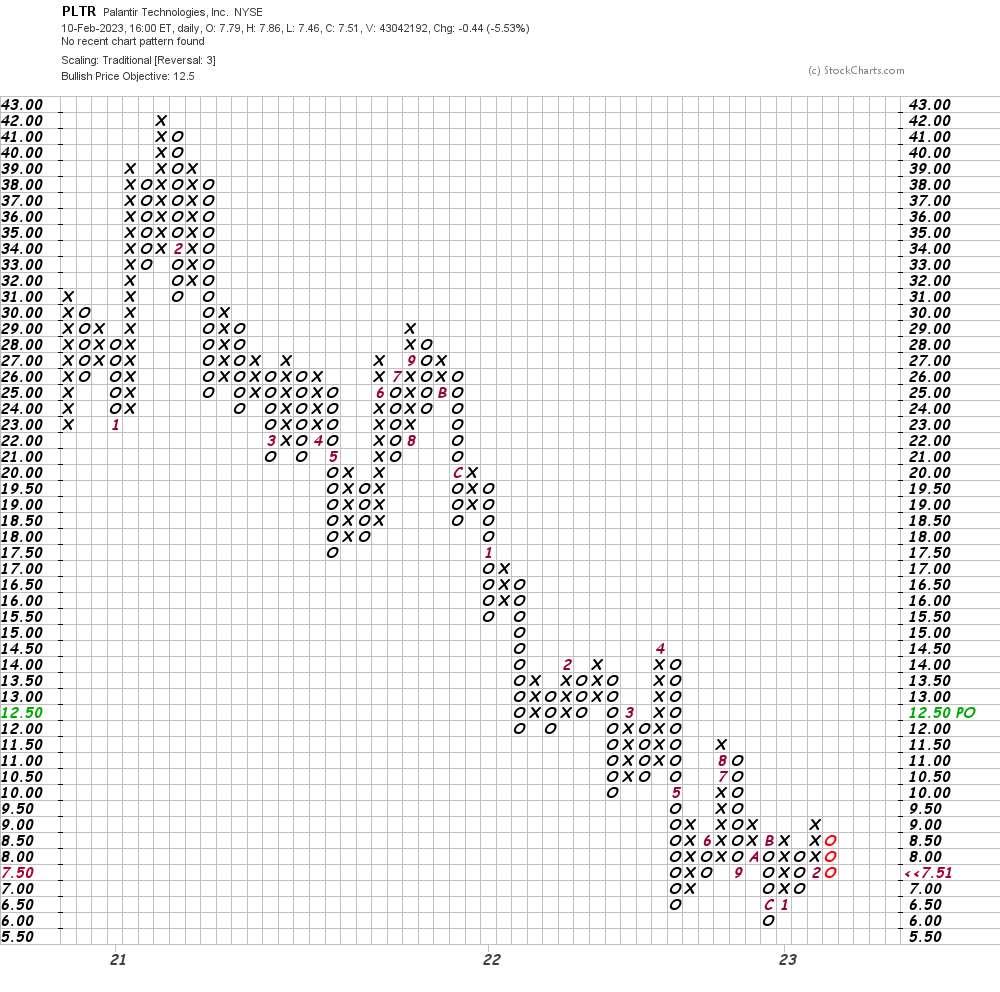

In this daily Point and Figure chart of PLTR, below, I can see an upside price target in the $12.50 area.

