ការបដិសេធ៖ ព័ត៌មានដែលបានបង្ហាញមិនបង្កើតជាហិរញ្ញវត្ថុ ការវិនិយោគ ការជួញដូរ ឬប្រភេទផ្សេងទៀតនៃដំបូន្មានទេ ហើយគ្រាន់តែជាគំនិតរបស់អ្នកនិពន្ធតែប៉ុណ្ណោះ

- NEAR was bullish at press time.

- But a key technical indicator was showing an increasing divergence, at press time.

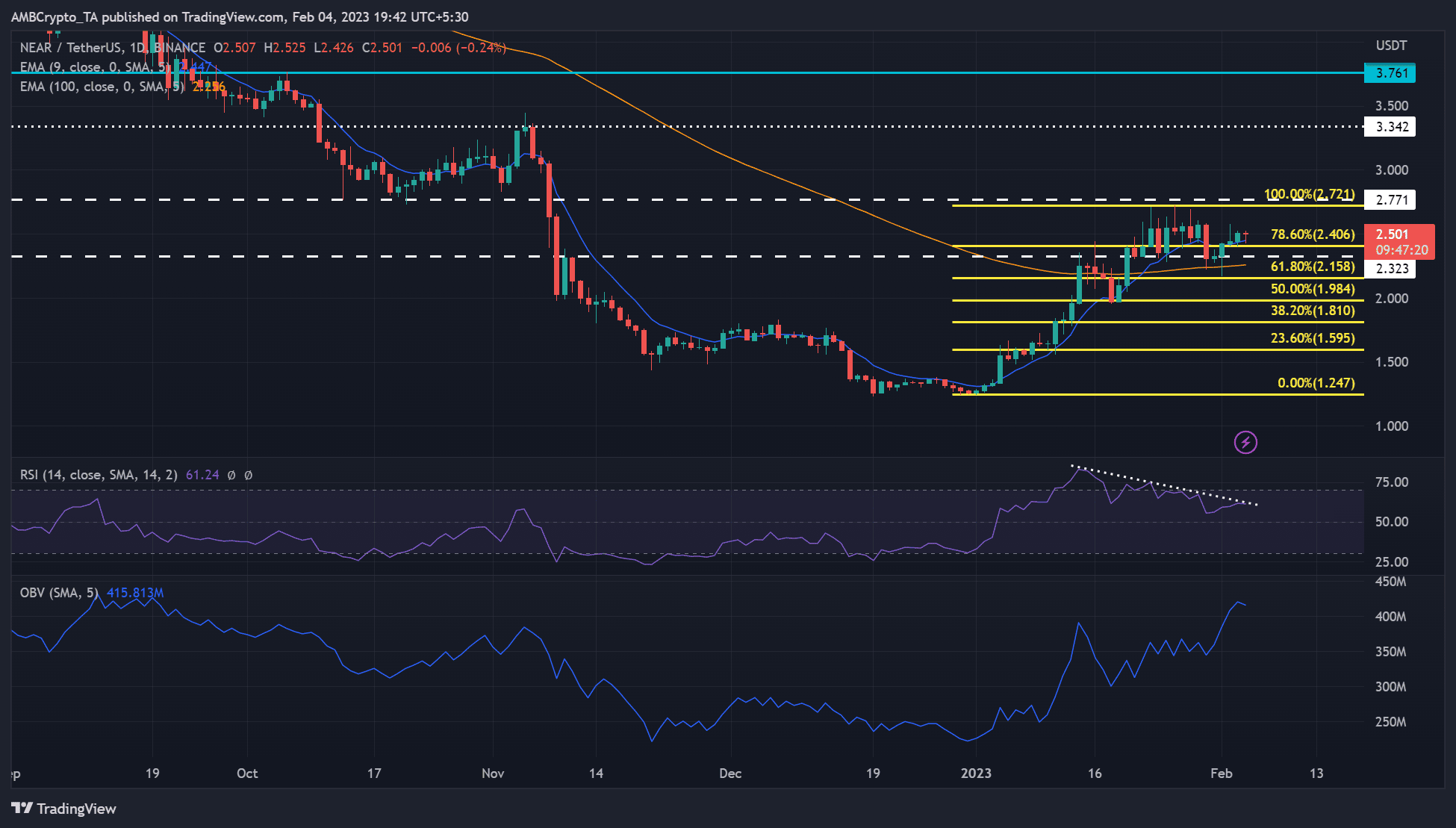

នៅជិតពិធីការ [ជិត] more than doubled in value after the January rally. It jumped from $1.247 to $2.721 but later fluctuated. At press time, NEAR’s value was $2.501 but increasingly faced a likely correction because of divergence from a technical indicator.

