- Following the announcements to make Silicon Valley Bank (SVB) depositors whole, MKR’s price rallied by double digits.

- Due to DAI depeg, MakerDAO’s fee income slipped by 10% over the weekend.

In response to recent developments, ក្រុមហ៊ុនផលិត [MKR] price experienced a substantial increase of nearly 30% in the last 24 hours.

This surge followed the សេចក្តីប្រកាស by Federal regulators to fully restore all deposits at failed Silicon Valley Bank (SVB). Additionally, fintech company Circle made a សេចក្តីថ្លែងការណ៍ to cover any of its stablecoin USDC reserves, which further bolstered market confidence.

ប្រតិបត្តិការ USDC របស់ Circle នឹងបើកសម្រាប់អាជីវកម្មនៅព្រឹកថ្ងៃចន្ទ រួមទាំងការទូទាត់ដោយស្វ័យប្រវត្តិថ្មី តាមរយៈភាពជាដៃគូថ្មីរបស់យើងជាមួយធនាគារ Cross River ។ https://t.co/ybkSEedzrC

- Jeremy Allaire (@jerallaire) ខែមីនា 13, 2023

MKR’s price had seen only double-digit declines for most of the weekend prior to these announcements.

Further, these announcements have also helped drive up the values of de-pegged stablecoins DAI and USDC. At press time, both coins traded at $0.99 and aimed at reclaiming their $1 peg before the end of trading today, per data from CoinMarketCap.

តើផលប័ត្ររបស់អ្នកមានពណ៌បៃតងទេ? សូមពិនិត្យមើល ការគណនាប្រាក់ចំណេញរបស់អ្នកបង្កើត

MKR holders have a cause to smile

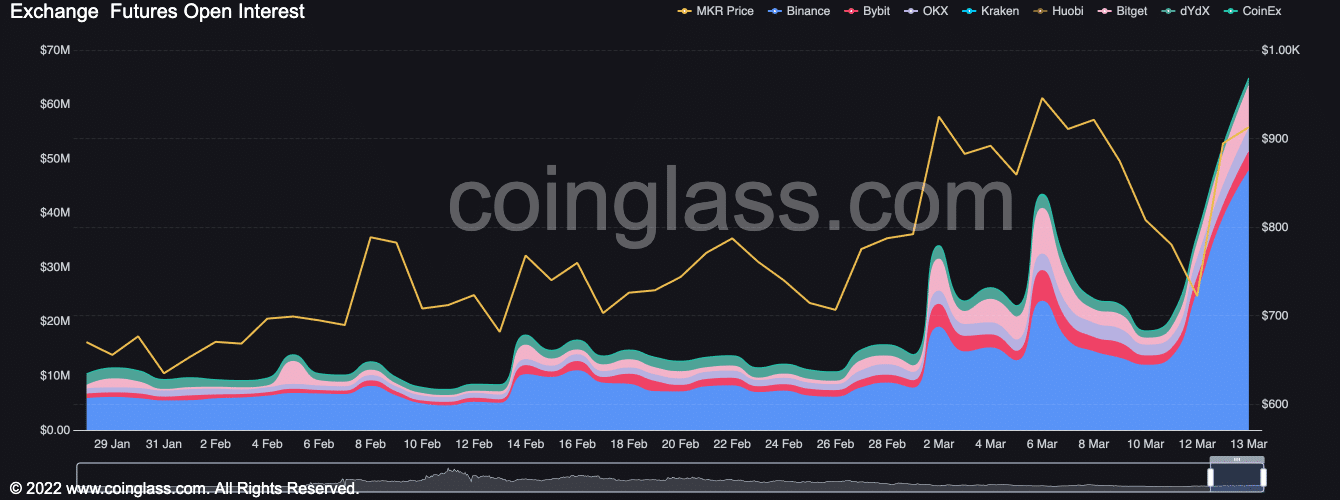

At press time, MKR exchanged hands at $915.60. With improved sentiment in the last 24 hours, MKR’s Open Interests shot up significantly, per data from Coinglass. At $64.87 million at press time, MKR’s Open Interests rallied by 24% in the last 24 hours.

A jump in a crypto asset’s Open Interest is a significantly bullish signal, indicating that the number of outstanding contracts or positions for that asset has increased. It also reflects increased trading activity and improved market sentiment for a particular crypto asset.