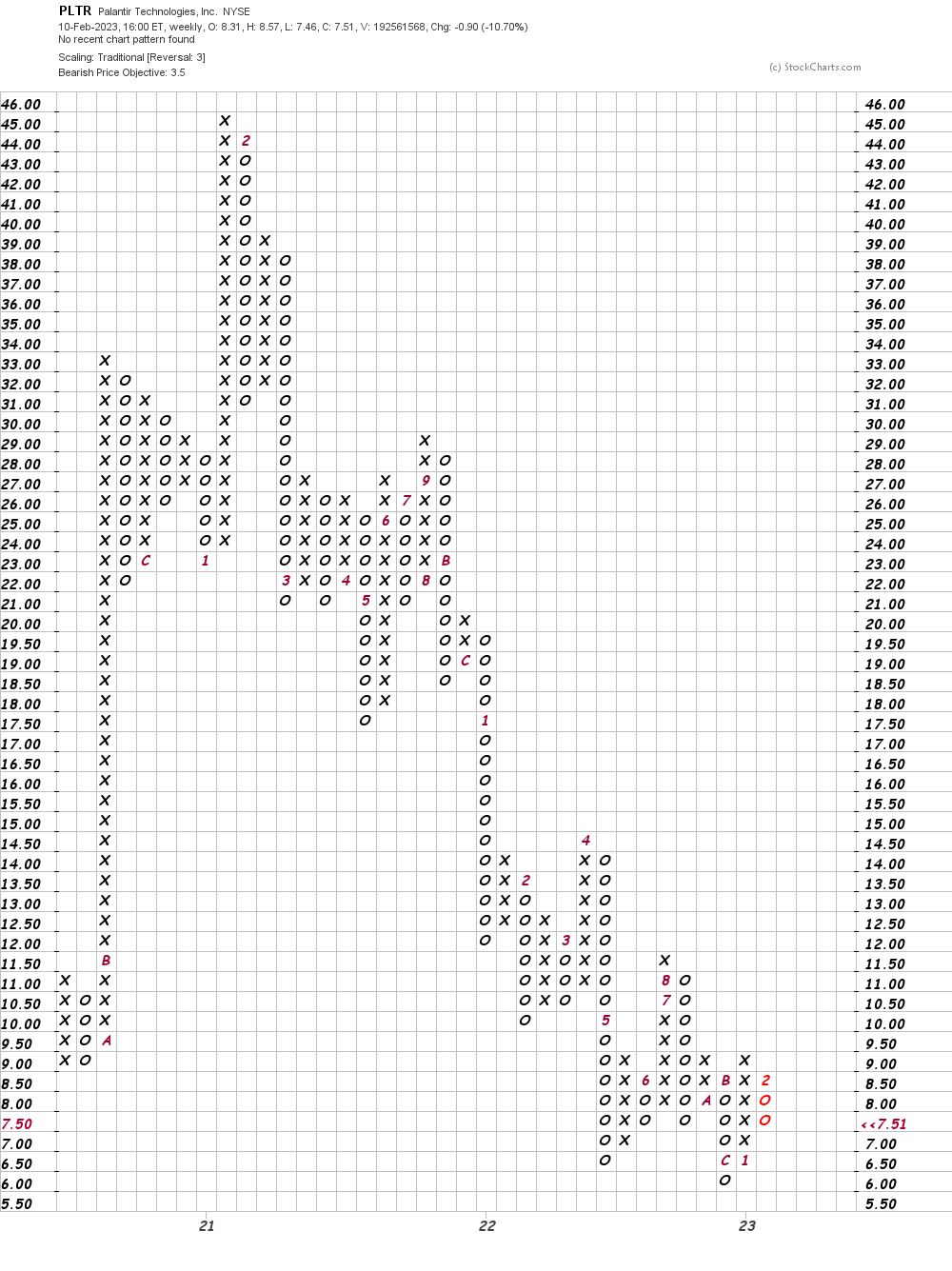

In this weekly Point and Figure chart of PLTR, below, I can see a potential downside price target in the $3.50 area.

យុទ្ធសាស្ត្របន្ទាត់ខាងក្រោម: I have no special knowledge of what PLTR may report to shareholders Monday evening but the charts and indicators do not support the idea of a sustained rally at this point in time.

ទទួលបានការដាស់តឿនតាមអ៊ីមែលរាល់ពេលដែលខ្ញុំសរសេរអត្ថបទសម្រាប់លុយពិត។ ចុច“ + តាមដាន” នៅក្បែរបន្ទាត់ភ្ជាប់របស់ខ្ញុំទៅនឹងអត្ថបទនេះ។

Source: https://realmoney.thestreet.com/investing/stocks/what-s-next-for-palantir-as-it-prepares-to-post-earnings–16115836?puc=yahoo&cm_ven=YAHOO&yptr=yahoo