ការមិនទទួលខុសត្រូវ: ព័ត៌មានដែលបានបង្ហាញមិនបង្កើតជាហិរញ្ញវត្ថុ ការវិនិយោគ ការជួញដូរ ឬប្រភេទផ្សេងទៀតនៃដំបូន្មានទេ ហើយគ្រាន់តែជាគំនិតរបស់អ្នកនិពន្ធប៉ុណ្ណោះ។

- The market structure and momentum favored the bulls.

- Given the significance of the imminent resistance, a breakthrough on the first attempt could be unlikely.

ApeCoin has performed well in recent weeks, and a breakout past the $6 level could be just a matter of time. Bitcoin also had a healthy outlook after sailing past the $22.5k resistance recently.

តើផលប័ត្ររបស់អ្នកមានពណ៌បៃតងទេ? ពិនិត្យ ApeCoin Profit Calculator

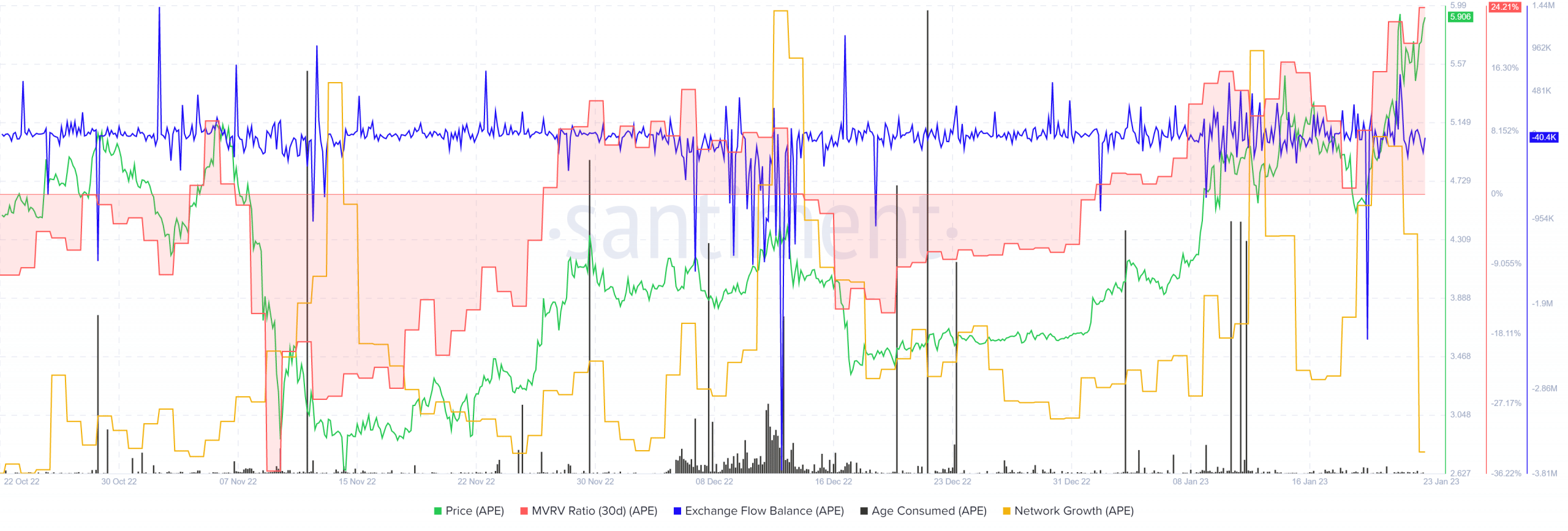

A របាយការណ៍ថ្មីៗ highlighted a large positive value on the MVRV ratio and noted diminishing returns from staking APE. Even so, public sentiment remained positive. At press time, the price reached a level of resistance from September. What can we expect in the coming weeks?