អាន នៅជិតការព្យាករណ៍តម្លៃ 2023-24

NEAR’s increasing RSI divergence Is a correction likely?

តើផលប័ត្ររបស់អ្នកមានពណ៌បៃតងទេ? សូមពិនិត្យមើល នៅជិតម៉ាស៊ីនគណនាប្រាក់ចំណេញ

The daily chart showed a bullish NEAR fronted a successful rally in January but faced price rejection at the overhead resistance level of $2.721. However, the rising price action was the opposite of its Relative Strength Index (RSI).

The RSI has exhibited a downtrend from mid-January – a divergence with price action that could suggest a possible correction in the next few days.

Based on the height of the recent price consolidation range of $2.323 and $2.721, the correction could target the support level at the 50% Fib level of $1.984.

But the drop could also be held by the 100-day EMA, or 61.8% Fib level. These could act as short-selling targets if the correction occurs.

However, the above bias would be invalidated if bulls break above the 100% Fib level of $2.721. Such an upswing will allow bulls to retest the October support level of $2.771 or the November high of $3.342.

NEAR saw fluctuating OI and a decline in active users

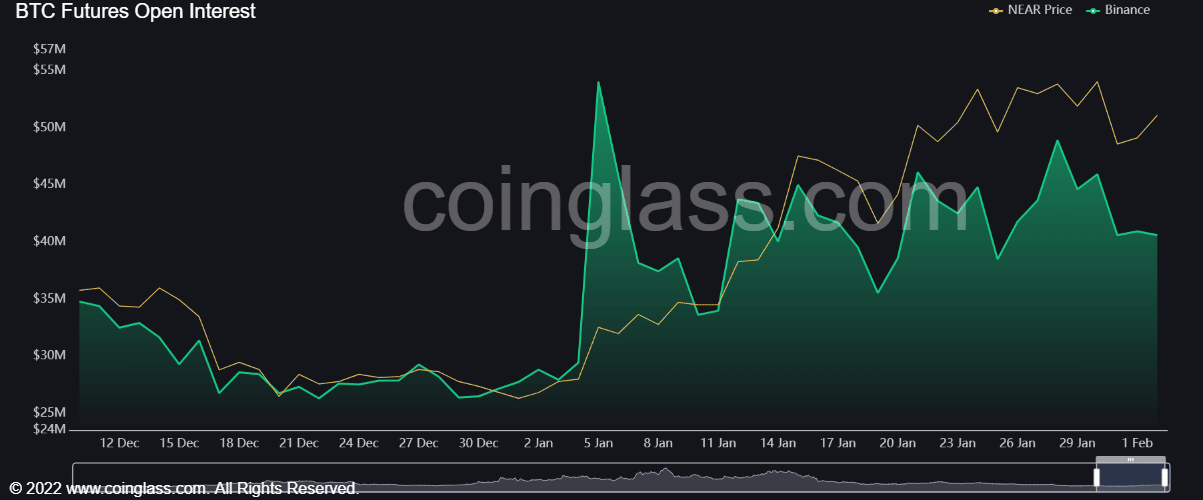

As per Coinglass data, NEAR’s fluctuating open interest (OI) rates undermined a strong uptrend rally. At press time, NEAR’s OI had dropped sharply but flattened out, indicating a possible change of momentum that could support NEAR’s uptrend.

However, an extended drop in OI could undermine further uptrend as more money moves out of NEAR’s futures market.

