ការបដិសេធ៖ ព័ត៌មានដែលបានបង្ហាញមិនបង្កើតជាហិរញ្ញវត្ថុ ការវិនិយោគ ការជួញដូរ ឬប្រភេទផ្សេងទៀតនៃដំបូន្មានទេ ហើយគ្រាន់តែជាគំនិតរបស់អ្នកនិពន្ធតែប៉ុណ្ណោះ

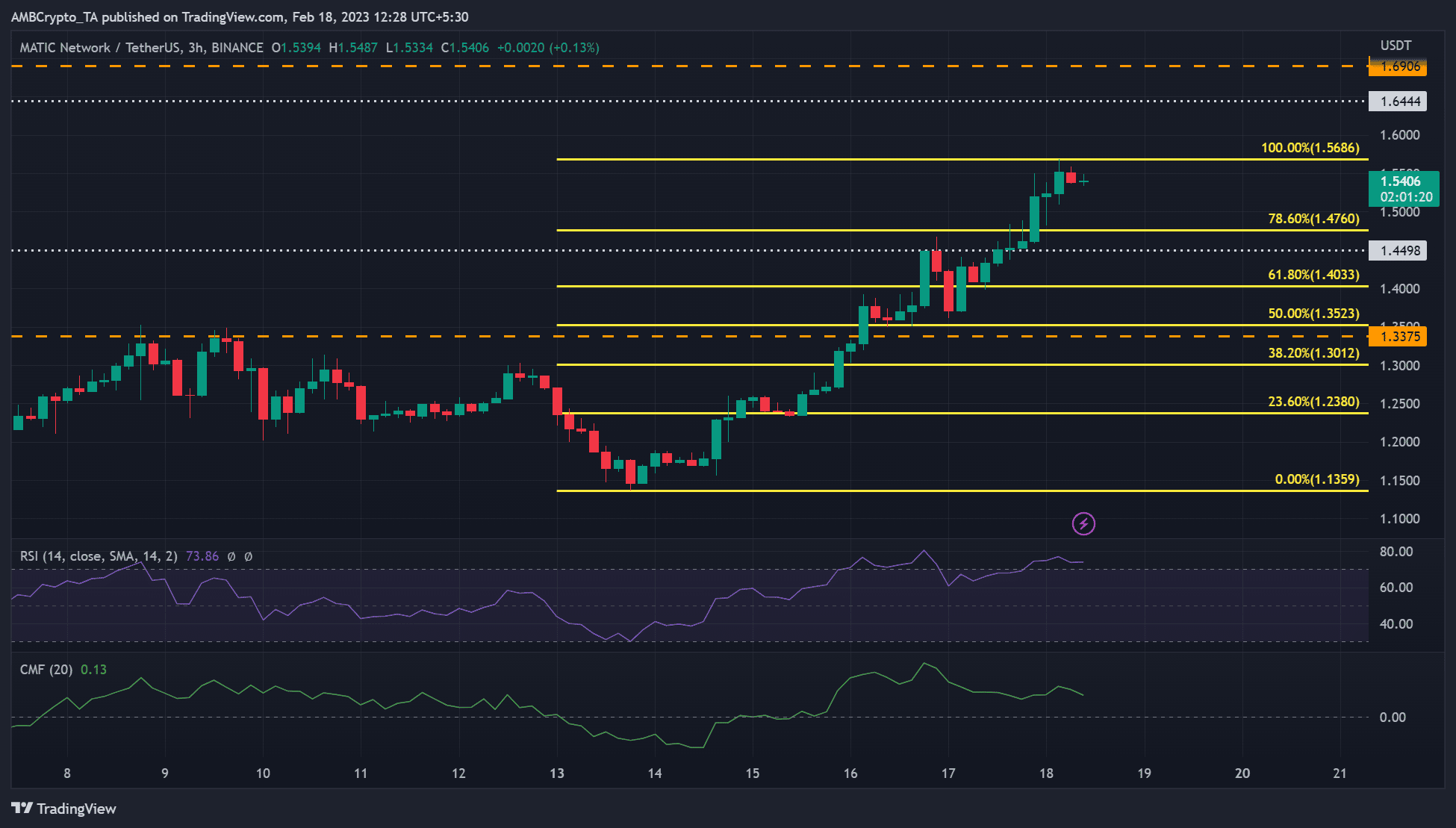

- MATIC hit the overbought zone on the lower timeframe chart.