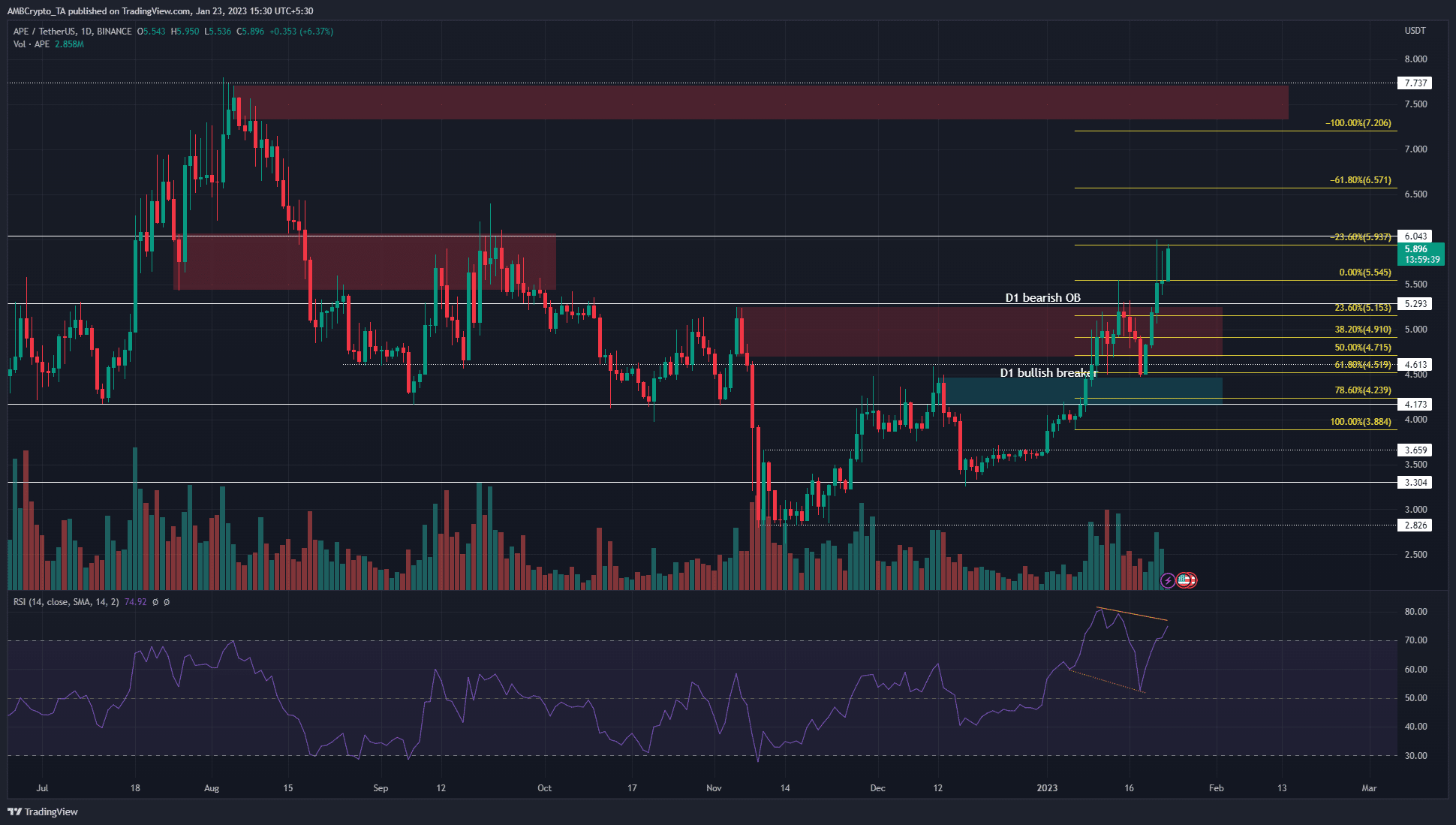

The $5.3 resistance was beaten, next up was the psychological $6 area

In early September, ApeCoin saw large losses and was forced to visit the $4.18 level as support. On September 7, the price bounced from this level to reach $6 just two weeks later. After a few days of intense skirmishing, the bulls were beaten back, and the sellers took control once more. They didn’t relinquish their vice grip till mid-November.

ពិតឬមិនពិត នៅទីនេះ APE’s market cap in BTC’s លក្ខខណ្ឌ

Therefore, there was a likelihood of rejection at this $6 resistance. It represented a psychological round number, and the bearish reaction in late September paved the way for losses throughout October and well into November.

Hence it was unlikely that APE would break out above this level on its first try. A rejection at $6, followed by a pullback to the $5.3-$5.5 area was more likely. This could also force lower timeframe bears into a false sense of security while giving bulls some time to lock in profits and prepare for the next march northward.

The RSI formed a bearish divergence (orange), which suggested an overextended market and supported the idea of a pullback. The previous rejection near $5.25 had been followed by a pullback to $4.5, where a hidden bullish divergence (dotted orange) was followed by a sharp upward move. Therefore risk-averse bulls can wait for a retest of a significant support level as well as a hidden bullish divergence before buying APE.

Network growth complemented the explosive price action and the MVRV ratio climbed higher

ប្រភព: សេនធូម

In the past two weeks, the network growth metric saw sizeable spikes alongside the expansion in prices. This suggested that genuine demand and users backed the rally of ApeCoin. The age consumed metric did not see large spikes after the ones on January 11 and 12. This could mean that large numbers of the token were not moved in a hurry, which is sometimes followed by a wave of selling.

The rising MVRV ratio meant profit-taking could occur soon. Yet, the $5.3 and $4.5 were important levels of support that would need to be flipped to resistance before the bears can claim the edge on higher timeframes.

Source: https://ambcrypto.com/apecoin-reaches-4-month-highs-but-this-decisive-resistance-was-yet-unbroken/