- Bot activity surged on DEXs such as SushiSwap.

- Even so, SushiSwap’s revenue continued to grow and whales showed interest.

After the fall of the mighty FTX, many crypto enthusiasts have been flocking toward DEXs. However, a recent report from Messari suggested that bots are populating the decentralized exchange.

អាន Sushi’s Price Prediction 2022-2023

BOT និងលក់

Even though bots make up a ភាគរយតូច of the overall users on decentralized exchanges, they still are majorly responsible for a large portion of transaction volume.

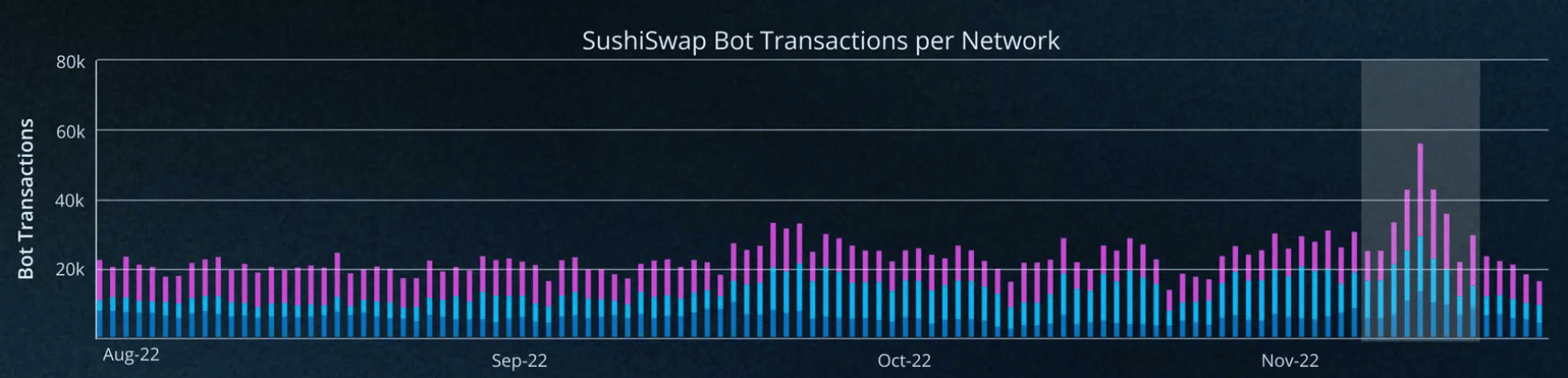

From the illustration provided below, it can be witnessed that a surge in bot activity was observed after the FTX debacle. This surge in bot activity could harm other unsuspecting users on various decentralized exchanges.

ស៊ូស៊ូសាយ users could be affected by something called a sandwich attack. In a sandwich attack, bots take advantage of low liquidity and high slippage. They then proceed to front-run a victim’s transaction and then sell their position for a profit.

No problems faced yet

Despite the increasing bot activity on ស៊ូស៊ូសាយ, the revenue generated by the protocol has remained in the green. Over the last 30 days, SushiSwap managed to increase by 68.54%. However, in terms of liquidity pool transactions, there was a depreciation of around 20.55%

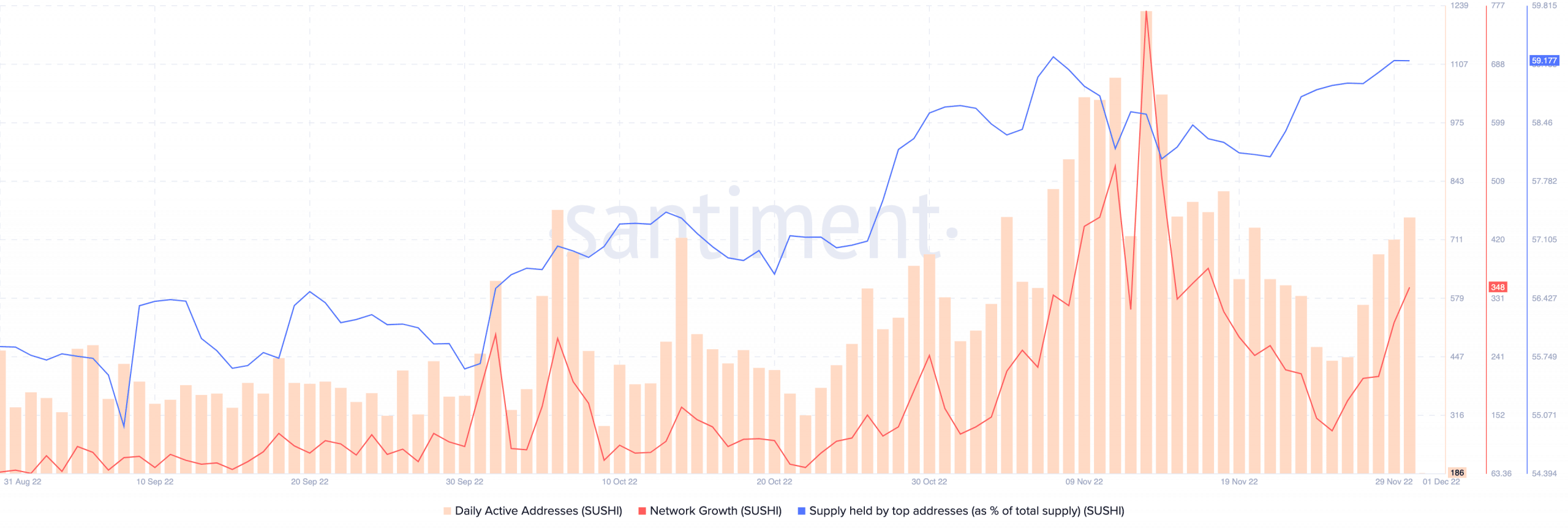

The increasing sandwich attacks and bot activity did not suppress user activity on SushiSwap at all. As can be seen from the image below, the daily activity witnessed massive growth over the past month.

