ការបដិសេធ៖ ព័ត៌មានដែលបានបង្ហាញមិនបង្កើតជាហិរញ្ញវត្ថុ ការវិនិយោគ ការជួញដូរ ឬប្រភេទផ្សេងទៀតនៃដំបូន្មានទេ ហើយគ្រាន់តែជាគំនិតរបស់អ្នកនិពន្ធតែប៉ុណ្ណោះ

- UNI’s market structure weakened further.

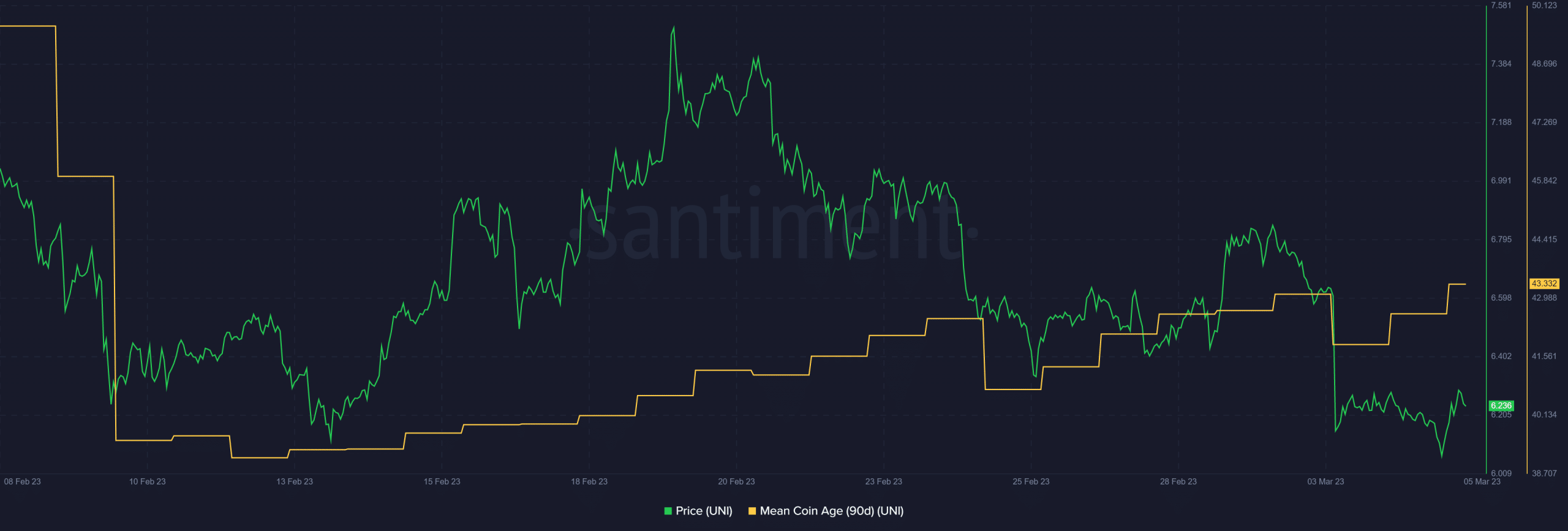

- The 90-day Mean Coin Age rose as quarterly outperformed monthly holders.