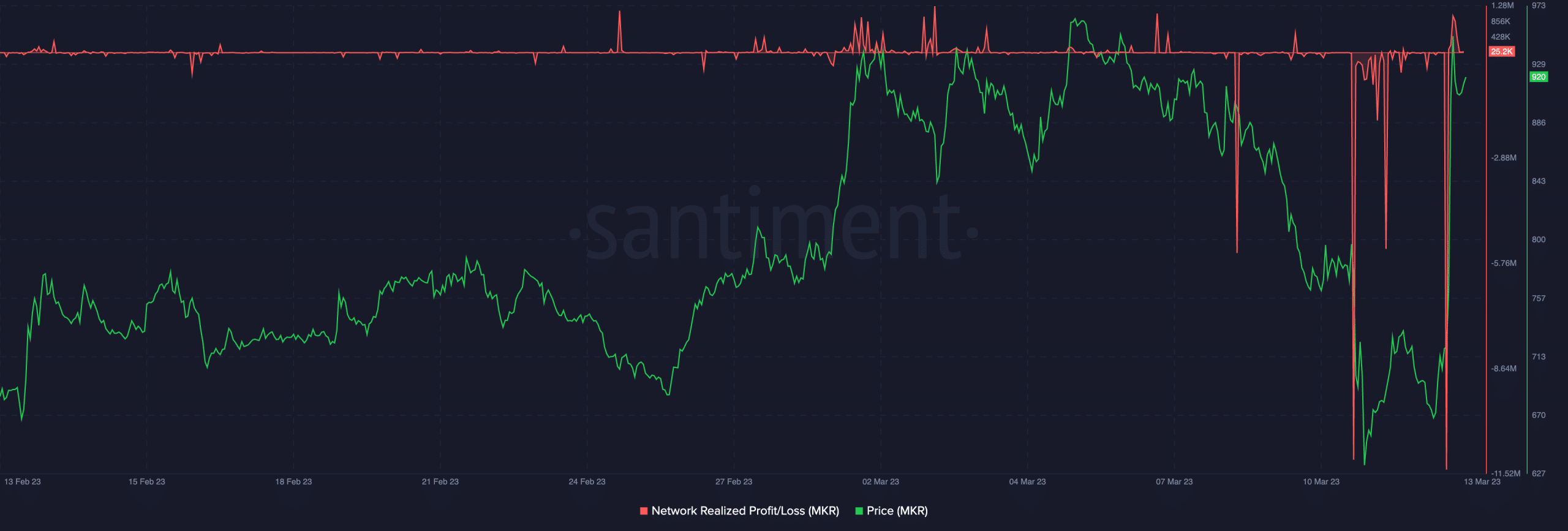

In addition, an assessment of MKR’s on-chain performance revealed a dip in its Network Profit/Loss ratio immediately before the price rally.

Typically, NPL dips often signal short-term capitulation of ‘weak hands’ and the re-entry of ‘smart money,’ according to សេនធូម. This is why “they tend to coincide with local bounce backs and periods of price recovery.”