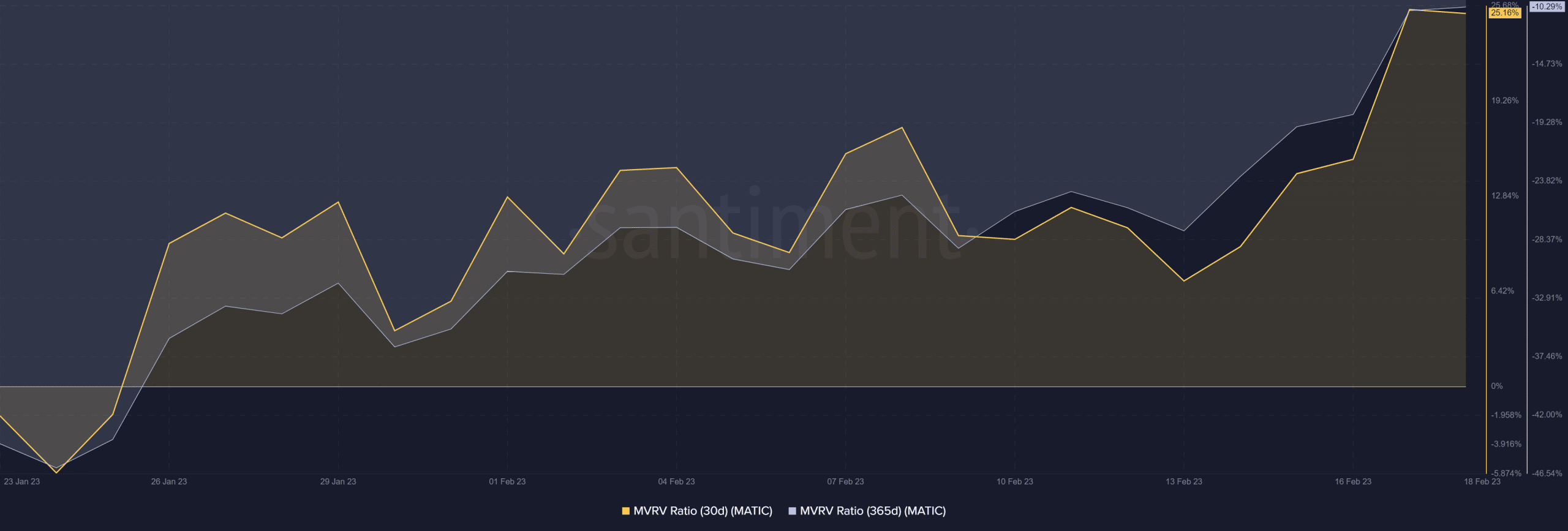

- Monthly holders saw gains jump from 7% to 25% at press time.

ពហុកោណ [MATIC] recent rally is a win for every investor. But short-term holders outperformed long-term holders in the recent hike.

MATIC posted over 20% and 7% in the past seven days and 24 hours, respectively. But long-term holders were still in losses.

អាន ការព្យាករណ៍តម្លៃរបស់ពហុកោណ [MATIC] 2023-24

MATIC formed a bearish order block: Will the momentum slow down?

The three-hour chart showed a strongly bullish MATIC with an RSI value of 73. But the value is also in the overbought zone, which makes MATIC ripe for a price reversal. In addition, the Chaikin Money Flow (CMF) moved southwards, showing a weakening short-term market structure.