Coupled with that, SUSHI’s network growth increased as well, indicating that the number of new addresses that transferred a SUSHI for the first time had increased.

Another positive indicator for SUSHI was the growing whale interest in SushiSwap. From the image below, it can be observed that the supply held by top addresses continued to increase over time for SushiSwap.

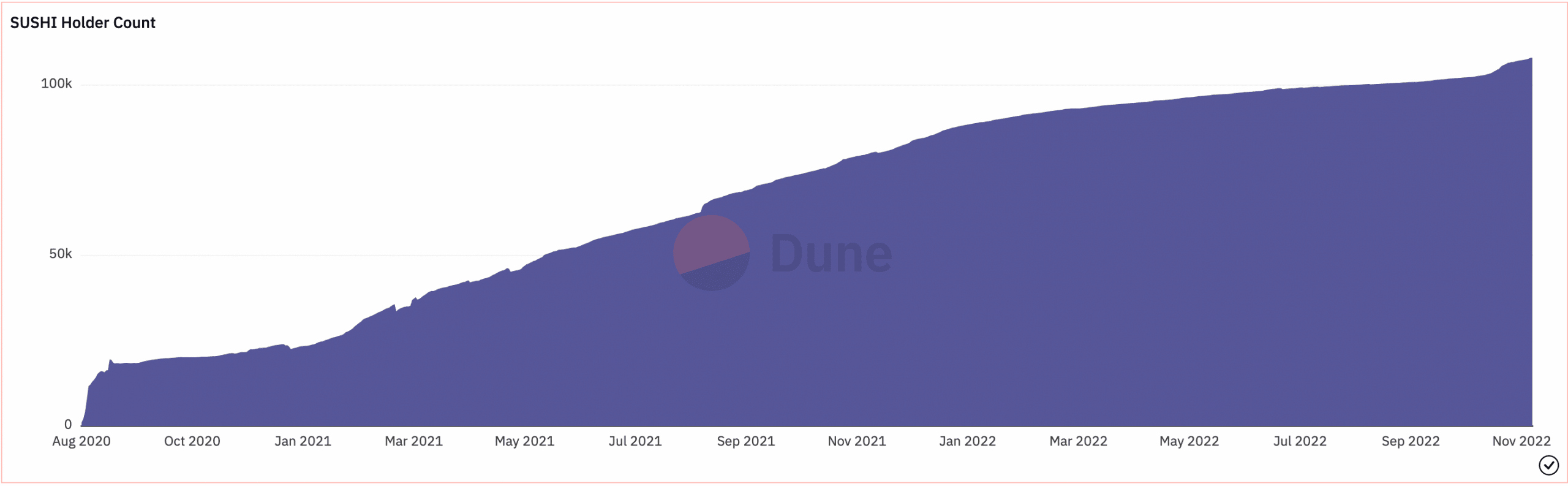

បើយោងតាមឧតាមប៉ាន់ស្មានរបស់ឧស្សាហកម្ម Gartner ក្នុងឆ្នាំ២០២១ បានឲ្យដឹងថា ការចំណាយរបស់អ្នកប្រើប្រាស់ចុងក្រោយលើសេវា public cloud បានកើនឡើងយ៉ាងខ្លាំង។ តួលេខនេះគឺគួរឱ្យភ្ញាក់ផ្អើល ដោយមានការប៉ាន់ប្រមាណការចំណាយគឺ ៣៩៦ ពាន់លានដុល្លារក្នុងឆ្នាំ ២០២១ និងកើនឡើង ២១.៧% ដល់ ៤៨២ ពាន់លានដុល្លារក្នុងឆ្នាំ ២០២២។ លើសពីនេះ Gartner ព្យាករណ៍ពីការផ្លាស់ប្តូរដ៏សំខាន់នៅក្នុងការចំណាយផ្នែកព័ត៌មានវិទ្យារបស់សហគ្រាស ជាមួយនឹងការចំណាយលើ public cloud លើសពី ៤៥% នៃការចំណាយសរុបនៅឆ្នាំ ២០២៦ តិចជាង ១៧% ក្នុងឆ្នាំ២០២១។ ការប៉ាន់ប្រមាណនេះ ឆ្លុះបញ្ចាំងពីការកើនឡើងនូវការកោតសរសើរ ចំពោះអត្ថប្រយោជន៍របស់ cloud ទាក់ទងនឹងការធ្វើមាត្រដ្ឋាន ភាពបត់បែន និងការបង្កើនប្រសិទ្ធភាពតម្លៃ។ Dune Analytics, the number of Sushi holders continued to rise over the last past year.

At press time the number of holders stood at 107,976.

It remains to be seen whether the increasing number of bots will impact ស៊ូស៊ុយ holders negatively.

និយាយថានៅពេលសរសេរ ស៊ូស៊ុយ was trading at $1.39 and its price had decreased by 3.31% in the last 24 hours according to CoinMarketCap ។ Its volume also fell by 30.83% during the same period.

Source: https://ambcrypto.com/can-bots-stunt-sushiswaps-growth-these-metrics-have-the-answer/