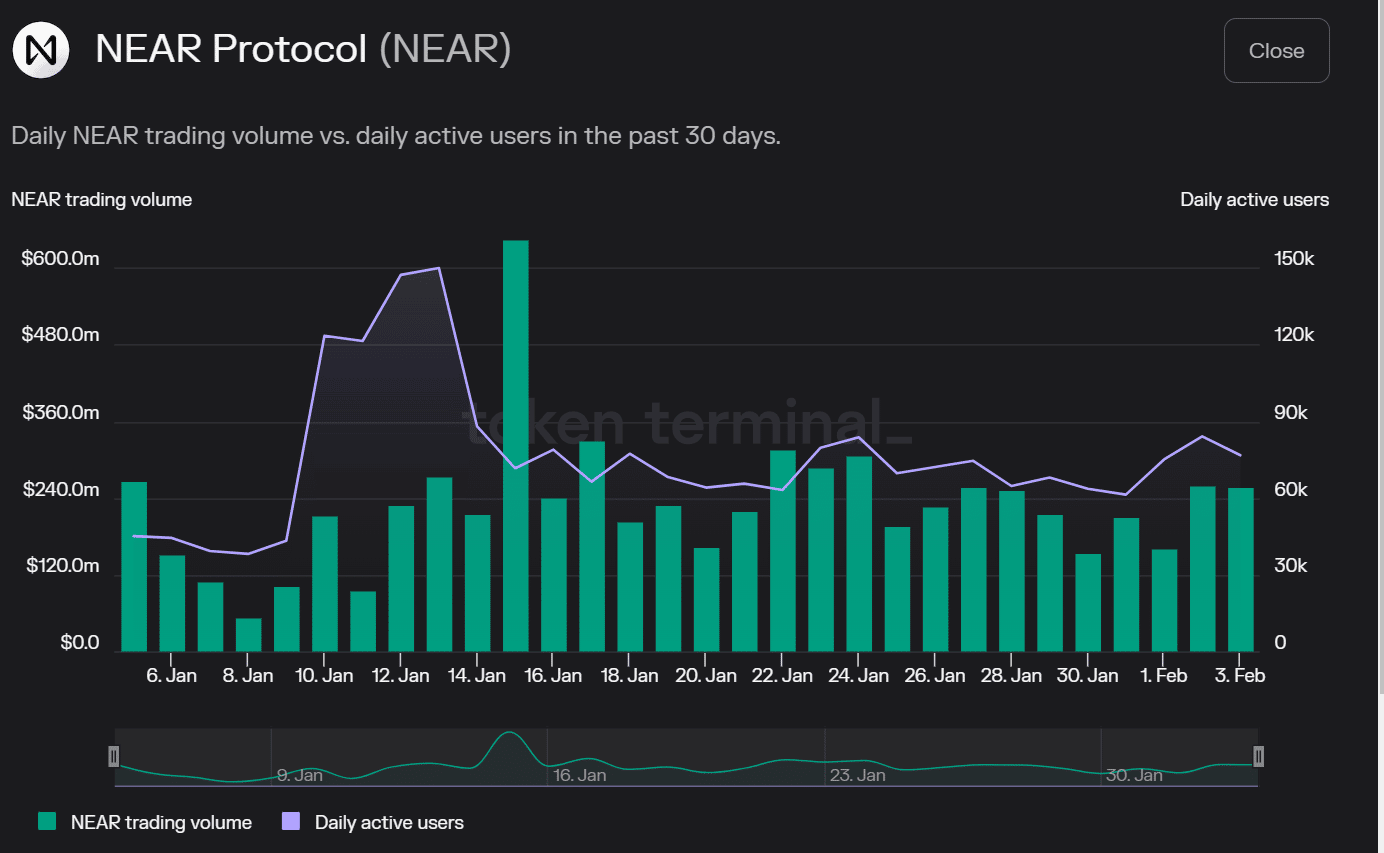

On the other hand, NEAR’s daily active users and trading volumes dropped from mid-January. The trend shows fewer accounts were trading NEAR, which could undermine buying pressure needed for a strong uptrend momentum.

As a result, bears could be tipped to devalue NEAR and set it into a correction.

Source: https://ambcrypto.com/near-protocols-near-key-divergence-calls-for-investors-caution/