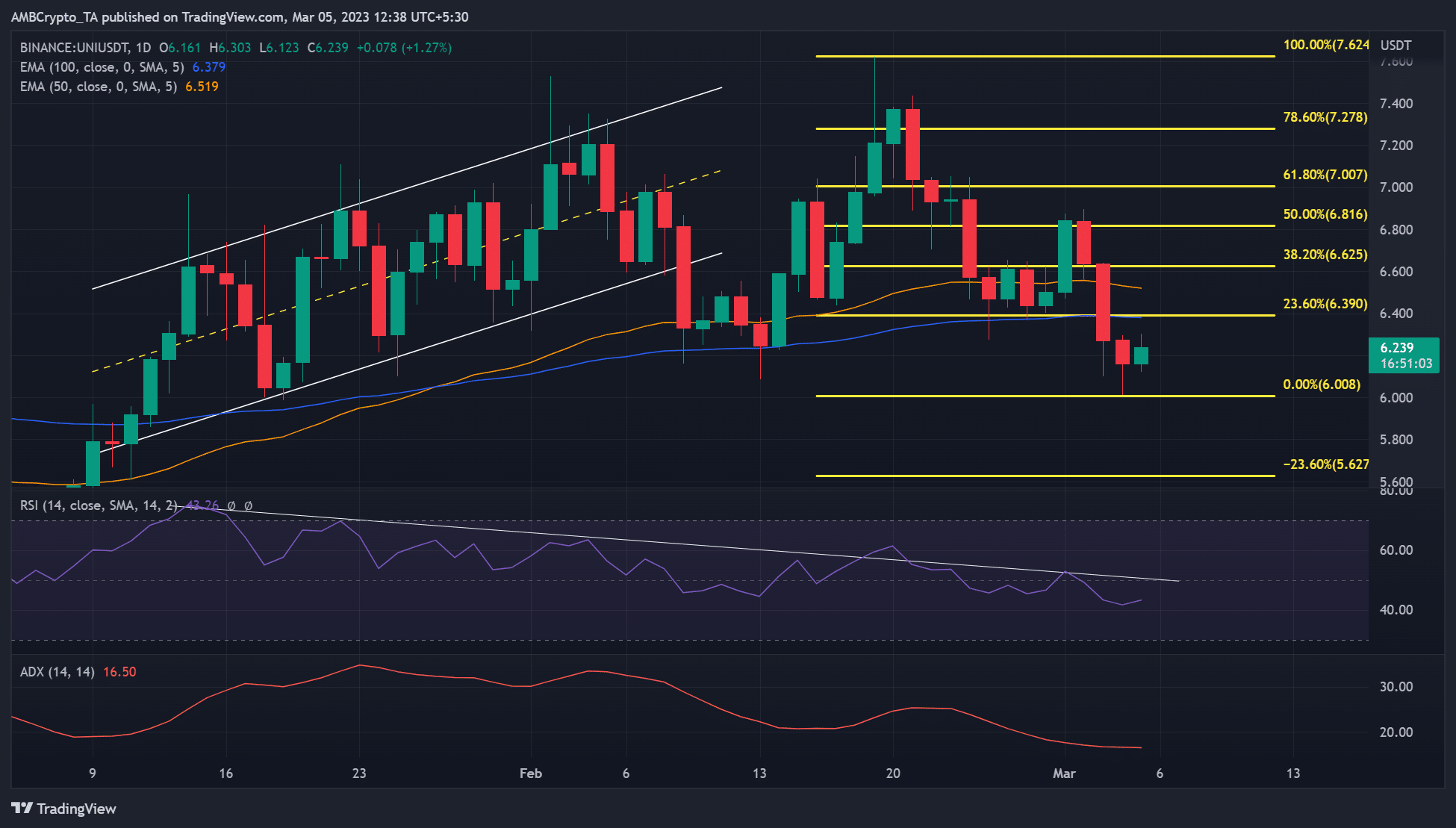

After the price rejection at $7.624 on 18 February, Uniswap [UNI] depreciated by 20%. At press time, the native DEX token traded at 6.239 and flashed green as bulls attempted to front a recovery.

However, key fundamentals and metrics offered conflicting results, calling for investors’ caution.

អាន Uniswap [UNI] ការព្យាករណ៍តម្លៃ 2023-24

The market structure weakened more – Can bulls survive?

At the height of the January rally, UNI entered a price consolidation and formed a rising channel (white). The price action breached below the channel in early February but was checked by the 100-day EMA (exponential moving average).

But bulls got boosted after a retest of the pullback on the 100-day EMA that offered a strong recovery, setting UNI to reach an overhead resistance at $7.624. The retracement after the price rejection at $7.624 has undermined a successful recovery.

Bears could re-enter the market if UNI fails to close above the 23.6% Fib level ($6.390). They could benefit from shorting the asset at $6. Stop loss could be set above $6.390.

On the contrary, a daily close above the 23.6% Fib level could tip bulls to target the Fib levels of 38.6% ($6.625), 50% ($6.816), or 61.8%($7.007). If Bitcoin [ប៊ីស៊ីធីធី] retests the $25K, UNI could swing to the overhead resistance level of $7.624.

However, the RSI on the daily chart showed an increasing divergence. In addition, the Average Directional Movement Index (ADX) retreated, showing the UNI’s market weakened and could enter consolidation or further retracement.

But the 100-day EMA moved horizontally, showing a consolidation could be likely in the mid-term.