Short-term sellers could target the 78.6% Fib level of $1.4760 or $1.4498 support level, especially if BTC breaks below the $24.42K level.

៥០ ប៉ុន្មាន ម៉ាទីក តម្លៃថ្ងៃនេះ?

The bearish thesis will be invalid if MATIC clears the bearish order block and closes above the 100% Fib level of $1.5686. Such an upswing will allow short-term bulls to profit at $1.6444 or $1.6906.

A CMF break below the zero line would give bears more leverage. However, a rebound from the level would reinforce the bullish structure.

Short-term holders saw gains, but long-term holders struggled to recover losses

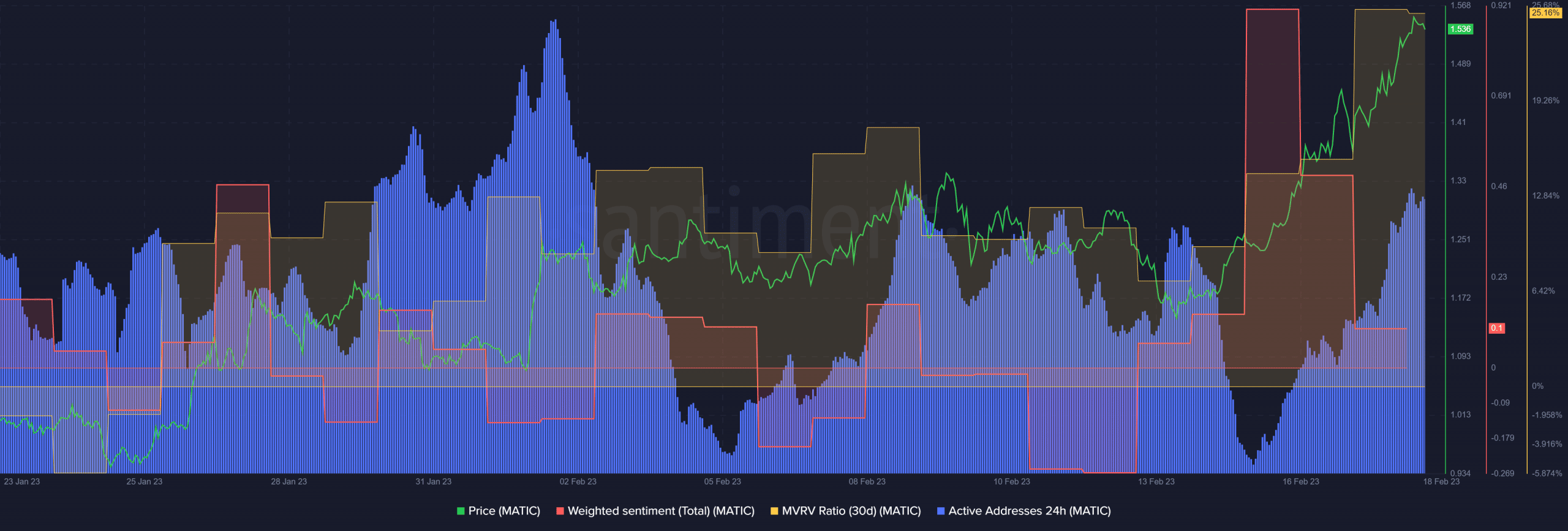

MATIC’s weighted sentiment sharply dropped following BTC’s unexpected fall from the $25K level. But the sentiment remained positive; thus, bulls could attempt an extra rally. In addition, MATIC saw increased active addresses, which could boost buying pressure and the uptrend.

However, monthly holders saw positive profits from 7% to about 25% by press time, as shown by the 30-day MVRV (Market Value to Realized Value).

In contrast, long-term holders were struggling to recover losses. Long-term holders were at -10%, as shown by the 365-day MVRV, indicating that they were yet to post gains despite the recent rally.

Source: https://ambcrypto.com/polygon-short-term-investors-outperform-long-term-holders-heres-how/