Chainlink (LINK) price hit a new 2023 peak of $16 on Nov. 9, before the bears force a retreat from last week’s euphoric peaks. However, recent on-chain data trends show that Chainlink investors remain optimistic of a quick rebound.

Chainlink’s bulls have fiercely defended the $14 price support level over the past week. Will LINK price rebound or retrace?

Majority of Chainlink (LINK) Investors Continue to Hold

LINK price dipped 13% to a daily low of weekly low of $14. Amid the neutral market sentiment recent on-chain movements suggest that most LINK holders remain positive.

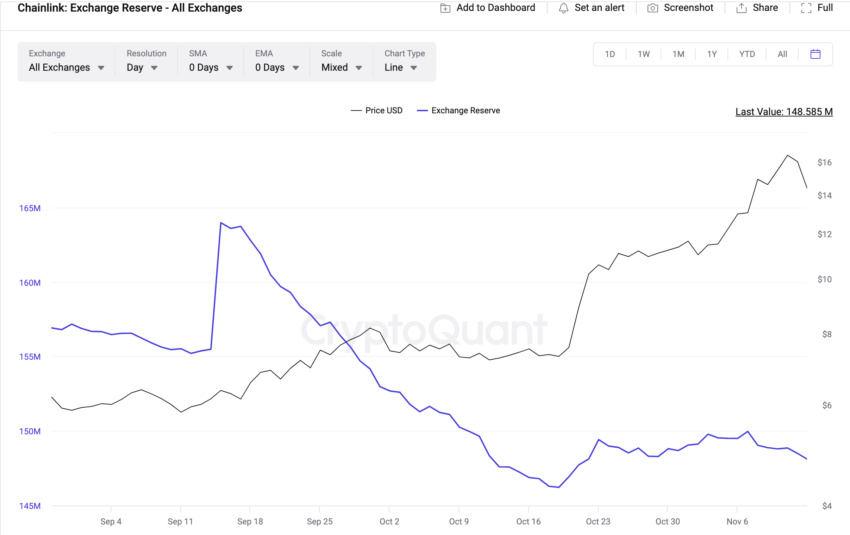

As depicted in the CryptoQuant chart below, Chainlink investors held a total of 149.9 million LINK tokens in exchange-hosted wallets. Interestingly, the figure has now dipped to 148 million LINK. In essence, investors have reduced their LINK exchange deposits by 1.4 million tokens this week, cooling concerns of a large-scale sell-off.

នេះ exchange reserves metric tracks real-time changes in the number of LINK tokens deposited wallets hosted on crypto exchanges and trading platforms. A persistent decline in exchange reserves is regarded as a bullish indicator as it causes a reduction in spot market supply. At the current price of $14.20, the 1.43 million LINK tokens withdrawal means a $20 million reduction in LINK spot markets this week.

អានបន្ត៖ តើ Chainlink (LINK) ជាអ្វី?

Furthermore, when investors opt for long-term cold storage during a price correction, it indicates they are holding out for an early rebound, rather than exit.

Despite Dropping Prices Chainlink is Still Attracting New Users

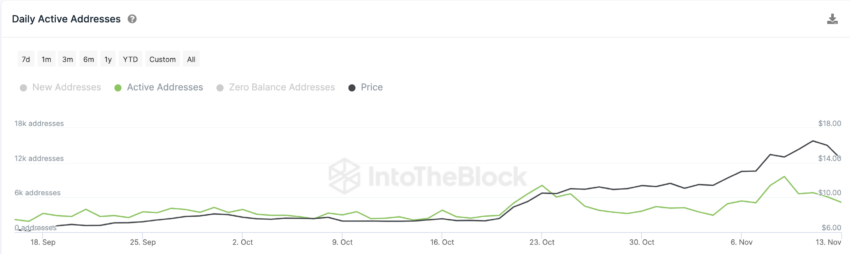

Chainlink price has been in a downtrend since retracing from it yearly peak of $16 last week. However, on-chain data trends show that this has not dissuaded new users and investor from trooping into the ecosystem. On Nov. 9, Chainlink active addresses reached a yearly peak of 9,630 wallets. The chart below illustrates that since then, it has consistently remained above 5,000 addresses.

The daily active addresses metric tracks the daily number of unique wallets that carry out economic transactions. When a network records a consistently high number of active users, it often puts upward pressure on price. Unsurprisingly, this has helped LINK price defend the $14 support over the past week.

អានបន្ថែម: 14 គ្មាន KYC Crypto Exchanges ល្អបំផុតនៅឆ្នាំ 2023

In conclusion, investors shifting out of the market, and the steady rate of network usage, suggest that LINK is in prime position for a rebound if the broader market sentiment shifts.

LINK Price Prediction: Further Consolidation Before $20 Rally

Drawing inferences from the on-chain metrics analyzed above, Chainlink could rebound toward $20, if the bulls can hold through the ongoing consolidation phase.

The Global In/Out of the Money (GIOM) data, which groups the current LINK token holders according to their entry prices, also affirms this forecast.

It, shows that the bulls have mounted a formidable support buy-wall around the $12 area. As depicted below, 52,840 holders had bought 51.3 million LINK at the average price of $12.24. If those investor stand firm, they could trigger an instant rebound as predicted.

But if the bears overturn that buy-wall LINK price could tumble toward $10.

Still, the bulls could seize control of the market again, if Chainlink’s price scales $15. But, in that case, the 55,130 holders that bought 35.5 million LINK at the minimum price of $15.19 could mount a resistance sell wall. But if that resistance gives way, Chainlink will likely rally toward $20.

អានបន្ថែម៖ របៀបទិញ Chainlink (LINK) និងអ្វីគ្រប់យ៉ាងដែលអ្នកត្រូវដឹង

ការមិនទទួលខុសត្រូវ

ស្របតាមគោលការណ៍ណែនាំគម្រោងការជឿទុកចិត្ត អត្ថបទវិភាគតម្លៃនេះគឺសម្រាប់គោលបំណងផ្តល់ព័ត៌មានតែប៉ុណ្ណោះ ហើយមិនគួរត្រូវបានចាត់ទុកថាជាដំបូន្មានផ្នែកហិរញ្ញវត្ថុ ឬការវិនិយោគនោះទេ។ BeInCrypto ប្តេជ្ញាចិត្តក្នុងការរាយការណ៍ត្រឹមត្រូវ ដោយមិនលំអៀង ប៉ុន្តែលក្ខខណ្ឌទីផ្សារអាចផ្លាស់ប្តូរដោយគ្មានការជូនដំណឹងជាមុន។ តែងតែធ្វើការស្រាវជ្រាវដោយខ្លួនឯង និងពិគ្រោះជាមួយអ្នកជំនាញមុនពេលធ្វើការសម្រេចចិត្តផ្នែកហិរញ្ញវត្ថុណាមួយ។

Source: https://beincrypto.com/can-chainlink-link-price-hit-20-2/