Quarterly holders outperformed monthly peers

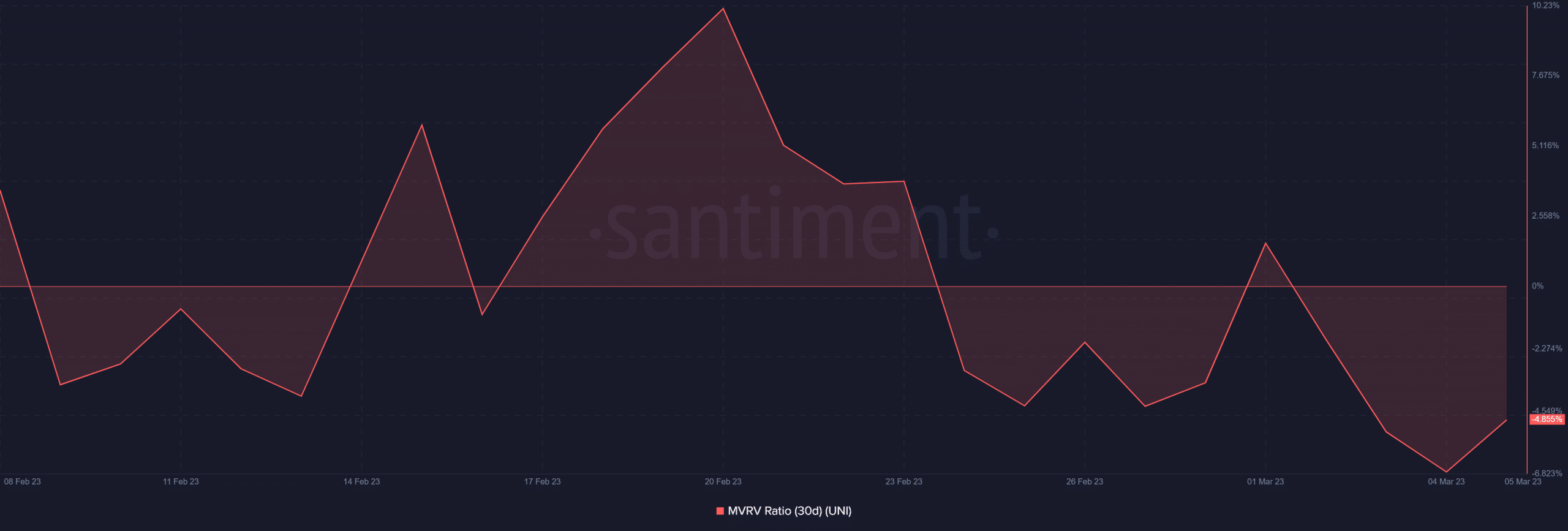

There was a wide-network accumulation of UNI tokens, as shown by the rising 90-day Mean Coin Age. It shows there could be a potential bullish rally in the works. Nevertheless, monthly holders incurred losses of 5% at press time, as shown by the 30-day MVRV.

តើផលប័ត្ររបស់អ្នកមានពណ៌បៃតងទេ? ពិនិត្យ ការគណនាប្រាក់ចំណេញ UNI

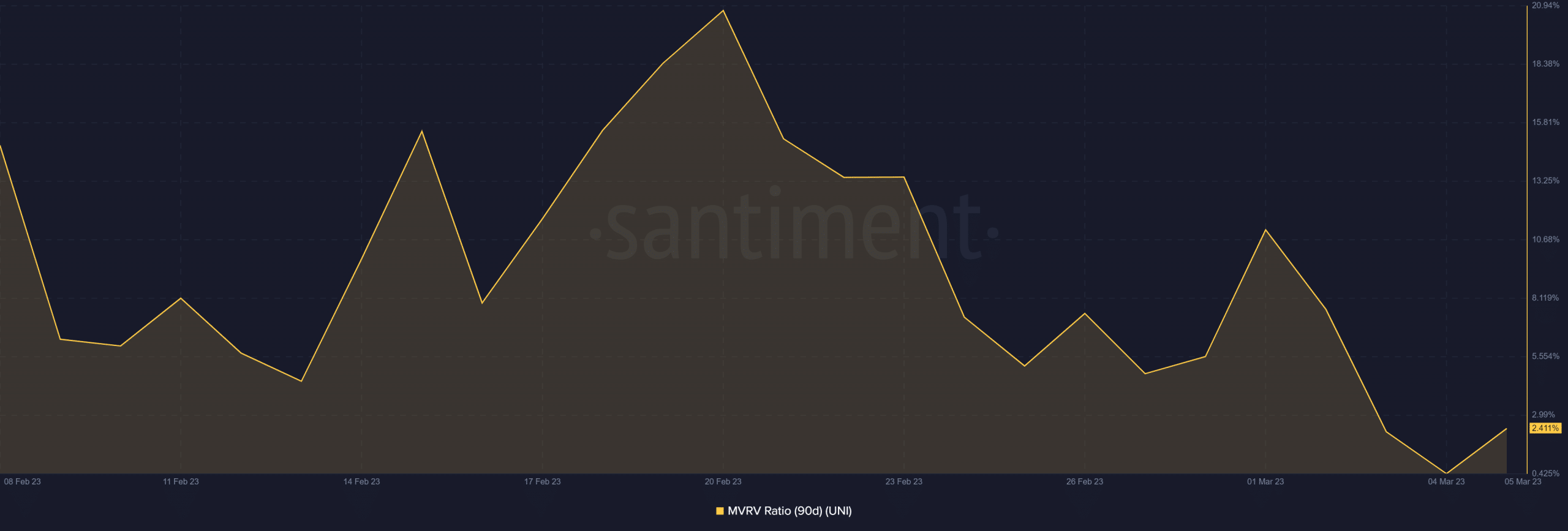

On the contrary, quarterly holders enjoyed a modest profit of 2% after most of the gains in January got cleared during the correction period. Quarterly holders could reclaim some of the lost gains if UNI clears the 23.6% hurdle.

Source: https://ambcrypto.com/which-way-for-uniswap-uni-a-recovery-consolidation-or-retracement/