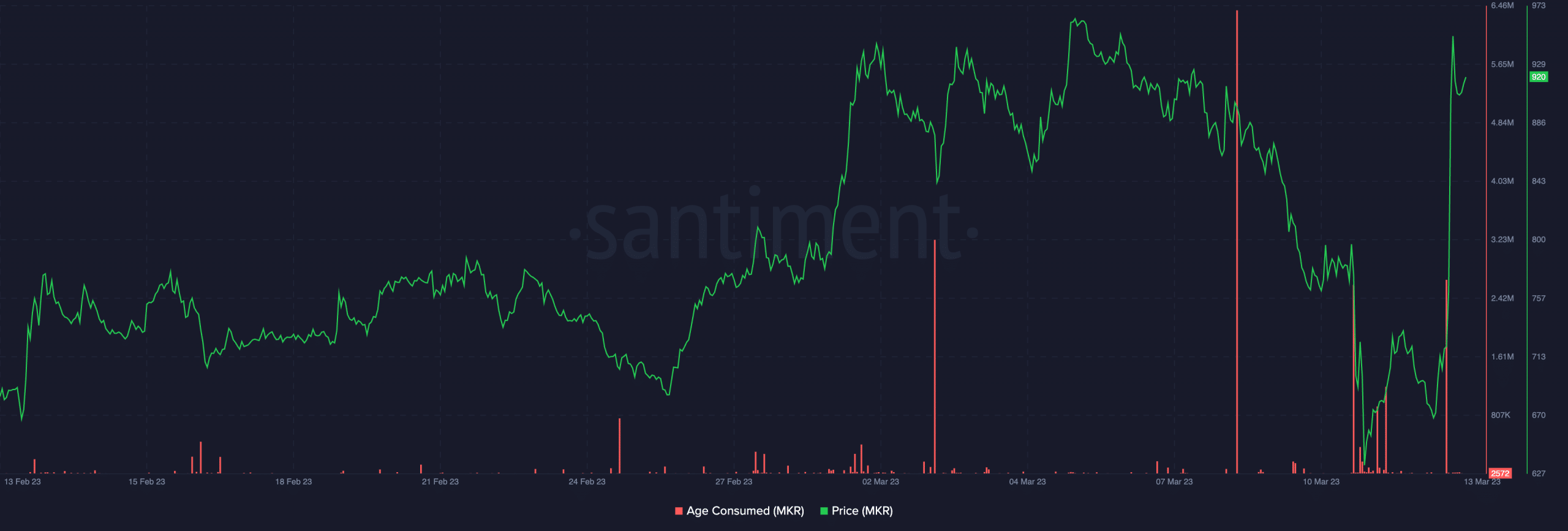

Moreso, improved sentiment led to a spike in MKR’s Age Consumed after the announcements were made. This spike earmarked a local bottom and corresponded with a sharp uptick in MKR’s value.

An increase in an asset’s Age Consumed metric indicates a significant transfer of inactive tokens to new addresses, indicating a sudden and significant change in the behavior of long-term holders.

Long-term holders are typically patient and cautious, so any sudden movement of idle coins may be associated with significant changes in market conditions.

អាន អ្នកបង្កើត [MKR] ការព្យាករណ៍តម្លៃ 2023-24

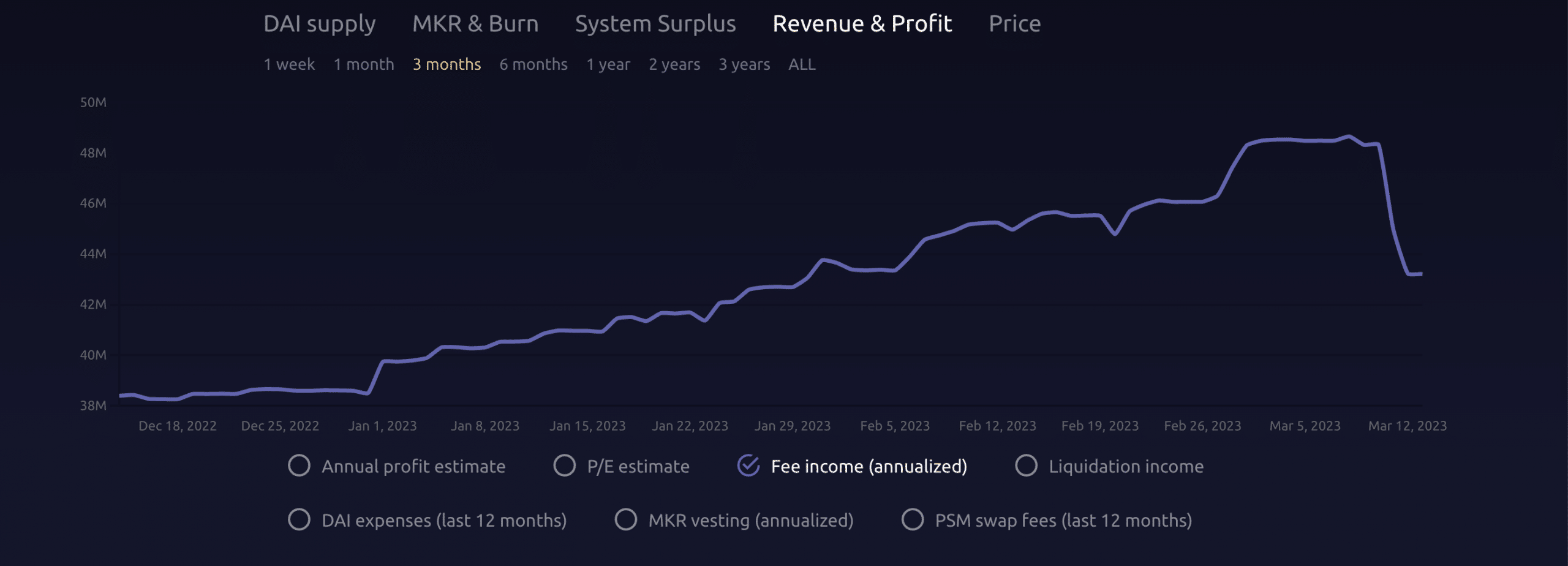

Maker still has to deal with the revenue decline

Due to DAI’s de-peg and drop in value in the past few days, MakerDAO suffered a decline in its fee income (annualized), data from អ្នកបង្កើតដុត បានបង្ហាញ។

This stood at 43.21 million DAI at press time, having fallen by 10% over the weekend. This is expected to embark on an uptrend once DAI reclaims its $1 peg.

Source: https://ambcrypto.com/mkr-sees-green-as-regulators-move-to-restore-deposits-at-failed-svb/